Ready to put your trading on autopilot? In the ever-evolving world of finance, automated trading software has become a game-changer, offering sophisticated tools and strategies for both seasoned professionals and newcomers. Whether you’re a day trader seeking quick gains or a long-term investor aiming for steady growth, the right software can significantly impact your success. This comprehensive guide explores the top automated trading platforms of 2025, providing in-depth automated trading software reviews 2025 to help you make informed decisions. We’ll cover key features, pricing, user experiences, and emerging trends, empowering you to choose the perfect platform for your individual needs and goals. From AI-powered algorithms to user-friendly interfaces, we’ll break down the complexities of automated trading, offering practical advice and actionable steps to get you started.

Key Takeaways

- Automated trading software streamlines your approach: From faster execution to emotionless trading, these platforms offer advantages for all skill levels. Consider your individual needs and preferences when selecting software.

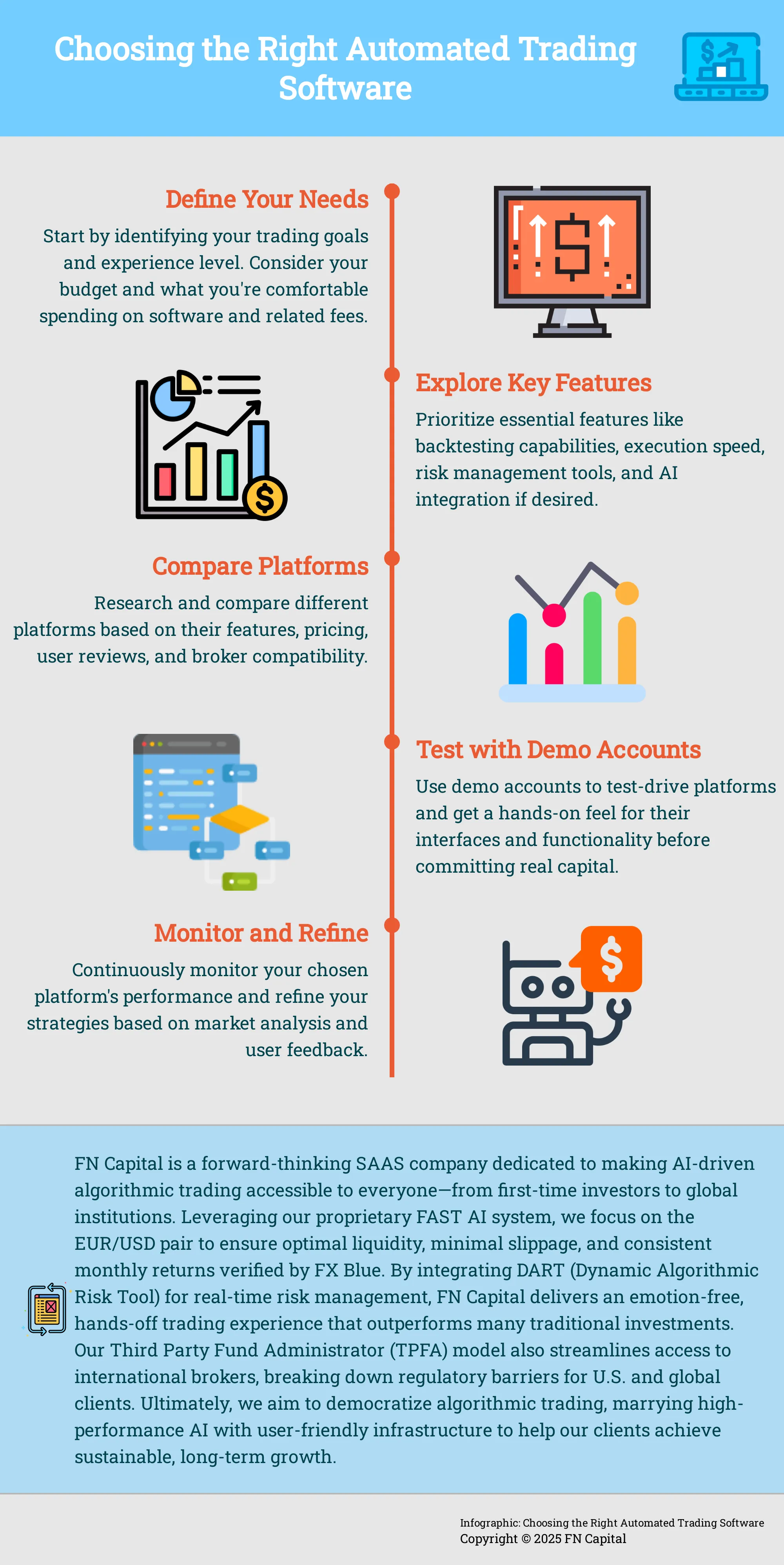

- Focus on essential platform features: Backtesting, execution speed, a user-friendly interface, and robust risk management tools are crucial. Test-drive platforms with demo accounts to find the best fit.

- Automated trading requires ongoing management: Actively monitor performance, refine your strategies, and stay informed about market dynamics. Human oversight remains essential, even with automation.

What is Automated Trading Software?

Automated trading software lets computer programs execute trades for you based on pre-defined rules. These systems analyze market data, identify opportunities, and make trades without human intervention, increasing efficiency and speed. Think of it as your personal trading assistant, working 24/7.

Modern automated trading platforms often use advanced algorithms and machine learning to refine their strategies. They process vast amounts of data in real-time, enabling quick decision-making and execution, which is crucial in today’s fast-moving markets. These platforms can handle anything from simple, rule-based strategies to complex AI-driven models that adapt to changing market conditions. By minimizing human error and emotional decisions, automated trading software offers a systematic approach to trading a range of assets, including stocks, forex, and cryptocurrencies. This evolution from basic algorithms to sophisticated AI is changing how we interact with the markets.

Top Automated Trading Platforms

Choosing the right automated trading platform is crucial for success. Here’s a rundown of some popular options, highlighting their strengths and weaknesses:

Top Automated Trading Platforms

Choosing the right automated trading platform is crucial for success. Here’s a rundown of some popular options, highlighting their strengths and weaknesses:

ProRealTime

ProRealTime consistently ranks high, praised for its server-side execution, which offers speed and reliability. Its robust backtesting features and a no-code option make it suitable for both beginners and experienced traders. However, ProRealTime is expensive, has limited broker compatibility, and relies on a single data source.

TradingView

TradingView’s large community and broad broker compatibility make it a popular choice. Its Pine Script functionality allows for customized strategies (coding experience required), and it offers solid backtesting capabilities. Keep in mind that automation requires third-party tools, and some key features sit behind a paywall.

TrendSpider

TrendSpider excels in AI-driven analysis and no-code strategy testing, making it ideal for those exploring automated trading. However, it lacks direct brokerage execution—trades must be placed manually—and has limited broker options. It’s also pricier than some other platforms.

MetaTrader

MetaTrader, a free, open-source platform, boasts wide broker compatibility and support for third-party APIs. While its flexibility is a plus, it requires coding knowledge (MQL) and uses client-side execution, which can be slower and less reliable than server-side. Customer support is also limited.

FN Capital’s FAST AI

FN Capital’s FAST AI focuses on a fully automated, AI-driven approach to forex trading, specifically targeting the EUR/USD pair. This specialized focus aims for optimized liquidity management and precise execution. The platform boasts a verified 4-year track record and offers a 100-day money-back guarantee. It’s designed for both individual investors seeking passive income and institutional clients looking for advanced algorithmic solutions.

NinjaTrader

NinjaTrader is a popular platform known for its advanced charting, backtesting, and order execution capabilities. It offers both free and paid versions, catering to traders of different experience levels. While it supports automated trading, it requires some coding knowledge for more complex strategies.

Quantopian

Quantopian provides a research and development environment for quantitative trading strategies. While it was once a popular platform for developing and deploying automated algorithms, it has shifted its focus. Currently, Quantopian primarily offers enterprise solutions for institutional investors.

AlgoTrader

AlgoTrader is a robust platform designed for institutional-grade algorithmic trading. It offers a comprehensive suite of tools for backtesting, execution, and risk management. Given its complexity and features, AlgoTrader is best suited for experienced quants and professional trading firms.

Backtesting Capabilities

Robust backtesting is crucial for evaluating a trading strategy. Look for platforms offering tick-accurate historical data and reproducible results. This lets you simulate your strategy’s performance and refine it before going live. A platform with clear, visual backtesting results is essential for understanding potential outcomes.

Execution Quality and Speed

In trading, every millisecond counts. Server-side execution is generally superior to client-side because of its speed and reliability. This means your orders are executed on the platform’s servers, closer to the exchanges, minimizing latency. Look for platforms that prioritize fast order execution.

User-Friendly Interface

Even complex trading strategies should be manageable within a clean interface. A good user experience is key, especially for newcomers. A well-designed platform simplifies strategy creation and monitoring, saving you time.

AI and Machine Learning Integration

AI and machine learning are transforming trading. Modern AI trading bots leverage these technologies to analyze market data and execute trades. If you’re interested in cutting-edge strategies, look for platforms that integrate these capabilities.

Risk Management Tools

Protecting your capital is paramount. Effective risk management tools are essential. Features like stop-loss orders and real-time risk assessments help you manage potential losses.

Key Features to Look For

Finding the right automated trading software depends on your specific needs and trading style. Whether you’re a seasoned pro or just starting out, consider these key features:

Backtesting Capabilities

Robust backtesting is crucial for evaluating a trading strategy. Look for platforms offering tick-accurate historical data and reproducible results. This lets you simulate your strategy’s performance and refine it before going live. A platform with clear, visual backtesting results is essential for understanding potential outcomes.

Execution Quality and Speed

In trading, every millisecond counts. Server-side execution is generally superior to client-side because of its speed and reliability. This means your orders are executed on the platform’s servers, closer to the exchanges, minimizing latency. Look for platforms that prioritize fast order execution.

User-Friendly Interface

Even complex trading strategies should be manageable within a clean interface. A good user experience is key, especially for newcomers. A well-designed platform simplifies strategy creation and monitoring, saving you time.

AI and Machine Learning Integration

AI and machine learning are transforming trading. Modern AI trading bots leverage these technologies to analyze market data and execute trades. If you’re interested in cutting-edge strategies, look for platforms that integrate these capabilities.

Risk Management Tools

Protecting your capital is paramount. Effective risk management tools are essential. Features like stop-loss orders and real-time risk assessments help you manage potential losses.

Customization Options

The ability to tailor your trading strategies is key for experienced traders. Look for platforms offering customization options, allowing you to code your own algorithms. This flexibility empowers you to implement your unique trading ideas.

Broker Compatibility

Seamless integration with your brokerage is essential. Ensure the platform you choose is compatible with your broker to avoid technical hurdles. This simplifies order routing and account management.

Compare Pricing and Value

Pricing and value are key factors when evaluating automated trading software. A higher price tag doesn’t always mean better performance, so weigh features against cost. Here’s a comparison of popular platforms:

Some platforms, like ProRealTime, are known for robust features like server-side order execution and accurate backtesting. While ProRealTime scores highly (90% in one recent review), it has a premium price. This might give budget-conscious traders pause. It’s also worth noting that ProRealTime relies on a single data source and has limited broker compatibility, potential drawbacks for some.

AI-powered platforms offer another set of pricing and value considerations. Trade Ideas offers subscriptions ranging from $89 to $178 per month. Its AI tools, HOLLY and OddsMaker, provide powerful market research capabilities. The platform’s real-time data and advanced features justify the cost for many, but the learning curve can be steep. Similarly, TrendSpider, with plans starting at $107 per month, offers comprehensive market research tools and AI-powered scanners. Its educational resources are a plus for those wanting to improve their trading. Both Trade Ideas and TrendSpider are covered in this helpful review of AI stock trading bots.

For a more flexible pricing model, StockHero offers plans from $29.99 to $99.99 per month. Its unique marketplace lets you create your own trading bots or rent pre-built strategies. This accessibility makes it a good option for both beginners and experienced traders. Keep in mind that bot performance on StockHero varies depending on the chosen strategy and market conditions. You can explore their pricing page for more details.

Beyond purely AI-driven platforms, consider brokers with automated features. AvaTrade, rated 4.6 stars, offers popular platforms like MT4 and MT5, along with AvaSocial and DupliTrade for copy trading. The automated signals and social trading features can be valuable, especially for those interested in mirroring successful traders. You can compare AvaTrade with other auto-trading brokers in this roundup of the best platforms.

Remember, the value of automated trading software goes beyond the sticker price. Consider the features, tools, educational support, and overall fit with your trading style. Each platform caters to different needs, so choose the one that best aligns with your goals.

Strengths: MetaTrader is a free, open-source platform known for its wide broker compatibility and support for third-party APIs. This makes it a highly versatile option for experienced traders comfortable with customization.

Weaknesses: Automation on MetaTrader requires coding in MQL, which can be a hurdle for beginners. Its client-side execution can be slower and less reliable than server-side alternatives. Customer support can also be limited.

FN Capital’s FAST AI

Strengths and Weaknesses of Leading Platforms

Picking the right automated trading software depends on your specific needs and trading style. Let’s break down the pros and cons of some popular platforms to help you find the best fit.

ProRealTime

Strengths: ProRealTime excels with its server-side trade execution, ensuring faster, more reliable order fulfillment. Its robust backtesting features help you refine your strategies before going live. The platform also offers a no-code option, making it accessible even for those new to automated trading.

Weaknesses: ProRealTime comes with a higher price tag. It also has limited broker compatibility, relying on a single data source, which might restrict your choices.

TradingView

Strengths: TradingView’s large, active community offers valuable support and shared insights. Its extensive broker integrations provide flexibility, and Pine Script allows for effective backtesting. It’s a popular choice for charting and analysis, making it a convenient all-in-one platform.

Weaknesses: Automating your strategies on TradingView often requires third-party tools, adding complexity. Some key features are locked behind a paywall, so factor in the subscription costs.

TrendSpider

Strengths: TrendSpider shines with its AI-driven market analysis and no-code strategy testing. This empowers traders of all skill levels to identify opportunities and experiment with different approaches.

Weaknesses: TrendSpider lacks direct brokerage execution. You’ll need to place trades manually, which can be a drawback for fully automated strategies. It also has a limited selection of brokers and a higher price point.

MetaTrader

Strengths: MetaTrader is a free, open-source platform known for its wide broker compatibility and support for third-party APIs. This makes it a highly versatile option for experienced traders comfortable with customization.

Weaknesses: Automation on MetaTrader requires coding in MQL, which can be a hurdle for beginners. Its client-side execution can be slower and less reliable than server-side alternatives. Customer support can also be limited.

FN Capital’s FAST AI

Strengths: FN Capital’s FAST AI offers a fully managed, AI-powered approach to forex trading, specifically focusing on the EUR/USD pair. This eliminates the need for manual strategy development or execution. The system boasts a 4-year verified track record, providing transparency and insight into its historical performance, which you can review on FX Blue. FN Capital also offers a 100-day money-back guarantee, allowing potential clients to test the platform risk-free. For those seeking passive income and simplified access to algorithmic trading, FN Capital handles the complexities, from account setup with a Third Party Fund Administrator (TPFA) to ongoing trade execution.

Weaknesses: FN Capital’s FAST AI specializes in forex, specifically the EUR/USD pair. This concentrated focus may not suit traders interested in diversifying across different asset classes or markets. While the managed approach simplifies trading, it also means less direct control over individual trades. The TPFA structure, while beneficial for accessing international brokers, may add a layer of complexity for some users.

User Experience and Expert Opinions

User experience (UX) is now a key factor in the success of automated trading platforms. A seamless UX not only makes users happy but also builds the trust essential for client retention in today’s competitive market. As the fintech industry keeps growing, projected to grow at a 16.5 percent compound annual growth rate (CAGR) from 2024 to 2032, intuitive and efficient interfaces are more important than ever.

Building effective trading software also relies heavily on incorporating user feedback. Teams that use early feedback to adjust their plans can cut development time, leading to faster improvements and happier users. Actively engaging with the community through forums and feedback channels ensures features actually address user needs. Plus, using techniques like Natural Language Processing (NLP) to analyze user reviews helps developers quickly identify feature requests and bug reports, further improving the platform and the overall user experience.

Emerging Trends

The world of automated trading is constantly evolving. Staying ahead of the curve means understanding the forces shaping the future of automated trading software. Here’s a glimpse at some key trends:

The Rise of AI-Driven Trading: We’re seeing a significant shift from basic algorithmic systems to sophisticated AI-powered platforms. Think advanced machine learning algorithms, neural networks, and even natural language processing to analyze market conditions and execute trades with greater precision. This isn’t just about speed; it’s about smarter decision-making. AI can identify subtle patterns and correlations that humans might miss, leading to potentially more profitable trades. These platforms can process vast amounts of data, identify complex patterns, and execute trades at speeds impossible for human traders.

Dynamic Adaptation: Forget rigid, rule-based systems. The future is about algorithms that learn and adapt to changing market dynamics. Imagine a platform that constantly refines its strategies based on real-time data and feedback. This dynamic adaptation allows automated systems to remain effective even in volatile or unpredictable markets. We’re also moving towards personalized investment strategies, with algorithms tailored to individual investor preferences and risk tolerance. This shift allows for more customized and potentially more effective trading strategies.

Data Integration for Deeper Insights: Modern trading bots are becoming increasingly sophisticated in how they gather and interpret data. They can now integrate multiple data streams, from traditional market data to social media sentiment and news feeds, to forecast market movements with increasing accuracy. This comprehensive approach provides a more holistic view of the market, enabling more informed trading decisions. Plus, sophisticated risk management protocols protect traders from excessive losses while optimizing potential gains. This allows traders to make data-backed decisions and manage risk more effectively.

Increasing Complexity (and the Need for Simplicity): As automated trading becomes more complex, the need for user-friendly interfaces becomes even more critical. While the underlying technology might be incredibly sophisticated, the platforms themselves need to be accessible and intuitive for traders of all skill levels. This means clear dashboards, easy-to-understand reporting, and streamlined setup processes. The goal is to empower traders with powerful tools without overwhelming them with technical jargon or complicated configurations. Even complex AI-driven systems should be easy to use and understand.

API-First Infrastructures: With liquidity spread across various markets and asset classes, trading venues are prioritizing API-first infrastructures. This allows for seamless connections between execution tools, data feeds, and risk management systems. This interconnectedness is key for traders who need to access and manage their trading operations efficiently across different platforms and markets. This trend facilitates greater flexibility and customization in automated trading setups.

Automated trading software comes with varying costs, from monthly subscriptions to one-time purchases. Factor in not just the software price, but also any potential brokerage fees, data feed costs, or other expenses. WallStreetZen provides a helpful list of factors to consider, including ease of use, backtesting capabilities, speed, data access, risk management tools, customer support, and security. Thinking through these elements will help you choose a platform that aligns with your budget and available resources.

Test Platforms with Demo Accounts

Most reputable platforms offer demo accounts, and I highly recommend taking advantage of them. A demo account lets you explore the software’s features, test different strategies, and get a feel for the platform’s interface without risking real money. This hands-on experience is invaluable. Before committing financially, use the demo account to ensure the platform provides the tools you need, such as backtesting, real-time data, customization options, and brokerage connectivity, as highlighted by Stock Analysis.

Getting started with automated trading might seem daunting, but with today’s intuitive platforms, it’s more accessible than ever. Begin by selecting a platform that aligns with your trading style and goals. Many platforms, including FN Capital, offer pre-built strategies or “scripts” that you can deploy immediately. These are a great starting point, especially if you’re new to automated trading. Modern AI trading bots leverage advanced machine learning algorithms and neural networks to analyze market conditions and execute trades with remarkable precision. Look for a platform that offers clear documentation and tutorials to guide you through the setup process. Once you’ve chosen a strategy, backtest it thoroughly using historical data to understand its potential performance and risk profile. Remember, starting with smaller amounts of capital is always wise until you gain confidence in your automated system.

Best Practices for Risk Management

Risk management is paramount in any trading strategy, and automated trading is no exception. While automation removes emotional decision-making, it’s crucial to implement safeguards. Modern AI trading bots have evolved to incorporate sophisticated risk management protocols that can help protect traders from excessive losses. Define your risk tolerance upfront—how much are you willing to lose on a single trade or across your entire portfolio? Utilize features like stop-loss orders, which automatically exit a trade at a predetermined price to limit potential losses. Position sizing is another critical element. Determine the appropriate amount of capital to allocate to each trade based on your risk assessment. Diversification is key, even within automated trading. Don’t put all your eggs in one basket. Explore different strategies or asset classes to spread your risk.

Continuous Learning and Strategy Refinement

The markets are dynamic, so your automated trading strategies should be too. Regularly review your strategy’s performance and identify areas for improvement. Incorporate user feedback and market analysis into your refinement process. Backtesting new ideas against historical data can help you assess their potential before implementing them live. Consider A/B testing different versions of your strategy to see which performs best. Embrace the iterative nature of algorithmic trading—continuous learning and refinement are essential for long-term success. Consistently listening to customer feedback and making data-driven decisions at every stage allows you to adapt quickly, even in a rapidly changing market.

Related Articles

- How to Make Money with Automated Trading: A Practical Guide

- Practical Guide to Buying Algorithmic Trading Software

- Algorithmic Trading Platforms: Your Complete Guide – FN Capital

- AI’s Impact on Algo Trading

- Understanding Algo Trading Risks: Essential Guide

Frequently Asked Questions

Is automated trading suitable for beginners?

Absolutely! Many platforms offer user-friendly interfaces, pre-built strategies, and educational resources, making it easier than ever for beginners to get started. Even if you’re new to trading, automated software can handle the technical complexities, allowing you to focus on your overall investment goals. However, it’s still crucial to understand the basics of trading and risk management before diving in.

What are the key advantages of automated trading?

Automated trading offers several benefits, including increased speed and efficiency, 24/7 market monitoring, and the removal of emotional decision-making. Automated systems can execute trades much faster than a human, taking advantage of fleeting market opportunities. They also eliminate impulsive trades driven by fear or greed, leading to more disciplined and consistent results.

How do I choose the right automated trading platform?

Consider your trading style, technical skills, and budget. If you’re a beginner, look for a platform with a user-friendly interface and pre-built strategies. More experienced traders might prefer platforms offering advanced customization options and robust backtesting capabilities. Don’t forget to test different platforms with demo accounts before committing real capital.

What are the potential risks of automated trading?

Like any trading method, automated trading carries risks. Technical failures, unexpected market volatility, and over-reliance on technology can all lead to losses. It’s essential to implement robust risk management strategies, including stop-loss orders and diversified portfolios. Regularly monitor your automated systems and be prepared to intervene if necessary.

How can I stay ahead of the curve in automated trading?

The world of automated trading is constantly evolving. Stay informed about emerging trends like AI-driven strategies, dynamic adaptation, and advanced data integration. Continuously learn and refine your strategies based on market analysis and user feedback. Engage with the trading community and explore new tools and techniques to maximize your potential.

Common Challenges and Solutions

Automated trading software can simplify trading and open up new opportunities, but it’s not without its challenges. Understanding these hurdles—and how to overcome them—is key to maximizing your success.

Manage Market Volatility

Markets fluctuate, and unexpected events can trigger significant price swings. A sudden news announcement or a shift in investor sentiment can impact even the most sophisticated algorithms. Modern AI trading bots incorporate sophisticated risk management protocols to protect traders from excessive losses while optimizing potential gains. Look for software with features like stop-loss orders, dynamic position sizing, and real-time risk assessments. These tools help you weather market storms and protect your capital. At FN Capital, our proprietary DART (Dynamic Algorithmic Risk Tool) constantly adjusts to market conditions, ensuring your investments remain protected.

Avoid Over-Reliance on Technology

While automation is powerful, it’s important to remember that software is a tool, not a magic bullet. Human oversight remains crucial. You’re still responsible for setting your overall trading strategy, defining your risk tolerance, and monitoring the software’s performance. Don’t blindly trust any system; understand its logic and be prepared to intervene when necessary. Regularly review your automated strategies and make adjustments as needed to stay aligned with your goals. FN Capital offers transparent reporting and performance tracking, empowering you to stay informed and maintain control.

Manage Technical Failures

Technology isn’t foolproof. Software glitches, connectivity issues, and power outages can disrupt your automated trading. Choose platforms with robust infrastructure and reliable customer support. User feedback plays a vital role in identifying and resolving technical issues, so select a provider that actively solicits and responds to user input. Having a backup plan is also essential. Know what steps to take if your software fails and consider having a manual trading strategy in place for emergencies. At FN Capital, we prioritize system stability and offer dedicated support to address any technical concerns.

Customize Strategies Effectively

Not all trading strategies are created equal, and what works for one trader might not work for another. Your software should allow you to customize your approach based on your individual goals, risk tolerance, and market outlook. Look for platforms that offer a range of customizable parameters, including indicators, entry and exit rules, and order types. The ability to backtest your strategies is also crucial. This allows you to simulate your strategy’s performance on historical data, helping you refine your approach before risking real capital. While FN Capital’s FAST AI algorithm is pre-built for optimal performance, our team can work with institutional clients to tailor strategies for specific needs.