Everyone’s looking for smarter ways to grow their investments, and the idea of achieving consistent returns without being glued to a screen is incredibly appealing. This is where the power of automated trading systems truly shines. Consider a system that executes trades with precision, driven by sophisticated AI, and backed by a verifiable track record of performance, like FN Capital’s FAST AI with its 7.5%+ average monthly returns verified on FX Blue. These systems are designed to remove emotional bias, operate 24/5, and stick to a defined strategy, aiming for optimized results. We’re going to explore how these systems can bring efficiency and discipline to your trading, potentially transforming how you approach the financial markets and work towards your financial objectives.

Key Takeaways

- Let Logic Lead Your Trades: Automated systems use your defined strategy to make trades, helping you avoid emotional reactions and stick to a disciplined investment approach.

- Keep Your Strategy Active, Day and Night: Automation ensures your trading plan is executed efficiently around the clock, and gives you the power to test and improve it with historical insights.

- Choose Your Automation Tools Wisely: Select a platform or service that fits your financial aims and comfort level, and stay engaged by understanding how it’s working for you.

What is an Automated Trading System?

If you’re exploring ways to make your money work for you, you might have heard about automated trading systems. It can sound a bit technical at first, but the basic idea is actually quite simple. Let’s walk through what these systems are and how they compare to the more traditional hands-on approach to trading. Understanding this can help you see if it’s a path you want to explore further.

Defining Automated Trading & Its Core Parts

So, what exactly is an Automated Trading System (ATS)? Think of it as a smart computer program that’s set up to automatically buy and sell investments for you. You, or the system provider, establish a specific set of rules—these rules might be based on technical analysis (which involves looking at price charts and historical data), complex mathematical formulas, or even information gathered from various news feeds and market indicators. Once these rules are programmed, the ATS monitors the markets and, when the conditions align with your pre-set criteria, it executes the trades. It’s like having a highly disciplined assistant who follows your instructions to the letter, 24/7.

Automated vs. Manual Trading: What’s the Difference?

The biggest distinction between automated and manual trading comes down to who, or what, makes the final decision to place a trade. In manual trading, you’re in the driver’s seat: you do the research, analyze market movements, decide when to buy or sell, and then physically execute each trade. It requires your constant attention and a steady hand. Automated trading, however, delegates the execution part to a computer program. You still define the trading strategy, but the system takes over from there, acting on your behalf. This can bring some real advantages, like incredible speed in reacting to market changes and the ability to stick to a plan without emotions like fear or excitement clouding judgment.

How Automated Trading Works

Okay, so you’re curious about what really goes on under the hood of an automated trading system. It might sound like complex magic, but it’s actually a very logical process, driven by technology to make smart trading moves. Think of it as having a super-efficient assistant who follows your instructions to the letter, 24/7, without ever getting tired or emotional. Let’s break down exactly how these systems turn market information into actual trades.

How Algorithms Drive Decisions

At the heart of every automated trading system is an algorithm—a set of carefully crafted instructions. These aren’t just random code; they are pre-programmed rules and strategies telling the system precisely when to buy, sell, or hold. Because decisions follow these pre-set conditions, they happen incredibly fast, far quicker than human reaction, and without emotional bias. This means no fear-driven selling or greed-based buying—just pure, data-driven execution. For example, FN Capital’s proprietary FAST AI algorithm is engineered to spot low-risk, high-probability market opportunities by adhering to its unique instructions.

Processing Market Data Instantly

For an algorithm to make smart decisions, it needs a constant stream of real-time information. Automated trading systems are always “listening” to the market, absorbing vast amounts of data every second. This includes live price movements, trading volumes, and other key market indicators. This instant data processing is crucial because markets can shift in an instant. By analyzing fresh information, the system accurately assesses if current conditions meet its trading criteria. Focusing on highly liquid pairs like EUR/USD, as FN Capital does with FAST AI, ensures robust data and efficient trade execution.

The Trade Execution Flow

Once the algorithm processes market data and spots a trading opportunity based on its rules, execution is next. Here’s the typical flow: the system constantly compares current market prices with its algorithm’s ‘ideal’ buy or sell price. When the live market price aligns with these criteria, the system acts immediately. It automatically places an order with the broker, ensuring swift action to capture the opportunity before conditions change. Tools like FN Capital’s DART (Dynamic Algorithmic Risk Tool) further refine this by adjusting trade parameters like position sizes in real-time, optimizing execution and managing risk.

Popular Automated Trading Strategies

Once your automated trading system is ready, you’ll choose its trading strategies. Think of these as specific game plans your system will use to make trades. Different strategies suit different market conditions and risk appetites. Let’s explore a few common approaches that systems, like our own FAST AI algorithm, can implement with precision.

Trend Following & Momentum Plays

Imagine you’re surfing; you want to catch a wave and ride it for as long as possible. Trend following strategies work similarly in the financial markets. These systems are designed to identify the direction the market is heading—whether prices are climbing, falling, or generally moving sideways—and then place trades that align with that flow. The core idea is to capitalize on the momentum of price movements. So, if a currency pair like EUR/USD starts showing a strong upward movement, a trend-following algorithm would aim to buy, holding the position as long as the trend appears to continue. It’s less about trying to predict the future and more about reacting intelligently to what’s happening right now.

Mean Reversion & Arbitrage Opportunities

Mean reversion is built on the idea that prices, much like a stretched rubber band, tend to snap back to their historical average over time. If an asset’s price strays significantly from its usual value without a clear underlying reason, a mean reversion strategy would bet on its return. For instance, if EUR/USD typically trades within a certain range but suddenly drops well below it, the system might see this as an opportunity to buy, anticipating a bounce back towards its average.

Another interesting approach is arbitrage. This is like finding the same item for sale at two different prices in two different shops and making a profit from that difference. In trading, arbitrage strategies involve exploiting tiny, often fleeting, price discrepancies of the same asset across different markets or brokers. An automated system excels here, as it can detect these opportunities and act on them in milliseconds—buying low in one place and selling high in another to capture a small, often low-risk, profit.

Market-Neutral Tactics

What if you want to pursue gains regardless of whether the overall market is soaring or taking a dip? That’s where market-neutral strategies come into play. These clever tactics aim to reduce or even eliminate broad market risk by taking carefully balanced, offsetting positions. For example, a system might simultaneously buy an asset it identifies as undervalued while selling short an asset in the same sector it deems overvalued. The goal here is to profit from the relative performance difference between the two positions, rather than relying on the market’s overall direction. This approach can be particularly appealing if you’re looking for returns that aren’t heavily tied to general market swings, focusing instead on specific, isolated opportunities.

Key Benefits of Automated Trading

Automated trading isn’t just about speed; it’s about fundamentally changing how you can approach the markets. By letting algorithms handle the heavy lifting, you open yourself up to a range of advantages that can make your trading more consistent, less stressful, and potentially more effective. At FN Capital, our FAST AI is designed to harness these benefits for you. Let’s look at some of the standout advantages that draw traders of all levels to automated systems.

Trade Logically, Not Emotionally & Improve Efficiency

One of the biggest hurdles in trading is managing your own emotions. Fear can make you close a position too early, while greed might tempt you to hold on too long. Automated trading systems help take these emotional rollercoasters out of the equation. Because trades are executed based on pre-set rules, you can maintain discipline and stick to your strategy, even when the market gets choppy.

This systematic approach also brings incredible efficiency. Instead of manually monitoring charts and placing orders, algorithms can process vast amounts of data and execute trades in fractions of a second. This means your strategies are implemented precisely as planned, improving overall trading efficiency and freeing up your time.

Enjoy 24/7 Market Coverage & Execution

The financial markets, especially forex, operate around the clock. As a human, you can’t possibly monitor every opportunity, 24/7 – you need to sleep! Automated trading systems, however, don’t. They can operate continuously, scanning the markets and executing trades based on your strategy at any time of day or night. This means you won’t miss out on potential moves that happen while you’re away from your screen.

This constant vigilance allows your strategies to be deployed faster and potentially more frequently than manual trading would permit. When a market opportunity aligns with your predefined criteria, the system can act instantly. This ability to seize moments as they arise is a significant advantage.

Backtest & Optimize Your Strategies

Ever wished you could test a trading idea without risking real money? With automated trading, you can. A key advantage is the ability to backtest strategies using historical market data. This process allows you to see how your algorithm would have performed in the past, giving you valuable insights into its potential profitability and risk characteristics before you deploy it in live markets.

Beyond just testing, backtesting results enable you to refine and optimize your approach. You can tweak parameters, adjust rules, and see how those changes might have impacted historical performance. This iterative process of testing and optimizing helps you build more robust strategies.

Understanding the Challenges & Risks

Automated trading is incredibly powerful, but like any sophisticated tool, it’s smart to understand its potential challenges. Being aware of these doesn’t mean you should shy away; instead, it means you can approach automated trading with a clear view and make informed decisions. Think of it as knowing your car needs regular oil changes – it’s just part of ensuring smooth performance. For instance, while systems like our FAST AI are designed with advanced risk mitigation features like DART, a foundational understanding of potential hurdles is always beneficial. Let’s walk through a few key areas to keep in mind so you feel fully prepared.

Dealing with Technical Glitches & System Failures

One common thought is that automated trading systems are entirely “set it and forget it.” While they do handle the heavy lifting of trade execution, they still operate on technology, which, as we all know, isn’t infallible. Think about internet outages, server issues, or even a simple software bug. These can disrupt your trading if you’re not prepared. That’s why ongoing monitoring is crucial. You’ll want to regularly check that your system is running as expected and that trades are being executed correctly. Remember, even the most robust systems can encounter unforeseen market events or technical hiccups, so having a plan for oversight is a smart move.

Avoiding Over-Optimization Traps

When you’re backtesting a strategy, it can be tempting to tweak parameters until your historical results look absolutely perfect. This is known as over-optimization. The danger here is that you might create a system that performs exceptionally well on past data but falls apart when faced with live, unpredictable market conditions. It’s like tailoring a suit so perfectly to a mannequin that it doesn’t fit a real person. The key is to build strategies that are robust and based on sound market principles, rather than just curve-fitting to historical data. While automated systems offer many advantages, ensuring your strategy isn’t over-optimized is vital for long-term success.

Considering Market Impact & Liquidity

If your automated system is placing very large orders, especially in markets with lower trading volumes, it can actually influence the price – this is called market impact. Imagine trying to buy a huge quantity of a rarely traded stock; your own buying pressure could drive the price up before your entire order is filled. This is why many sophisticated automated systems, including our FAST AI which focuses on the highly liquid EUR/USD pair, are designed to manage order execution carefully. Automated trading strategies often factor in liquidity to minimize slippage (the difference between the expected price of a trade and the price at which the trade is actually executed) and ensure efficient order filling.

Building Your Own Effective System

Creating an automated trading system that truly works for you involves more than just finding some code online. It’s about thoughtful design, smart safeguards, and ongoing attention. Whether you’re aiming to build your own system from scratch or simply want to understand what makes a sophisticated pre-built system like FN Capital’s FAST AI algorithm so effective, focusing on a few core pillars is key. These elements are what separate a potentially profitable system from one that might quickly run into trouble.

Develop a Robust Algorithm

At the very core of any automated trading system is its algorithm. Think of this as the central intelligence, a detailed set of pre-programmed rules and strategies that dictate precisely when to buy and sell assets. These rules aren’t just pulled out of thin air; they can be based on a wide array of factors, such as technical indicators like moving averages or RSI, recognizable chart patterns, or even how the market reacts to specific economic news.

The goal here is to develop an algorithm that is not only logical and based on a sound trading idea but also rigorously tested. A well-crafted algorithm is designed to consistently identify trading opportunities that have a high probability of success and then execute those trades with precision. This systematic approach helps to remove the emotional decision-making that can often be a pitfall for manual traders, leading to more consistent application of your strategy.

Implement Smart Risk & Position Sizing

Even the most brilliant trading algorithm can lead to significant losses if it’s not paired with strong risk management. This is where implementing smart risk and position sizing strategies becomes absolutely essential. Before you even think about live trading, you need to clearly define how much of your capital you’re prepared to risk on any individual trade, and what your overall risk exposure will be.

Effective systems achieve this by incorporating specific rules, such as automatically setting stop-loss orders to cap potential losses if a trade moves against you, and take-profit levels to secure gains when a trade works out. For example, FN Capital’s own DART (Dynamic Algorithmic Risk Tool) is built to continuously optimize these critical parameters in real-time. By clearly establishing your risk tolerance and how much capital to allocate to each trade, you create a vital safety net for your funds and help ensure your trading strategy can hold up under various market conditions.

Monitor Continuously & Adapt

The financial markets are incredibly dynamic; they’re always changing and evolving. A strategy that performed exceptionally well last year, or even last month, might not be as effective today. This is why continuous monitoring and a willingness to adapt your system are fundamental to long-term success in automated trading. If you’re building your own system, one of the advantages is having the control to make these necessary tweaks to your strategies as market behaviors shift.

Regularly reviewing your system’s performance, carefully analyzing the trades it makes (both wins and losses), and staying informed about broader market conditions are all crucial activities. This ongoing process of refinement ensures that your automated trading system can evolve. It helps keep your system aligned with your financial goals and responsive to the ever-changing landscape of the markets, much like how advanced AI-driven systems are designed for self-optimization over time.

Getting Started with Automated Trading

Dipping your toes into the world of automated trading can feel exciting, and maybe a little overwhelming at first. But like any new skill, breaking it down into manageable steps makes all the difference. You don’t need to be a Wall Street wizard or a coding genius to begin, especially with today’s technology designed to simplify the process. The key is to approach it thoughtfully and arm yourself with the right information and tools.

Think of it as learning to drive a new car. Initially, there are a few new buttons and systems to understand, but soon enough, you’re cruising. Automated trading is similar; it’s about understanding the vehicle that can help you reach your financial goals. Whether you’re looking to build your own system from the ground up or leverage a sophisticated AI-powered solution, the foundational steps are quite similar. We’re here to walk you through them, so you can feel confident as you begin your automated trading journey. Remember, the goal is to make trading work for you, efficiently and intelligently. With a clear path, you’ll find that getting started is more straightforward than you might imagine.

Choose Your Platform & Tools Wisely

Your trading platform is your command center, so picking the right one is a crucial first step. You’ll want software that aligns with your goals and comfort level. Some platforms, like MetaTrader 4, are popular for those who want to create their own trading rules and algorithms. However, if you’re looking for a more hands-off approach, a service like FN Capital provides a fully automated system, so you don’t have to build from scratch.

The best platform for you will allow for an efficient workflow and support your current skill level while offering room to grow. Consider factors like ease of use, the range of available tools, backtesting capabilities, and, of course, the costs involved. For many, especially those new to automated trading or seeking passive income, exploring AI trading solutions designed for individual investors can be an excellent starting point, as they often handle much of the complexity for you.

Integrate with Brokers & Data Feeds

Once you have a platform or system in mind, the next step is connecting it to the market. Automated trading systems thrive on real-time market data – this includes price movements, trading volume, and other key metrics that inform trading decisions. Think of it as the system’s eyes and ears, constantly watching for opportunities. This data needs to be accurate and fast.

Equally important is a seamless integration with a broker. Your system needs a reliable way to send buy or sell orders to the market. This is where choosing a compatible and trustworthy broker comes in. Some platforms offer direct integrations, while others might require a bit more setup. At FN Capital, we streamline this by operating within a structured legal framework, using Third Party Fund Administrators (TPFA) to give our clients smooth access to international brokers and ensure optimal trade execution. This setup handles the technicalities of data feeds and broker connections, letting you focus on your investment.

Invest in Your Knowledge & Skills

While AI-powered systems like our FAST AI are designed to handle the heavy lifting of trade execution and decision-making, a foundational understanding of trading principles and how automated systems operate is always valuable. It’s not about becoming an expert programmer overnight, but rather about appreciating the mechanics behind the magic. This knowledge empowers you to make informed decisions about the strategies you employ and the tools you trust.

Think of it as being an informed passenger; you don’t need to know how to fly the plane, but understanding the basics of aerodynamics can make the journey more comfortable. Many resources are available, from online courses to financial blogs. Taking the time to learn can also help you better evaluate different automated trading options and understand the financial models that drive their performance. Remember, even with automation, your financial journey is still yours to direct.

The Future of Automated Trading

Automated trading isn’t a field that stands still; it’s always moving forward, shaped by new technologies and the ever-changing currents of the market. If you’re thinking about getting started, or if you’re already using automated systems, keeping an eye on these trends is really important for staying competitive. We’re seeing some genuinely exciting developments that are set to make trading even more sophisticated and, ideally, more accessible for everyone. For systems like FN Capital’s FAST AI, which already uses advanced algorithms, these future trends open doors for even better precision and performance. The main idea is to use technology to help us make trading decisions that are smarter, quicker, and more informed by data.

AI & Machine Learning: The Next Wave

Artificial intelligence (AI) and machine learning (ML) are definitely leading the charge into the next phase of automated trading. As noted in industry analyses, AI trading has significantly changed how markets operate, enabling traders to use complex algorithms for speed and accuracy that were hard to imagine before. What’s especially powerful is AI’s ability to process and make sense of huge amounts of data almost instantly. This means AI can spot patterns, anticipate market shifts, and adjust to new conditions in ways that are beyond human capability. For you, this means access to systems that can learn from past data and current market inputs, constantly fine-tuning their strategies to pinpoint those low-risk, high-probability trades. It’s about shifting from just following pre-set rules to making truly intelligent, adaptive decisions.

The Evolution of High-Frequency Trading

High-Frequency Trading (HFT) has been a major player in automated trading for some time, but it’s also changing. It’s no longer just about being the fastest; it’s about the intelligence driving those rapid-fire trades. Automated trading strategies have introduced a more organized way to approach market decisions, offering a structured method to pursue profits by using automation. The progress here involves more advanced algorithms that can carry out complex strategies in tiny fractions of a second. These often focus on reducing slippage and ensuring top-notch execution quality, similar to how FN Capital’s FAST AI operates with its dedicated EUR/USD focus. This ongoing refinement means HFT systems are getting better at managing risk and adapting to unpredictable market behavior, making them valuable components in a well-rounded trading plan.

The Regulatory Horizon & Compliance

As automated trading systems become more common, the rules and regulations around them are also evolving. We’re seeing these systems being used by a wide variety of market participants, including exchanges, trading firms, banks, and even pension funds, all of whom might develop their own systems or use those from third-party providers. This growing use highlights the need for dependable and secure systems. Regulatory bodies are focused on maintaining market stability and fairness, so compliance is becoming an even more vital consideration. For companies like FN Capital, this involves setting up operations, such as using a Third Party Fund Administrator (TPFA), to operate within international standards and offer transparent, secure access for clients. Keeping up with these regulatory changes is key for anyone involved in automated trading.

Is Automated Trading Right for You?

Deciding to use an automated trading system is a significant step, and it’s smart to consider if it truly fits your personal investment style and financial aspirations. While the idea of a system trading on your behalf sounds fantastic, let’s think about what that means for you specifically. At FN Capital, we believe in making powerful trading tools accessible, whether you’re just starting to explore passive income or you’re an experienced investor looking for an edge. The key is finding the right fit for your journey.

Assess Your Goals & Resources

First things first, what are you hoping to achieve with automated trading? Are you looking for a way to generate passive income without spending hours watching the markets? Or perhaps you’re an active trader tired of emotional decisions derailing your strategy. Automated trading systems use sophisticated computer programs, or algorithms, to buy and sell assets based on pre-set rules. This means they can execute trades with discipline, a huge plus since one of the main advantages is the removal of human emotion from the process.

Consider your resources too. This isn’t just about capital, but also about your comfort level with technology. Systems like our FAST AI are designed to be user-friendly, but it’s good to be honest about how hands-on or hands-off you prefer to be. If your goal is to diversify your investments or scale your trading activities with a system that has a verified track record, then exploring a solution like FN Capital could be a very good match.

Balance Automation with Your Oversight

While “automated” implies a set-it-and-forget-it approach, the reality is a bit more nuanced. Even the most advanced systems benefit from some level of human understanding and oversight. Think of it like having a highly skilled employee; you trust them to do their job, but you still want to understand the overall strategy and check in on performance. Reputable sources will tell you that automated systems aren’t entirely hands-off and do require monitoring.

At FN Capital, our FAST AI, with its DART risk management tool, handles the complex, real-time decision-making and execution. However, we encourage our clients to understand the principles behind our EUR/USD focused strategy. While algorithmic trading can be a complex field, our aim is to provide you with transparent performance data and the support you need. This way, you can feel confident and informed, knowing that the automation is working effectively towards your financial objectives.

Related Articles

- How to Make Money with Automated Trading: A Practical Guide

- Automated Trading Systems: A Practical Guide – FN Capital

- Algorithmic vs. Manual Trading: Which Is Best? – FN Capital

- Automated Trading Software Guide

- Benefits of Automated Trading: A Practical Guide – FN Capital

Frequently Asked Questions

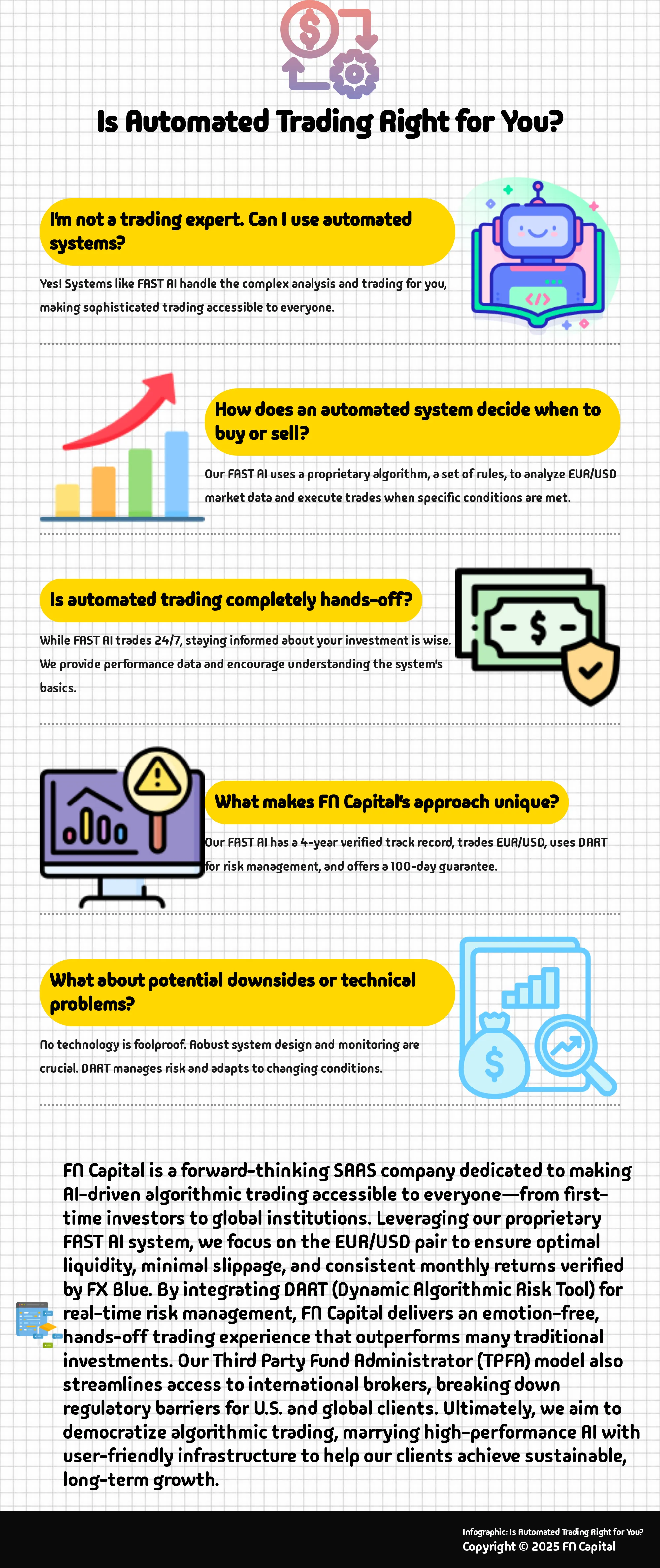

I’m not a trading expert. Can I still benefit from an automated system like FAST AI? Absolutely! You don’t need a deep understanding of financial markets to get started. Systems like our FAST AI are designed to do the complex analysis and trading for you. We aim to make sophisticated trading accessible, so whether you’re new to investing or just looking for a more hands-off approach, you can certainly explore the benefits.

How does an automated system like FAST AI decide when to buy or sell? Think of it like a highly skilled chef following a precise recipe. Our FAST AI uses a proprietary algorithm, which is essentially a detailed set of rules and strategies we’ve developed and refined. It constantly analyzes market data for the EUR/USD pair, and when specific conditions outlined in its “recipe” are met, it automatically executes a trade. It’s all based on logic and data, not guesswork.

Is automated trading completely ‘set and forget,’ or do I still need to be involved? While our FAST AI handles all the trading activity 24/7, it’s wise to stay informed about your investment. We provide transparent access to performance data, and understanding the basics of how the system works can give you peace of mind. So, while you don’t need to make trading decisions yourself, a little oversight to monitor your account and understand the strategy is always a good idea.

What makes FN Capital’s approach to automated trading stand out? We focus on a few key things: our proprietary FAST AI algorithm has a 4-year verified track record, which we’re very open about. It specifically trades EUR/USD for optimal liquidity and uses our DART tool for real-time risk management. Plus, we offer a 100-day money-back guarantee, so you can see how it performs with confidence. We’ve also structured things to provide access for international clients smoothly.

Automated trading sounds great, but what about the potential downsides or technical problems? That’s a fair question! No technology is entirely foolproof, and technical glitches or unexpected market events can occur. That’s why robust system design, like our FAST AI, and continuous monitoring are so important. We’ve also built in risk management tools like DART to adapt to changing conditions. It’s about having strong safeguards and a realistic understanding that while automation offers many advantages, it operates within a dynamic environment.