A prop firm can make or break your trading career. It’s about more than just the capital. It’s the entire trading experience. This Algo Forex Funds review covers everything they offer: instant funding, high leverage, customer support, and withdrawals. We’ll also address trader concerns and compare Algo Forex Funds to its competitors. Get the info you need to make the right choice for your trading future.

Is Algo Forex Funds a Scam? Addressing the Controversy

When you’re considering a prop firm like Algo Forex Funds, it’s essential to see what other traders are saying. Unfortunately, the feedback surrounding Algo Forex Funds raises some serious red flags. The firm holds a troubling 2.1-star rating on Trustpilot, with a staggering 65% of the 796 reviews giving it a mere 1-star rating. Many users report significant problems withdrawing their profits, citing excuses such as “server shutdowns” and “legal violations.”

Even more concerning are the numerous reviewers who accuse Algo Forex Funds of operating as a scam, alleging theft and a lack of accountability. Many express frustration with the firm’s poor communication, describing generic responses to complaints and a failure to address serious issues. Some users even report that their accounts were wiped out during a supposed server migration, receiving no compensation.

Given these alarming reports, proceed with extreme caution. The lack of transparency and the sheer volume of negative experiences suggest exploring alternative prop firms before committing any capital to Algo Forex Funds. Consider a firm like FN Capital, which offers a 100-day money-back guarantee and a verified track record of performance, prioritizing transparency and client trust.

Key Takeaways

- Instant funding and high leverage are available through Algo Forex Funds, providing traders with rapid access to capital and the potential for amplified returns. However, remember that leverage magnifies both profits and losses, so manage risk effectively.

- Flexible trading conditions, including a generous profit split and high drawdown tolerance, can accommodate a range of trading strategies. This flexibility allows traders more room to maneuver but still requires careful risk management.

- Customer reviews present a mixed picture of Algo Forex Funds, with some traders praising customer support and timely payouts while others report withdrawal issues and account restrictions. Do your research and carefully consider both the positive and negative feedback before making a decision.

What is Algo Forex Funds?

Algo Forex Funds is a prop trading firm offering instant funding accounts for forex traders. They’ve been in the industry for over 10 years, giving them a solid foundation and the experience to build a robust infrastructure. This includes dedicated servers designed to handle high trading volumes, a key differentiator in the prop trading world. This focus on a stable trading environment aims to minimize technical disruptions and ensure smooth execution, even during periods of high market volatility. For more information, visit the Algo Forex Funds website.

About Algo Forex Funds

Algo Forex Funds positions itself as a performance-driven prop firm, emphasizing speed and efficiency. Their instant funding model streamlines the onboarding process, allowing traders to bypass the often lengthy evaluation phases common with other firms. This rapid access to capital can be particularly appealing to traders eager to start trading immediately. The firm’s commitment to providing high leverage and a generous profit split further underscores their focus on attracting and retaining successful traders. However, it’s crucial for potential clients to thoroughly research and understand the terms and conditions before committing to any prop firm. You can find additional details on their website.

How Algo Forex Funds Works

Algo Forex Funds operates on a straightforward model. Traders sign up and receive instant funding, eliminating the need for any initial challenges or evaluations. They offer leverage of 1:100, allowing traders to control larger positions with a smaller initial investment. Profits are split 80/20 in favor of the trader, a potentially attractive feature for those confident in their trading strategies. Algo Forex Funds also allows a relatively high drawdown tolerance, with an 8% daily drawdown and a maximum drawdown of 25%. This flexibility can be beneficial for traders who employ strategies with higher volatility. Finally, there are no minimum trading day requirements, giving traders the freedom to manage their trading schedule. This flexibility can be particularly appealing to those balancing trading with other commitments.

Understanding Prop Firms and Their Role

Proprietary trading firms, or prop firms, provide funded trading accounts to traders, allowing them to manage the firm’s capital for a share of the profits. Think of it as a partnership: the firm provides the resources (capital, trading platform, and often the risk management infrastructure) and the trader brings their expertise. This arrangement benefits both sides. Traders gain access to more capital than they might have individually, accelerating their potential earnings. Prop firms leverage the skills of talented traders to grow their own capital. Algo Forex Funds, for example, has operated under this model for over 10 years.

A key advantage of working with a prop firm like Algo Forex Funds is the instant funding model. This eliminates the lengthy evaluation periods common at other firms, letting traders begin active trading quickly. For those wanting to capitalize on market opportunities without delay, this rapid access to capital is a significant benefit. This speed doesn’t compromise the stability of the trading environment. Algo Forex Funds emphasizes a robust infrastructure, including dedicated servers, to ensure smooth execution even when markets are volatile. Learn more about their approach on the Algo Forex Funds website.

The profit-sharing model is another crucial aspect. Prop firms often offer a generous profit split, usually favoring the trader. Algo Forex Funds offers an 80/20 split, so the trader keeps 80% of any profits. This incentive aligns the interests of both trader and firm. However, trading always involves risk. High leverage can amplify profits, but it also magnifies losses. Effective risk management is critical, regardless of the profit split or the firm’s drawdown tolerance. Flexible trading conditions are helpful, but they shouldn’t encourage reckless trading.

Algo Forex Funds: Features and Benefits

Algo Forex Funds offers several features designed to attract and retain traders. Let’s break down some of the key benefits:

Get Funded Instantly

Time is money in trading, and Algo Forex Funds understands this. They offer instant funding accounts, allowing traders to quickly access capital and start trading. The company emphasizes its experience and infrastructure, citing over 10 years in the industry and dedicated servers built to handle high trading volumes. This focus on a seamless experience aims to minimize technical hiccups and maximize trading uptime.

Maximize Returns with High Leverage

Algo Forex Funds provides traders with high leverage options, reaching a ratio of 1:100. This can significantly amplify trading positions, potentially leading to higher profits. However, it’s crucial to remember that leverage is a double-edged sword. While it can magnify gains, it also amplifies potential losses. Effective risk management is essential when using high leverage.

Profit Split: What You Keep

A key attraction for many traders is Algo Forex Funds’ generous profit split. They offer traders an 80% share of the profits generated. This competitive profit-sharing model incentivizes traders to perform well and creates a strong alignment of interest between the trader and the firm.

Flexible Trading: Your Way

Algo Forex Funds offers flexible trading conditions, including a relatively high drawdown tolerance. Traders have an 8% daily drawdown limit and a maximum drawdown of 25%. This flexibility can be beneficial for traders who employ strategies that might experience short-term fluctuations, giving them more room to maneuver before hitting account restrictions.

Account Sizes to Fit Your Needs

Recognizing that traders have varying capital needs and risk tolerances, Algo Forex Funds offers a range of account sizes. Options include $100,000, $250,000, $500,000, $800,000, and $1,000,000 accounts, each with a corresponding price point. They also offer a 35% discount for payments made with cryptocurrency, which can be a significant saving for those comfortable using digital currencies.

Algorithmic Trading with Algo Forex Funds: Is it Allowed?

Algo Forex Funds supports algorithmic trading, allowing traders to use automated strategies. This flexibility benefits those who prefer systematic approaches and want to leverage the speed and efficiency of automated systems. For those exploring AI-powered algorithmic trading, FN Capital’s quantitative trading solutions offer advanced modeling and high-frequency execution.

Common Algorithmic Trading Strategies

Several algorithmic trading strategies can be employed with Algo Forex Funds. Here are a few examples:

- Trend Following: These algorithms follow market trends using tools like moving averages to capitalize on sustained movements. Learn more about trend following.

- Arbitrage: This strategy exploits small price differences for the same currency in different markets, profiting from inefficiencies. Explore arbitrage strategies.

- Mean Reversion: This strategy bets that prices will return to their average after extreme movements. Discover mean reversion.

Benefits of Algorithmic Trading

Algorithmic trading offers several advantages:

- Speed and Efficiency: Trades execute much faster than humanly possible, crucial in the fast-paced forex market. Explore the speed advantage.

- No Emotions: Algorithms make objective decisions, avoiding emotional mistakes for more consistent results. Learn about emotionless trading.

- Backtesting: Test your algorithm on past data to see its potential performance and refine strategies before live trading. Understand backtesting.

Risks of Algorithmic Trading

While promising, be aware of the risks:

- Over-reliance: Don’t depend entirely on algorithms; human oversight remains essential. Learn about oversight importance.

- Technical Issues: Computer problems can cause losses, so ensure reliable systems and contingency plans. Explore technical risks.

- Market Crashes: Sudden drops can impact algorithms, potentially leading to significant losses. Understand market crash risks.

Algo Forex Funds Pricing and Account Types

Algo Forex Funds offers several account sizes, making it accessible to traders with varying capital and experience levels. Understanding the pricing structure is key to choosing the account that best suits your trading goals.

Which Account Size is Right for You?

Algo Forex Funds provides instant funding accounts for forex traders, emphasizing their extensive experience and robust infrastructure. They offer a range of account sizes to accommodate different trading styles and risk tolerances. This approach allows traders to select an account that matches their capital and experience level. For example, a newer trader might start with a smaller account, while a more seasoned trader with more capital could opt for a larger account size. You can find more details on their account options page.

Understanding the Pricing Structure

The pricing structure for Algo Forex Funds accounts is tiered, with larger accounts generally offering a lower cost per dollar of funding. Here’s a current breakdown of the pricing:

- $100,000 account: $895

- $250,000 account: $1493

- $500,000 account: $2468

- $800,000 account: $3885

- $1,000,000 account: $4808

This tiered pricing model allows traders to select an account size that aligns with their trading strategy and capital requirements. Always confirm the latest pricing on the Algo Forex Funds website.

Save with Crypto Payments

For traders who prefer using cryptocurrency, Algo Forex Funds sometimes offers a discount. Check their website for any current promotions. Using the code OFF35 at checkout might give you a 35% discount, but this can change. This discount makes Algo Forex Funds a potentially more cost-effective option for crypto-savvy traders. Be sure to visit the Algo Forex Funds site to confirm current cryptocurrency payment options, discounts, and any applicable terms.

Algo Forex Funds Trading Conditions

Algo Forex Funds’ trading conditions cater to various trading styles, especially those interested in high-frequency and aggressive strategies. Let’s break down the key components:

Leverage and Margin Explained

Algo Forex Funds offers flexible leverage options, a significant draw for traders, especially those employing high-frequency trading (HFT) strategies. The firm is known for having minimal restrictions on trading styles, empowering traders to potentially maximize returns while actively managing risk. This high leverage allows for greater flexibility in position sizing and can amplify profits. However, it’s crucial to remember that it also magnifies potential losses. Prudent risk management is essential when trading with leverage.

Available Instruments to Trade

Traders using Algo Forex Funds gain access to a diverse selection of financial instruments, including forex pairs, indices, and cryptocurrencies. This range allows for implementing various strategies across different markets, expanding trading opportunities. Whether you’re focused on major currency pairs, stock indices, or the crypto market, Algo Forex Funds provides the instruments to diversify your approach.

Forex Options Trading with Algo Forex Funds

While Algo Forex Funds doesn’t directly offer options trading in the traditional sense (like buying calls and puts on currencies), its features create a supportive environment for strategies that mimic the benefits of options trading. The combination of high leverage, flexible trading conditions, and a generous profit split allows traders to implement strategies that capture potential gains while managing risk effectively.

Think of it this way: high leverage (up to 1:100 as offered by Algo Forex Funds) acts like a lever magnifying your potential profits, similar to how a small investment in an options contract can control a larger amount of underlying assets. This can be particularly appealing in the fast-paced world of forex trading, where capturing quick price movements is key. However, just like with options, it’s essential to manage risk carefully. Leverage magnifies both profits and losses, so a robust risk management strategy is crucial.

Algo Forex Funds’ flexible trading conditions, including an 8% daily drawdown limit and a maximum drawdown of 25%, provide a buffer against market volatility. This flexibility can be particularly valuable when implementing strategies that might experience short-term fluctuations. This tolerance for drawdowns gives traders more breathing room to navigate market swings, similar to how options strategies can define and limit potential losses. The generous 80/20 profit split further incentivizes traders, allowing them to keep a significant portion of their earnings.

Furthermore, access to a diverse range of instruments, including forex pairs, indices, and cryptocurrencies, allows traders to implement a wider array of strategies. This can be particularly useful for creating synthetic options positions using combinations of these instruments. For example, a trader could potentially replicate the payoff profile of a put option by combining a short position in the underlying asset with a long position in a correlated index. While not a direct replacement for traditional options, this flexibility allows for creative strategies that can offer similar risk-reward profiles.

Your Trading Toolkit

Algo Forex Funds utilizes the popular MetaTrader 4 (MT4) platform, known for its user-friendly interface and powerful features. Its widespread adoption means many traders are already familiar with its functionality. The platform’s robust support for algorithmic trading is a key advantage for those looking to automate their strategies.

Drawdown Tolerance: What to Expect

A notable feature of Algo Forex Funds is its high drawdown tolerance, giving traders more room to maneuver. This tolerance is particularly valuable for traders using aggressive strategies, providing a buffer to recover from temporary losses. While this flexibility can be advantageous, it’s still important to maintain disciplined risk management practices.

Algo Forex Funds Reviews: A Balanced Perspective

When evaluating Algo Forex Funds, it’s essential to consider the diverse experiences shared by traders. Customer reviews paint a mixed picture, highlighting both positive aspects and significant concerns. Honest Algo Forex Funds reviews are crucial for making informed decisions.

On the positive side, many traders appreciate the customer support and timely payouts. Some users report satisfactory interactions with the support team, noting their queries were addressed promptly. Additionally, the instant funding model allows traders to access capital quickly, a significant advantage for those eager to begin trading. This aligns with Algo Forex Funds’ stated commitment to speed and efficiency.

However, it’s crucial to acknowledge the withdrawal issues frequently reported. Numerous traders have expressed frustration over difficulties withdrawing profits, with some alleging that their requests were unjustly denied. Complaints range from excuses like “server shutdowns” to a lack of communication from the firm. This disconnect between the promised seamless experience and the reported withdrawal difficulties raises concerns.

Moreover, allegations of being a scam have surfaced, with some users claiming mishandled funds or account restrictions without clear justification. This necessitates thorough research before committing to the firm. Consider exploring alternatives like FTMO or My Forex Funds as part of your due diligence. At FN Capital, we prioritize transparency and offer a 100-day money-back guarantee, providing a risk-free way to experience our AI-powered trading system. Create a free account to see how we prioritize client success.

While Algo Forex Funds offers attractive features like high leverage and a generous profit split, potential traders should weigh these benefits against the reported challenges. A balanced perspective, informed by both positive and negative Algo Forex Funds reviews, is vital when deciding if this prop trading firm aligns with your goals and risk tolerance. Choosing the right prop firm is a critical step in your trading journey.

What Traders Are Saying About Algo Forex Funds

User reviews of Algo Forex Funds paint a mixed picture. While some traders are happy with the service, others have shared significant concerns. Let’s take a closer look at the good and the bad.

What Traders Love

Algo Forex Funds receives praise for its customer support. Users describe helpful interactions and quick responses via live chat, indicating a responsive support team.

Addressing Common Concerns

Despite positive comments about support, a substantial number of negative reviews raise concerns about withdrawals. Traders report accounts being flagged for alleged “copy trading” or “account management” violations, often without clear explanations. These issues, combined with reported difficulties receiving funds, have led some users to call the company a “scam” on review platforms like Trustpilot.

Withdrawal Process: What You Need to Know

Withdrawal problems appear to be a recurring issue. One user described multiple declined withdrawal requests, each with the same “copy trading” explanation. In contrast, other users report smooth and timely payouts. This inconsistency in withdrawal experiences is concerning. You can read more about these contrasting experiences on page 5 of the Trustpilot reviews.

Overall Trader Sentiment

The overall sentiment toward Algo Forex Funds is mixed. Positive experiences exist, but the volume of negative reviews, especially regarding withdrawals, is a definite red flag. The company’s responses to negative reviews, while present, don’t always address the specific complaints, leaving potential clients with unanswered questions. Carefully consider both the positive and negative feedback before making a decision about Algo Forex Funds.

Analyzing Negative Reviews and Complaints

While Algo Forex Funds has its supporters, a substantial volume of negative reviews warrants careful consideration. A balanced perspective requires examining these issues thoroughly.

Withdrawal Issues and Concerns

The most frequent complaint centers around difficulties withdrawing funds. Traders report accounts being flagged for alleged “copy trading” or “account management” violations, often without clear explanations. This lack of transparency breeds frustration, especially when earned profits are inaccessible. One user on Trustpilot described multiple declined withdrawal requests, each with the identical “copy trading” reason, despite maintaining they traded independently. This raises questions about the consistency and fairness of Algo Forex Funds’ account review procedures. Numerous other reviews echo these frustrations, citing significant problems withdrawing profits. Common complaints include unjustified denial of withdrawals, vague excuses like “server shutdowns” or “legal violations,” and a general lack of communication from AFF.

Account and Data Security Concerns

Beyond withdrawal problems, critical reviews consistently point to AFF’s communication practices as a major concern. Generic, impersonal responses to complaints and a perceived inability to address specific issues further damage trader confidence. This lack of individual attention can leave traders feeling ignored and disregarded. Further compounding these concerns, at least one reviewer reported the misuse of their personal data, claiming AFF publicly displayed their Trustpilot profile information without consent. Such an allegation, if true, raises serious questions about the company’s data privacy and security practices. These combined issues surrounding withdrawals, communication, and data privacy create a concerning impression for potential clients evaluating Algo Forex Funds. Carefully weigh these potential risks against the advertised benefits before making a decision. Consider exploring alternative options like FN Capital, which prioritizes transparency and client satisfaction, offering a 100-day money-back guarantee and a publicly verifiable track record on FX Blue.

Getting Started with Algo Forex Funds

So, you’re interested in Algo Forex Funds and want to know how to get started? Here’s a breakdown of the process, from registration to funding and withdrawals.

Register Your Account

Algo Forex Funds aims to make account registration straightforward. As a prop trading firm offering instant funding accounts, you can begin trading relatively quickly.

Funding Your Algo Forex Funds Account

One of Algo Forex Funds’ key features is instant funding. No challenges to complete; your account is funded immediately after signup. This is a big draw for traders eager to jump into the markets. Algo Forex Funds offers several account sizes with varying pricing:

- $100,000 account: $895

- $250,000 account: $1493

- $500,000 account: $2468

- $800,000 account: $3885

- $1,000,000 account: $4808

They also offer a 35% discount if you pay with cryptocurrency, using the code OFF35.

How to Withdraw Your Profits

Withdrawals are a critical aspect of any prop firm, and Algo Forex Funds has received mixed reviews in this area. Some traders report positive withdrawal experiences, while others have shared concerns. Some users mention experiencing issues with withdrawals due to alleged violations like “copy trading” or “account management,” often without clear explanations. It’s essential to be aware of these potential issues and do your research before committing funds. Reading through customer reviews can offer valuable insights.

Algo Forex Funds vs. the Competition

Choosing a prop firm depends on your individual trading style, risk tolerance, and financial goals. Let’s see how Algo Forex Funds stacks up against some of its main competitors. This comparison focuses on key features like funding options, profit splits, and overall trader experience, drawing on insights from various sources.

Algo Forex Funds vs. FTMO

FTMO is well-regarded for its comprehensive educational resources, including a trading academy and economic calendar. These tools can be valuable for traders looking to improve their market analysis. FTMO also offers account sizes up to $400,000 and fosters a strong community where traders can connect and share knowledge. However, their evaluation process is known to be challenging, which may be a barrier to entry for some.

Algo Forex Funds vs. MyForexFunds

MyForexFunds provides a more straightforward evaluation process compared to FTMO, along with competitive profit splits. They offer a range of account sizes and also provide educational resources, though perhaps not as extensive as FTMO’s. Traders generally appreciate MyForexFunds’ supportive community and transparent operations.

Algo Forex Funds vs. The Funded Trader Program

The Funded Trader Program stands out with its unique evaluation process, which emphasizes practical trading skills and risk management. This approach may appeal to traders who prefer a performance-based assessment. The program also provides traders with the tools and support they need to succeed, focusing on long-term development.

Algo Forex Funds vs. The 5%ers

The 5%ers focuses on long-term trading strategies and responsible risk management. Their funding model allows traders to retain a significant portion of their profits, which can be a major incentive. They also offer educational resources and cultivate a strong community where traders can exchange ideas and learn from each other. However, their emphasis on long-term strategies might not suit traders who prefer short-term or high-frequency trading styles.

Alternatives to Algo Forex Funds

Choosing a prop firm depends on your individual trading style, risk tolerance, and financial goals. Before committing to any prop firm, especially one with mixed reviews like Algo Forex Funds, it’s wise to explore other options. Let’s see how Algo Forex Funds stacks up against some of its main competitors. This comparison focuses on key features like funding options, profit splits, and overall trader experience, drawing on insights from various sources like Trustpilot and Forex Prop Reviews.

Algo Forex Funds vs. FTMO

FTMO is well-regarded for its comprehensive educational resources, including a trading academy and economic calendar. These tools can be valuable for traders looking to improve their market analysis. FTMO also offers account sizes up to $400,000 and fosters a strong community where traders can connect and share knowledge. However, their evaluation process is known to be challenging, which may be a barrier to entry for some. If you’re a newer trader, FTMO’s educational resources might be a plus, but the rigorous evaluation process could be a deterrent.

Algo Forex Funds vs. MyForexFunds

MyForexFunds provides a more straightforward evaluation process compared to FTMO, along with competitive profit splits. They offer a range of account sizes and also provide educational resources, though perhaps not as extensive as FTMO’s. Traders generally appreciate MyForexFunds’ supportive community and transparent operations. If ease of entry is a priority, MyForexFunds might be a better fit than Algo Forex Funds or FTMO. You can explore their different account options to see which aligns best with your goals.

Algo Forex Funds vs. The Funded Trader Program

The Funded Trader Program stands out with its unique evaluation process, which emphasizes practical trading skills and risk management. This approach may appeal to traders who prefer a performance-based assessment. The program also provides traders with the tools and support they need to succeed, focusing on long-term development. If you value a practical, performance-based approach, The Funded Trader Program could be a strong contender. Learn more about their evaluation stages to see if it’s the right fit for you.

Algo Forex Funds vs. The 5%ers

The 5%ers focuses on long-term trading strategies and responsible risk management. Their funding model allows traders to retain a significant portion of their profits, which can be a major incentive. They also offer educational resources and cultivate a strong community where traders can exchange ideas and learn from each other. However, their emphasis on long-term strategies might not suit traders who prefer short-term or high-frequency trading styles. If you’re a long-term, swing trader, The 5%ers might be a good choice, but if you’re a scalper or day trader, their model might not be the best fit. Check out their pricing and account options for more details.

For traders seeking a completely different approach, consider exploring AI-powered algorithmic trading solutions like those offered by FN Capital. This type of automated trading removes emotional bias and executes trades based on sophisticated algorithms and market analysis. It’s a hands-off approach that can be particularly appealing to those new to trading or those seeking a more passive income stream. Create a free account to learn more.

Important Considerations Before You Begin

Before jumping in with Algo Forex Funds, take some time to weigh the potential benefits against the drawbacks. A clear-eyed assessment will help you decide if this platform aligns with your trading goals and risk tolerance.

Understanding the Risks Involved

Forex trading, even with algorithms, carries inherent risks. Algo Forex Funds emphasizes high leverage, which can magnify both profits and losses. While their website and marketing materials may showcase potential gains, it’s crucial to remember that past performance isn’t indicative of future results. Customer reviews mention several traders experiencing difficulties with withdrawals, citing violations related to “copy trading” or “account management.” Before committing funds, understand the specific rules and restrictions to avoid potential issues.

Is Your Experience Level a Good Fit?

Algo Forex Funds caters to traders of all experience levels. However, newer traders might find the learning curve steep. While positive feedback often mentions responsive customer support, particularly through live chat, it’s still essential to have a basic understanding of forex markets and trading principles. Consider whether you’re comfortable managing leveraged trades and navigating the platform’s interface. If you’re a beginner, explore the available learning materials and educational resources before committing to a paid account.

Assess Your Financial Readiness

Carefully consider the financial implications before signing up. Algo Forex Funds offers various account sizes and pricing tiers, so choose an option that aligns with your budget and trading capital. Some user reviews highlight withdrawal problems and communication issues regarding funds. Be sure you’re comfortable with the funding and withdrawal processes before committing any money.

Potential Account Access Issues to Consider

While less common, some users have reported issues accessing their trading accounts. These account access problems, ranging from login difficulties to platform glitches, can disrupt your trading activity. Before funding your account, test the platform’s functionality and ensure you can reliably access your account and trading tools. Contact customer support if you encounter any problems to assess their responsiveness and effectiveness in resolving technical issues.

Support and Resources at Algo Forex Funds

Customer Service Options

Algo Forex Funds has received positive feedback for its 24/7 live chat customer support. Users appreciate the support team’s responsiveness and professionalism, noting their ability to address questions effectively. One trader commented, “The support team was fast and responded accurately. In the end, we found out that it was just a configuration problem. Thanks to support for the quick and accurate response!” This level of service builds trust, with another user stating, “Absolutely trustworthy. Got my first payout today after I made a withdrawal request two days back.” However, some users have reported issues with declined withdrawal requests, raising concerns about the explanations provided by the support team.

Available Learning Materials

While Algo Forex Funds doesn’t offer extensive formal training resources, their website provides essential information about account types, trading conditions, and the funding process. For traders seeking additional educational resources, numerous online platforms offer forex trading courses and market analysis tools. These external resources can supplement the practical experience gained through trading with an Algo Forex Funds account.

Is Algo Forex Funds the Right Choice for You?

Deciding if a prop firm is a good fit depends on your trading style, experience level, and risk tolerance. Let’s explore whether Algo Forex Funds aligns with your trading goals.

Who is Algo Forex Funds Best For?

Algo Forex Funds seems like a solid choice for traders who prioritize responsive customer service. Traders frequently praise the firm’s readily available live chat support, highlighting its knowledgeable and helpful team. This can be a major advantage for those who value quick assistance and clear communication. Positive customer experiences also point to the platform’s reliability, with users specifically mentioning professional and expert support. Furthermore, successful traders report timely payouts, which suggests a generally smooth withdrawal process for those who adhere to the platform’s rules.

Exploring Alternative Options

While Algo Forex Funds has its strengths, it’s crucial to acknowledge potential drawbacks. Some traders have shared negative experiences regarding withdrawals, citing declined requests and questionable justifications. This mixed feedback underscores the importance of carefully weighing the pros and cons. The range of reviews on Trustpilot, with both enthusiastic endorsements and critical one-star ratings, further emphasizes the need for thorough research. Consider your individual trading needs and risk tolerance before making a decision. Exploring other prop firms like FTMO, MyForexFunds, or The Funded Trader Program might be worthwhile to compare offerings and find the best fit for your trading style. You can also research and compare various prop firms using a site like Forex Prop Reviews.

Related Articles

- Trading Assistant 101: Essential Skills & Finding the Best Fit – FN Capital

- Eminence Pro Review: Is This Forex AI Right for You? – FN Capital

- EFX Trading Platform: Your Complete Guide – FN Capital

- AlgoTrade: AI-Powered Trading Made Simple – FN Capital

- FN CAPITAL FAST AI LIVE – FN Capital

Frequently Asked Questions

What is the main advantage of using a prop firm like Algo Forex Funds? Prop firms like Algo Forex Funds provide traders with capital to trade, often at significantly higher leverage than they could access individually. This allows traders to potentially magnify their profits without risking their own capital. Algo Forex Funds, specifically, offers instant funding, eliminating the lengthy evaluation periods common with other prop firms.

What are the potential downsides of trading with Algo Forex Funds? While Algo Forex Funds offers attractive features like high leverage and an 80/20 profit split, some traders have reported difficulties with withdrawals. Concerns about accounts being flagged for violations like “copy trading” or “account management” are recurring themes in online reviews. It’s essential to thoroughly research and understand these potential risks before committing funds.

How does Algo Forex Funds compare to other prop firms? Algo Forex Funds distinguishes itself with instant funding and a high profit split. However, other firms like FTMO and MyForexFunds offer more structured training programs and potentially smoother withdrawal processes. The best choice depends on your individual trading style, experience level, and risk tolerance. Researching and comparing various prop firms is crucial to finding the right fit.

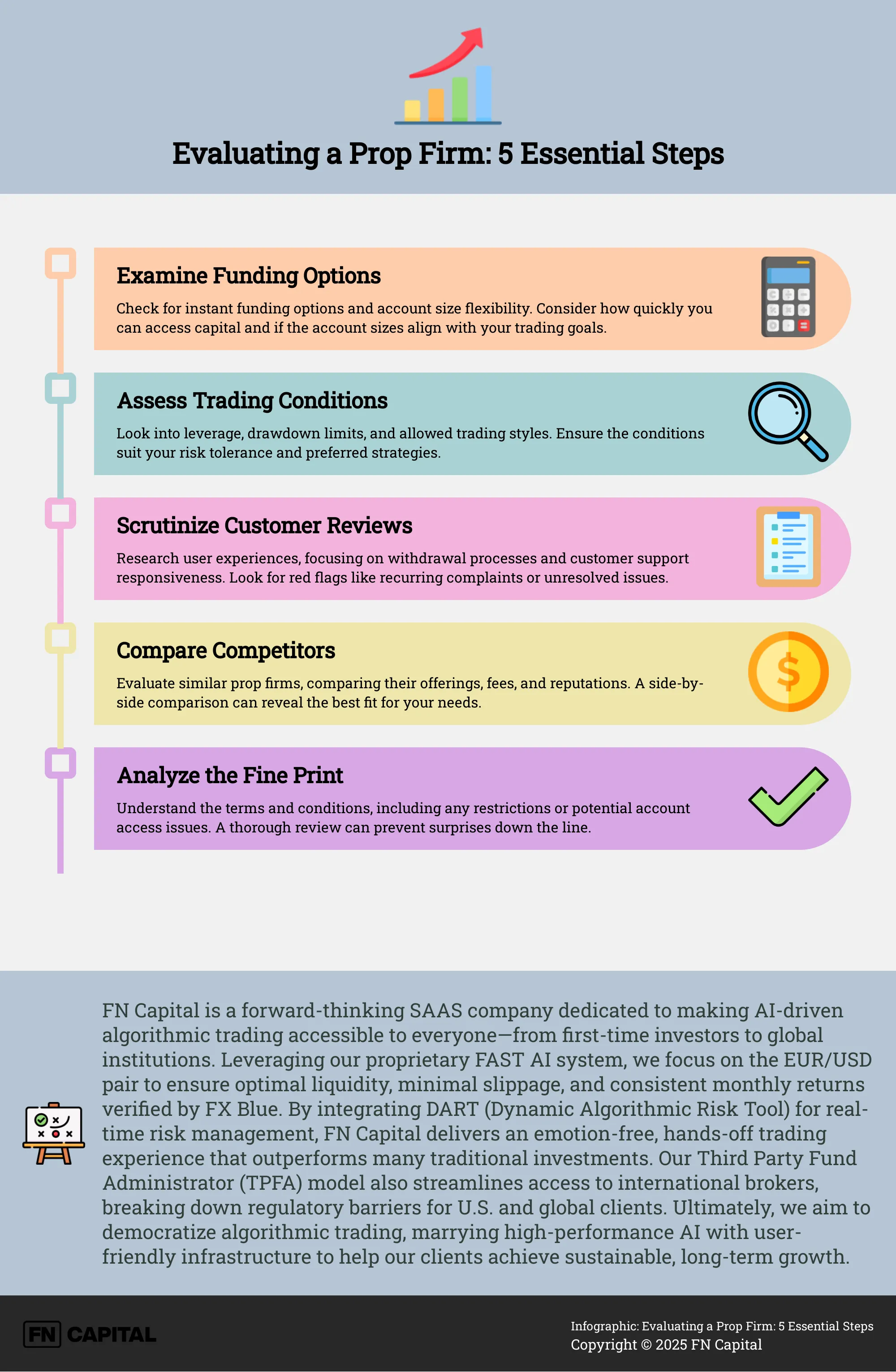

What are the key things to consider before signing up with any prop firm? Before joining any prop firm, carefully evaluate your trading experience, risk tolerance, and financial goals. Understand the firm’s trading conditions, including leverage, drawdown limits, and any restrictions on trading strategies. Thoroughly research the firm’s reputation, paying close attention to customer reviews regarding withdrawals and customer support.

What resources are available if I need help with my Algo Forex Funds account? Algo Forex Funds offers 24/7 live chat customer support, which has generally received positive reviews for responsiveness and helpfulness. However, if you encounter issues, particularly with withdrawals, be prepared to provide detailed documentation and potentially engage in extended communication to resolve the problem. While the firm doesn’t offer extensive educational resources, numerous online platforms provide forex trading courses and market analysis tools that can supplement your trading experience.