Want to take the emotion out of trading? An algo trading app can automate your strategies and potentially boost your returns. But finding the right one can be tricky. This guide breaks down the must-have features, from backtesting and real-time data to top-notch security. Whether you’re a newbie or a seasoned trader, we’ll help you find the perfect platform for your trading style and budget. Let’s find the algo trading app that’s right for you.

What is Algo Trading?

Algo trading, short for algorithmic trading, is simply using computer programs to execute trades based on pre-defined rules and criteria. Think of it as putting your trading strategies on autopilot. Instead of manually placing trades, you set up a system that follows your established parameters. This approach helps remove emotional biases, allowing the system to execute trades based on logic and data. This can be especially helpful in fast-moving markets where quick decisions are crucial.

Automated Trading Strategies

Several platforms are available for building and running automated trading strategies. QuantConnect, for instance, is a popular platform used by quants and engineers to develop and deploy their algorithms. These platforms often provide tools and resources for backtesting strategies using historical market data, which helps refine your algorithms before risking real capital. Testing different scenarios and market conditions provides valuable insights and increases confidence in your strategy’s potential.

Benefits of Algorithmic Trading

One key benefit of algo trading is its speed. Platforms like AlgoTrader highlight the 24/7 operation of automated systems, allowing you to capitalize on opportunities anytime. This speed and efficiency can be particularly advantageous in volatile markets. Using an algo trading app also helps maintain discipline and consistency, as the system strictly adheres to programmed rules, regardless of market sentiment or emotions. Tools like AlgoTrade 2 offer advanced strategy simulators with real market data, allowing for thorough analysis and optimization. This data-driven approach can lead to more informed decisions and potentially improve overall trading performance. For example, at FN Capital, our proprietary FAST AI algorithm executes trades with a laser focus on EUR/USD, ensuring optimized liquidity management and execution precision. Learn more about how FN Capital leverages AI in algo trading.

Key Takeaways

- Algo trading apps automate your trades, but tech failures and bad data can hurt. Pick a platform that matches your skills and offers strong risk management.

- A good algo trading app needs a friendly interface, customization, backtesting, and secure APIs. Think about price, user reviews, and how well it handles real-time data.

- AI, blockchain, and better design are changing algo trading. Find platforms using these technologies to improve your trading and stay ahead.

What is an Algo Trading App?

Algo trading apps let you automate the trading process using algorithms, allowing for efficient execution of large trade volumes. This approach, popular with both institutional and retail traders, analyzes vast amounts of real-time market data, helping you capitalize on market opportunities faster than manual trading allows. Essentially, these apps use computer programs to automatically execute trades based on predefined rules and mathematical models. This removes human emotion from trading decisions.

It’s worth noting that these apps rely heavily on technology. Technical failures can disrupt algorithms and lead to unexpected losses. Similarly, these apps need accurate real-time and historical market data. Any latency during the algorithmic trading process could mean missed opportunities.

Mobile vs. Desktop Algo Trading Apps

Choosing between mobile and desktop depends on your trading style and how you like to work. A good mobile trading app lets you manage trades from anywhere, mirroring much of the functionality of its desktop version. This is perfect for traders who need to react to market changes immediately, even when they’re not at their computer. It’s like having a portable command center for your investments.

However, mobile apps sometimes have limitations. Because of hardware constraints, mobile platforms may not offer every feature available on desktop versions, as Real Trading points out. Desktops often provide more advanced charting, in-depth market analysis, and broader customization. If you’re a seasoned trader using complex strategies and need a comprehensive toolkit, a desktop platform might be better.

Key Features to Look For

Whether you choose mobile or desktop, some key features are essential for any effective algo trading app. A user-friendly interface is critical, especially for new traders. The ability to customize the app to fit your specific trading strategies is also crucial, as FN Capital emphasizes. Look for features like customizable dashboards, watchlists, and alerts to tailor the app to your preferences.

More experienced traders need access to advanced tools. MonoVM suggests finding platforms with robust charting, automated trading options, comprehensive market analysis, and real-time trading signals. These features can significantly improve your decision-making and help you refine your strategies. Backtesting is also essential for evaluating how your algorithms would have performed historically before using them with real money.

Finally, don’t underestimate security and reliability. WallStreetZen advises considering your experience level when selecting a platform. Secure APIs, two-factor authentication, and reputable security protocols are non-negotiable. A reliable platform should also offer seamless real-time data and minimal downtime to avoid missed opportunities. Your financial security is paramount, so choose a platform with a proven track record.

Best Algo Trading Apps

Finding the right algo trading app can feel overwhelming. There are countless options, each with its own strengths and weaknesses. To simplify your search, we’ve compiled a list of top contenders, including our own offering at FN Capital.

FN Capital’s FAST AI

FN Capital’s FAST AI caters to both individual and institutional investors. Our system focuses on the EUR/USD pair, leveraging its high liquidity for efficient execution. We combine a proprietary high-frequency trading algorithm with a dynamic risk management tool (DART) to pinpoint and capitalize on low-risk, high-probability opportunities. For a hands-off, AI-driven approach to forex trading, FN Capital offers a 100-day money-back guarantee, allowing you to explore the platform risk-free. Learn more and register for an account on our website.

Why Choose FN Capital?

For the last 5 years, we’ve been running FAST AI, delivering 7.5% average monthly returns and consistently outperforming hedge funds and manual traders. At FN Capital, transparency is key, which is why we offer a publicly verified performance record on FX Blue. This consistent performance demonstrates the potential of our AI-driven approach.

Beyond impressive returns, we prioritize a seamless user experience. Whether you’re a seasoned trader or just starting out, our platform offers intuitive AI-driven tools designed for ease of use. We handle the complexities of algorithmic trading, so you can focus on your investment goals.

We also understand that managing risk is paramount. Our proprietary high-frequency trading algorithm works in conjunction with DART, our dynamic risk management tool, to identify and capitalize on low-risk, high-probability trading opportunities. This powerful combination helps protect your investments while maximizing potential returns.

How FAST AI Works

FAST AI forms the core of FN Capital’s automated trading platform. This sophisticated algorithm analyzes massive amounts of real-time market data, identifying and executing trades with speed and precision beyond human capability. It’s like having a dedicated, tireless trading expert working for you around the clock.

Automation and efficiency are at the heart of FAST AI. Our system uses computer programs to execute trades automatically based on predefined rules and sophisticated mathematical models. This removes emotional biases from trading decisions, ensuring every trade aligns with your chosen strategy.

We’re confident in FAST AI’s potential to transform your trading. To prove it, we offer a 100-day money-back guarantee. This allows you to explore the platform and experience the power of AI-driven trading risk-free. It’s the perfect way to see firsthand how FAST AI can elevate your trading approach.

Tradetron

Tradetron is a versatile platform supporting multiple asset classes. Its user-friendly design makes it a solid option for beginners, while its robust features also cater to experienced traders. If automating your trading strategies is a priority, Tradetron is worth exploring. Find more details about Tradetron’s features and pricing on their website.

AlgoBulls

AlgoBulls distinguishes itself with its visual strategy builder and community features. These tools empower users to create and share trading strategies, fostering a collaborative learning environment. This platform is particularly helpful for those new to algorithmic trading. See how AlgoBulls can help you get started on their website.

Quantman

Known for its intuitive interface and backtesting capabilities, Quantman allows traders to refine their strategies before risking real capital. This feature is crucial for optimizing algorithms and minimizing potential losses. Visit Quantman’s website for more information.

Bigul API

For developers and traders comfortable with coding, the Bigul API offers seamless, free integration with Python. This allows for maximum customization and control over your trading algorithms. Learn more about integrating the Bigul API on their blog.

Robo Trader

Robo Trader simplifies strategy creation and execution with its visual builder and expert signals. This makes it accessible to traders who prefer a visual approach and don’t want to deal with complex coding. Explore Robo Trader’s features and pricing on their website.

MetaTrader 5

MetaTrader 5 is a widely used platform known for its comprehensive features and support for algorithmic trading. It’s a popular choice among traders for its versatility and robust functionality. You can find more information about MetaTrader 5 on the MetaQuotes website.

TradingView

TradingView is a favorite among traders who value community insights and powerful charting tools. Its social trading features allow users to share ideas and learn from each other. Explore TradingView’s platform and community on their website.

Quantconnect

Quantconnect offers a cloud-based platform supporting multiple asset classes and extensive backtesting capabilities. This makes it a suitable option for serious algorithmic traders seeking a scalable and robust solution. Learn more about Quantconnect’s platform on their website.

Must-Have Algo Trading App Features

Looking for the right algo trading app? Here’s a breakdown of essential features:

AI and Machine Learning Integration

AI and machine learning are transforming how we interact with technology. Leading algo trading apps leverage these advancements to analyze massive datasets, identify complex patterns, and predict market movements with increasing accuracy. This goes beyond basic automation, offering predictive interfaces and personalized insights for a more adaptive and user-centric trading experience. Look for apps that offer AI-driven predictive analytics and continuously learn and adapt to changing market conditions.

Intuitive User Interface

A cluttered or complicated interface can hinder even the most sophisticated trading strategies. Intuitive design is key. The best algo trading apps prioritize user experience with clean dashboards, easy-to-use menus, and clear visualizations of your trading activity. UI/UX design is critical for a smooth, efficient trading process, so prioritize platforms that are both visually appealing and easy to use. Check out FN Capital for an example of a user-friendly interface.

Algorithm Customization

Flexibility is paramount in algo trading. Customizable algorithms let you tailor strategies to specific market conditions and risk tolerances. A good algo trading app should offer a range of customization options, allowing you to adjust parameters, define entry and exit rules, and backtest your strategies before deploying them live. Microservices architecture is becoming increasingly popular, enabling platforms to handle large datasets and manage multiple personalized portfolios efficiently. Find an app that offers the algorithm customization you need to refine your approach.

Backtesting Effectively

Before risking real capital, test your strategies using historical data. Robust backtesting capabilities allow you to simulate trades and evaluate the potential performance of your algorithms under various market scenarios. This helps you identify weaknesses, refine your approach, and gain confidence in your strategies before going live. Look for platforms that offer comprehensive backtesting tools and historical data access.

Real-Time Data and Analytics

In the fast-paced world of algorithmic trading, real-time data is essential. Your app needs to process and analyze market data instantaneously to identify opportunities and execute trades efficiently. Look for platforms with low-latency data feeds, real-time charting, and advanced analytical tools to help you make informed decisions in the moment. Real-time data processing is the backbone of any successful algorithmic trading platform.

API Performance and Security

Secure and reliable APIs are critical for integrating your algo trading app with other platforms and data sources. A well-designed API allows for seamless data exchange and automated trading execution. Prioritize apps with robust API documentation, strong security measures, and reliable performance to ensure smooth integration and protect your trading data. Consider factors like API access, data frequency, and security protocols when evaluating different options.

Smart Execution Strategies

Control over your execution strategies is crucial for maximizing profitability. Look for algo trading apps that offer advanced order types, such as limit orders, stop-loss orders, and trailing stops, to manage risk and optimize your entries and exits. The ability to adjust your execution strategies based on real-time market conditions is a key feature of sophisticated trading platforms. A lack of execution strategy control can significantly impact your results, so choose a platform that provides the flexibility and control you need. FN Capital offers insights into dynamic risk controls and volatility management.

Risk Management Tools

Effective risk management is paramount in algo trading. The automated nature of these systems amplifies the need for robust tools to protect your capital. Look for features like stop-loss orders, trailing stops, and position sizing controls to mitigate potential losses. Being able to set predefined risk parameters and automate responses to market fluctuations is crucial. For example, FN Capital’s DART (Dynamic Algorithmic Risk Tool) provides AI-driven real-time risk management, continuously optimizing position sizes and stop-loss levels. Remember, control over your execution strategies is crucial for maximizing profitability and minimizing potential downside.

Reporting and Analysis

Comprehensive reporting and analysis tools are essential for evaluating the performance of your algo trading strategies. Detailed trade logs, performance metrics, and visualizations can offer valuable insights into your trading activity. Robust backtesting capabilities let you simulate trades using historical data and assess how your algorithms might perform under various market conditions. This helps you identify weaknesses, refine your approach, and gain confidence before risking real capital. Access to real-time data and analytics is equally important for monitoring current trades and making informed, in-the-moment decisions. Look for platforms that offer customizable reporting and integrate with third-party analytics tools for a complete view of your trading performance.

Compare Top Algo Trading Apps

Not all algo trading apps are created equal. When choosing a platform, consider these key features to find the best fit for your trading style and experience level.

Ease of Use

A clean, intuitive interface is crucial, especially for beginners. Look for apps with straightforward navigation, clear charts, and easy-to-understand order management tools. TradingView, for example, is known for its user-friendly charting tools and customizable dashboards. The future of app design is moving towards more personalized and adaptable user experiences, so consider platforms that prioritize a seamless and intuitive user journey.

Customization Options

The ability to customize your algorithms is essential for tailoring your trading strategies. Platforms like Tradetron and Quantconnect offer extensive customization options, allowing you to build algorithms using various technical indicators and strategies. You can even code your own custom logic. A modular, microservices-based architecture can offer greater flexibility and scalability for complex trading strategies.

Backtesting and Simulation

Before deploying your algorithms in live markets, robust backtesting tools are essential. These tools allow you to test your strategies against historical data and identify potential weaknesses. You can then optimize your algorithms for better performance. Many platforms, including AlgoBulls and MetaTrader 5, provide backtesting capabilities to help you refine your strategies before risking real capital.

Trading Platform Integration

Seamless integration with your preferred brokerage platform is key for efficient order execution. Look for apps that offer direct integration with popular brokers or support API connections for automated trading. Bigul API, for instance, is designed specifically for API integration, enabling you to connect your algorithms directly to your brokerage account. A microservices approach can also improve the efficiency and scalability of platform integrations.

Data Analysis and Reporting

Comprehensive data analysis and reporting tools are vital for monitoring performance and making informed trading decisions. Look for apps that provide real-time market data, detailed trade history, and customizable reports. Real-time data processing is crucial for effective algorithmic trading. This allows you to react quickly to market changes and optimize your strategies. FN Capital’s FAST AI, for example, offers transparent performance tracking and reporting through FX Blue.

Algo Trading App Pricing

When choosing an algo trading app, pricing and accessibility are key factors. Costs can vary significantly, from free basic plans to premium subscriptions with hefty price tags. Understanding the different pricing models and what they offer will help you find an app that fits your budget and trading goals.

Freemium Options

Some algo trading apps offer freemium models, providing a taste of their features at no cost. These free tiers often include access to basic market data, such as real-time and historical prices, and fundamental financial data. For example, Financial Modeling Prep (FMP) offers a free tier with access to basic stock data. While freemium options are great for beginners or those wanting to explore algo trading without a financial commitment, they typically come with limitations, such as restrictions on the number of algorithms you can run, limited backtesting, or slower execution speeds.

Subscription Plans

Many algo trading apps offer tiered subscription plans, providing different levels of access and features at increasing price points. These tiers often cater to different levels of trading experience and frequency. A basic plan might suit a casual trader, while a professional trader might need a premium plan with advanced features and higher API request limits. IC Markets, a popular forex and CFD broker, offers various platforms that support automated trading, coupled with tiered commissions and spreads. Carefully consider the features offered at each tier and choose the one that aligns with your needs and budget. Look for transparent pricing structures that clearly outline the costs associated with each tier.

Performance-Based Fees

Some algo trading platforms, particularly those for professional or institutional investors, may charge performance-based fees. This means that in addition to a subscription fee, they take a percentage of your profits. While this can incentivize the platform to maximize your returns, it also means you’ll pay more when you’re successful. Be sure to understand the fee structure and how it impacts your overall profitability. Consider whether a performance-based fee aligns with your risk tolerance and investment strategy.

Hidden Costs to Watch Out For

Beyond the upfront costs of subscriptions or performance fees, be aware of potential hidden costs. These can include data fees for real-time market data feeds, exchange fees for executing trades, and even commissions charged by your broker. Latency can also be a hidden cost, as delays in data or execution can lead to missed opportunities or unfavorable prices. Before committing to an algo trading app, thoroughly research all potential costs to avoid surprises. Also, consider the potential impact of technical failures, which can disrupt trading and potentially lead to losses. Factor these potential costs into your budget and risk assessment.

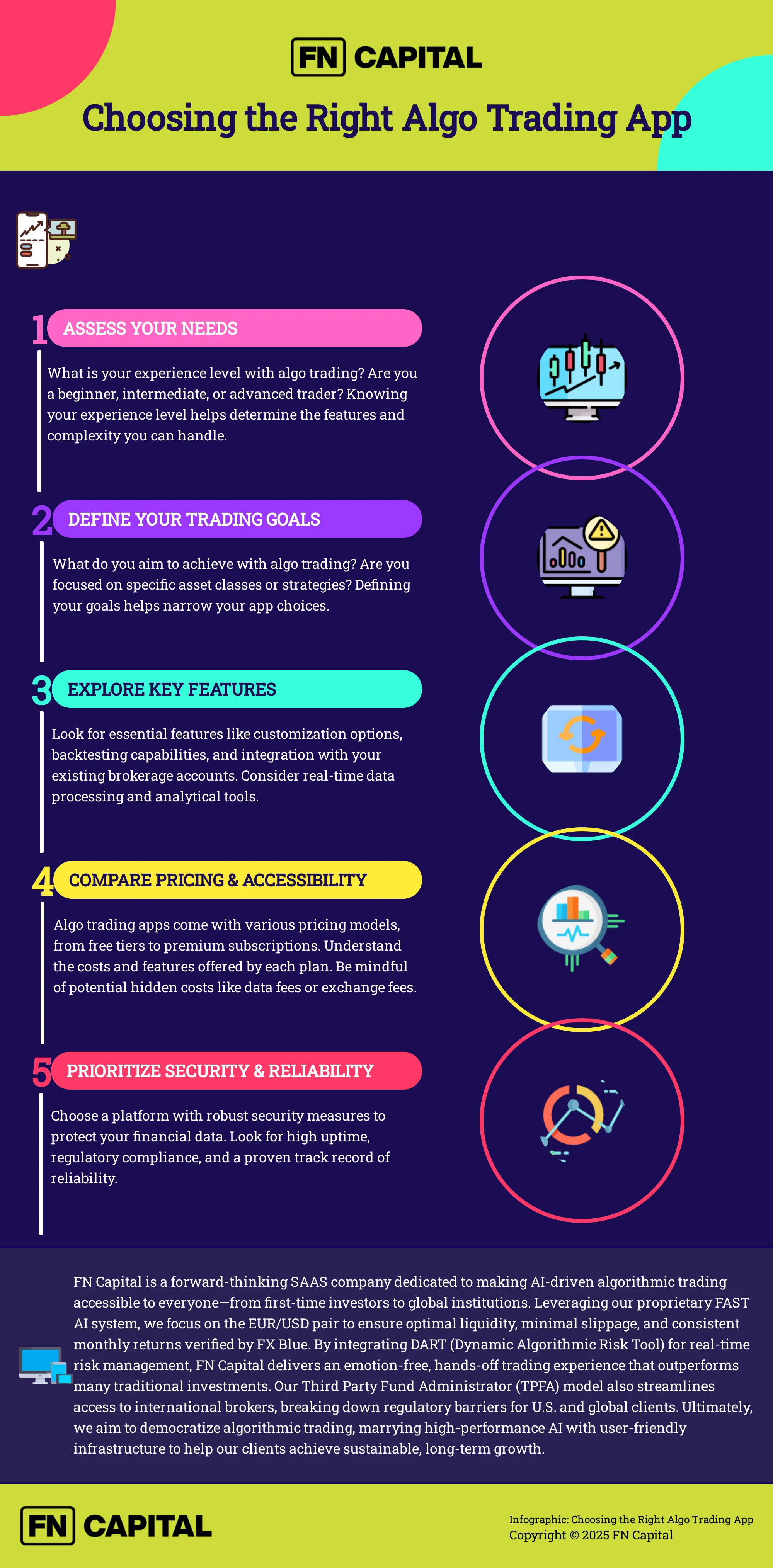

How to Choose the Right Algo Trading App

Finding the perfect algo trading app can feel like searching for a needle in a haystack. With countless options available, each with its own strengths and weaknesses, it’s easy to feel overwhelmed. This guide will help you cut through the noise and find the platform that’s right for you. Whether you’re a seasoned trader or just starting, these key considerations will empower you to make an informed decision.

Define Your Trading Goals

Before you explore algo trading apps, define your trading goals. What are you hoping to achieve? Are you looking to generate passive income, actively manage your portfolio, or experiment with different trading strategies? Your goals will heavily influence the type of app that best suits your needs. For instance, if passive income is your aim, a platform like FN Capital’s FAST AI, specializing in automated forex trading, might be a good fit. If you’re keen on actively managing your portfolio, you might prefer a platform with customizable algorithms and real-time data analysis tools, like Quantconnect.

Consider the asset classes you want to trade (stocks, forex, crypto, etc.), your preferred trading frequency (high-frequency, day trading, swing trading), and your risk tolerance. Defining these aspects will help you narrow your options and choose an app aligned with your overall trading strategy. For example, if you’re interested in high-frequency trading, you’ll need a platform with low-latency data feeds and high-speed execution. If you’re more risk-averse, look for platforms with robust risk management tools, like FN Capital’s DART (Dynamic Algorithmic Risk Tool).

Consider Your Experience Level

Your experience level is crucial. Beginners will likely want a user-friendly platform with a simple interface, educational resources, and perhaps a demo account for practice. Platforms like AlgoBulls, with its visual strategy builder, can be a great starting point. More experienced traders might prefer platforms with advanced features like customizable algorithms, backtesting capabilities, and API access for integration with other trading tools. Tradetron offers a good balance of user-friendliness and advanced features, suitable for both beginners and experienced traders. Explore different platforms and try their demo accounts (if available) to get a feel for their interface and features. Reading user reviews and comparing platforms can also provide valuable insights.

As your experience grows, you might find yourself needing more sophisticated tools. Many algo trading platforms offer different tiers of service, allowing you to upgrade as your needs evolve. Don’t feel pressured to jump into the most complex platform right away. Start with what you’re comfortable with and gradually explore more advanced features as you gain confidence and experience.

Assess Your Budget

Algo trading apps come with varying costs, from free basic plans to premium subscriptions. Carefully assess your budget and determine your investment comfort level. Consider not only subscription fees but also additional costs like data fees, exchange fees, and broker commissions. Some platforms, like Financial Modeling Prep, offer freemium models with limited features—a good starting point for tight budgets. Others, like FN Capital, offer various pricing tiers to accommodate different needs and budgets. The cheapest option isn’t always the best. A more expensive platform might offer valuable features—advanced charting tools, real-time data feeds, and robust risk management—justifying the higher cost.

Weigh the costs against the benefits and choose a platform that offers good value. Think about your long-term trading goals and choose a platform that can scale with you as your portfolio grows. Investing in the right tools can significantly impact your trading success. Remember to factor in potential transaction costs and the impact of technical failures, which can disrupt trading. A thorough understanding of the costs involved will help you make a sound financial decision.

Algo Trading App Reviews

Understanding user experiences is crucial when choosing an algo trading app. While each platform boasts unique features, real-world feedback offers valuable insights into their strengths and weaknesses.

User-Reported Strengths

Users consistently praise the efficiency of algo trading, highlighting its ability to execute large trade volumes. Automated trading, powered by algorithms, analyzes extensive market data in real-time, allowing traders to capitalize on fleeting opportunities, a key advantage noted by Finance World. This speed and efficiency is particularly appealing to both institutional investors and retail traders. Access to numerous platforms that support automated trading, combined with competitive commissions and spreads, contributes to positive user experiences, as highlighted in reviews of platforms like IC Markets.

Weaknesses and Limitations

Despite the advantages, users also point out potential downsides. Technical glitches, including software bugs, server downtime, and connectivity problems, can disrupt algorithms and lead to unforeseen losses, as detailed on Investing Robots. Another significant concern is limited control over execution strategies. FX Algo News reports that over half of market leaders want more flexible and adaptable trading solutions. This highlights the importance of platforms that allow users to fine-tune their strategies and respond to changing market conditions.

Overall User Satisfaction

User satisfaction hinges on several factors. Reliable access to accurate real-time and historical market data is paramount. Samco emphasizes that latency issues can lead to missed trading opportunities, impacting overall performance. To address these challenges, many platforms are adopting advanced technologies like microservices architecture. This approach enables platforms to manage massive datasets, process trades rapidly, and support multiple personalized portfolios efficiently, contributing significantly to user satisfaction in the algo trading space.

Is Algo Trading Profitable?

The million-dollar question (sometimes literally!) is whether algo trading is actually profitable. The truth? It’s complicated. Like any investment strategy, there are no guarantees. While algorithmic trading offers significant advantages, profitability isn’t a given. It depends on several factors, including how well your system is designed and executed, and even the current market conditions. A well-designed algorithm can capitalize on market opportunities faster than any human, eliminating emotional biases that often lead to bad decisions. Backtesting, a key feature of many algo trading platforms, lets you test your strategies against historical data, potentially improving your chances of success. The ability to scale your trading across multiple markets and asset classes offers further potential for returns.

Factors that Influence Profitability

Several factors play a crucial role in determining the profitability of your algo trading. Market conditions are a major influence. A strategy that thrives in a volatile market might struggle during periods of stability, and vice versa. The specific financial instruments you’re trading also matter. For example, FN Capital’s FAST AI focuses on the EUR/USD pair due to its high liquidity, minimizing slippage and maximizing execution efficiency. Your risk tolerance is another key factor. Are you comfortable with aggressive strategies that offer higher potential returns but also greater risk, or do you prefer a more conservative approach? Finally, your time horizon plays a role. Short-term strategies require different algorithms and risk management approaches compared to long-term investments. Your time frame influences the types of algorithms and the level of risk management you’ll need. Even with the best technology, continuous performance monitoring and system improvements are essential for staying ahead. And, like any trading strategy, be aware of the risks, including market unpredictability, technical failures, and the potential for overfitting your algorithms to historical data. Understanding these risks is essential for evaluating the potential profitability of algorithmic trading.

Find the Right Algo Trading App

Finding the right algo trading app depends on your experience level. A suitable platform can significantly impact your success, whether you’re a beginner or a seasoned trader. Here’s a breakdown to help you choose:

Best Algo Trading Apps for Beginners

For beginners, user-friendliness and educational resources are key. Look for a platform that simplifies complex processes and offers a gentle learning curve. Think drag-and-drop interfaces, pre-built strategies, and paper trading options to practice without risking real capital. Bigul API, with its free access and Python integration, is a great starting point if you have some technical skills. If you prefer a more visual approach, platforms like Quantman, Tradetron, AlgoBulls, or Robo Trader offer intuitive interfaces and backtesting features. Some even have community forums where you can connect with other traders and learn the basics of algo trading.

Algo Trading Apps for Intermediate Traders

As you gain experience, your needs will change. You might want more control over your algorithms, access to advanced order types, and the ability to backtest more complex strategies. Exploring a broader range of platforms becomes beneficial at this stage. Resources like Slashdot’s list of algorithmic trading software can be invaluable. This compilation of 25 platforms offers a good overview of available options, including pricing and user reviews. Consider your coding skills when making your choice. Some platforms cater to non-programmers, while others offer greater flexibility for those comfortable with coding.

Advanced Algo Trading Platforms

Experienced traders often require highly customizable platforms with robust APIs, low latency execution, and access to various markets and data feeds. For forex and CFD trading, IC Markets is often cited as a top choice for its support of automated trading. At this level, understanding the technical details of your chosen platform is crucial. Algorithmic trading relies heavily on technology, and any technical failures can have significant financial consequences. InvestingRobots.com offers insights into the potential challenges of algo trading. Remember, due diligence and a deep understanding of your chosen platform are essential for success.

Algo Trading App Security

Security and reliability are paramount when choosing an algo trading app. A secure platform protects your financial data and investments, while a reliable platform ensures consistent performance and minimizes disruptions. Let’s explore the key aspects to consider:

Data Protection Measures

Your financial data is sensitive, so robust security measures are essential. Look for platforms that prioritize data encryption and offer cold storage for funds, safeguarding your assets from unauthorized access. Protecting against unauthorized API access is also crucial. Secure API keys and two-factor authentication add extra layers of security, preventing malicious actors from compromising your account. Thorough due diligence on the app provider’s security practices is a must. A platform’s security infrastructure should be a top priority.

Platform Stability

Technical failures can disrupt your trading strategies and lead to potential losses. A reliable algo trading app should have a proven track record of stability and high uptime. Consider factors like server infrastructure, redundancy measures, and disaster recovery plans. Inquire about the app’s response to past incidents and their ability to quickly resolve technical issues. Malfunctions due to bugs, server crashes, or connectivity issues can have severe consequences, so choose a platform that minimizes these risks. Aim for a provider with a robust and reliable infrastructure.

Regulatory Compliance

Ensure the algo trading app complies with relevant regulations. This protects you as an investor and fosters trust in the platform. Research the app provider’s licensing and registration status. Verify their adherence to regulatory requirements for data protection, financial reporting, and risk management. For example, some jurisdictions mandate regular audits for algo trading firms, including detailed trade logs and parameter documentation. Understanding these compliance measures helps you make informed decisions and choose a reputable platform. Researching regulatory compliance is a crucial step in selecting a trustworthy algo trading app.

Common Algo Trading Challenges

Even with the best algo trading apps, unforeseen challenges can arise. Here’s how to address them proactively:

Managing Technical Failures

Algorithmic trading relies heavily on technology. Bugs, server crashes, or connectivity issues can disrupt algorithms and lead to unexpected losses. Choose a robust platform with built-in redundancy and real-time monitoring. Regularly test and update your algorithms to minimize the risk of malfunctions. A reliable app provider should offer support and troubleshooting assistance to help you quickly resolve any technical problems.

Minimizing Latency Issues

Latency—the delay between an order being placed and executed—can make or break your trades. High latency during any part of the process, from receiving market data to executing trades, can mean missed opportunities. Prioritize apps with high-speed data feeds and efficient order routing. Consider co-locating your servers closer to the exchange to reduce physical distance and improve response times.

Data Quality and Availability

Accurate data is the lifeblood of algorithmic trading. Your algorithms need access to reliable real-time and historical market data to function effectively. Choose a platform that provides high-quality data from reputable sources. Implement data validation checks to identify and correct any inaccuracies. Having a backup data source can also prevent disruptions in case your primary feed experiences issues.

Execution Strategy Control

Maintaining control over your execution strategies is crucial. A lack of flexibility can hinder your ability to adapt to changing market conditions. Look for adaptable trading solutions that allow you to adjust parameters and refine your approach as needed. Real-time monitoring tools and customizable alerts can help you stay informed and make necessary adjustments on the fly. Backtesting your strategies with historical data can also help you identify potential weaknesses and optimize performance before deploying them in live markets.

The Future of Algo Trading

The world of algo trading is constantly evolving, driven by rapid advancements in technology. Let’s explore some key trends shaping the future of automated trading.

Predictive Analytics with AI

Artificial intelligence is poised to revolutionize how we analyze markets and predict asset price movements. Sophisticated algorithms can identify subtle patterns and correlations in vast datasets, leading to more accurate market predictions and more profitable trading strategies. Imagine AI predicting market shifts with increasing accuracy, allowing your algorithms to adapt and capitalize on emerging opportunities. This predictive power transforms algo trading from reactive to proactive. As AI and machine learning models become more refined, expect even greater precision and efficiency in automated trading, empowering traders to make data-backed decisions and optimize their portfolios.

Blockchain Integration

Blockchain technology offers a solution to growing concerns around transparency and security in financial markets. By recording every transaction on a secure, distributed ledger, blockchain can eliminate the potential for market manipulation and increase trust. This increased transparency also benefits regulators, providing an immutable audit trail. Smart contracts can further automate and streamline the trading process, reducing costs and increasing efficiency.

Improving User Experience

The future of algo trading isn’t just about complex algorithms; it’s also about accessibility. Intuitive interfaces and user-friendly design are crucial. Think personalized dashboards providing real-time insights, AI-powered assistants offering tailored trading recommendations, and seamless integration with various trading platforms. These advancements will empower both seasoned traders and newcomers to harness the power of automated trading strategies.

Real-Time Data Advancements

The ability to process and analyze vast amounts of data in real time is critical for successful algo trading. Advancements in technologies like microservices and cloud computing are enabling platforms to handle the increasing demands of high-frequency trading. This means faster execution speeds, reduced latency, and the ability to manage multiple portfolios simultaneously. As real-time data processing capabilities improve, algo trading platforms will become even more responsive and efficient, allowing traders to capitalize on fleeting market opportunities.

Related Articles

- AI Trading Bots: An Investor’s Guide to Automated Trading – FN Capital

- Algorithmic Trading Platforms: Features, Benefits, and Risks – FN Capital

- A Practical Guide to Buying Algorithmic Trading Software – FN Capital

- AI-Powered Trading Solutions: An Investor’s Guide – FN Capital

- Algorithmic Trading Tutorials: A Practical Guide – FN Capital

Frequently Asked Questions

What is the main advantage of using an algo trading app? Algo trading apps automate trading decisions and execution, removing emotional bias and enabling faster reactions to market changes than manual trading allows. They can process vast amounts of data and execute trades much faster than a human, potentially leading to increased profitability.

How do I choose the right algo trading app for my needs? Consider your experience level, technical skills, and trading goals. Beginners might prefer user-friendly platforms with visual interfaces and educational resources, like Tradetron or AlgoBulls. Intermediate traders could benefit from platforms offering more customization and backtesting capabilities, such as Quantman or Robo Trader. Experienced traders often require advanced features, robust APIs, and low-latency execution, potentially looking at options like MetaTrader 5, TradingView, or Quantconnect. Also, consider factors like pricing, security features, and available customer support.

What are the potential risks of using algo trading apps? Technical failures, such as software bugs or connectivity issues, can disrupt algorithms and lead to unexpected losses. Market volatility and unforeseen events can also impact performance. Additionally, latency, the delay between placing and executing an order, can result in missed opportunities or unfavorable trade executions. It’s crucial to choose a reliable platform, thoroughly test your algorithms, and manage risk effectively.

Are there any free algo trading apps available? Yes, some platforms offer free tiers or freemium models, often with limitations on features or usage. Bigul API, for example, offers free API access for developers. These options can be a good starting point for beginners or those wanting to explore algo trading without a large financial commitment. However, for more advanced features and higher usage limits, you’ll likely need to subscribe to a paid plan.

What is the future of algo trading? The future of algo trading is likely to be shaped by advancements in artificial intelligence, blockchain technology, and user interface design. AI-driven predictive analytics can lead to more accurate market predictions and personalized trading strategies. Blockchain integration can enhance transparency and security in financial markets. Improved user interfaces and personalized dashboards will make algo trading more accessible to a wider range of users. Real-time data processing advancements will further enhance the speed and efficiency of automated trading.