For many years, accessing advanced algorithmic trading strategies felt like an exclusive club, mainly for big financial institutions. However, technology has a fantastic way of opening doors. Today, an auto trading app can provide you with powerful tools and strategies, no matter your level of trading experience. Whether you’re looking into ways to build passive income or you’re an active trader seeking more efficient execution, these apps offer a fresh approach to market participation. Systems like our FAST AI are engineered to manage intricate market analysis and trade execution, aiming for consistent performance. This guide is designed to give you the confidence and knowledge to understand what an auto trading app can do for you and how to select the best fit for your financial journey.

Principales conclusiones

- Select Your App Thoughtfully: Before you start, really look into an app’s features, security measures, and ease of use to make sure it truly matches your trading approach and financial goals.

- Monitor and Understand for Success: Even with automated systems, make it a habit to review performance, grasp the core strategy (like FN Capital’s AI), and know how its risk management tools function to protect your capital.

- Embrace Automation with Realism: Treat auto trading apps as efficient tools for carrying out your strategy, not as guaranteed profit machines; your informed oversight and clear expectations are vital for making them work effectively.

So, What Exactly Are Auto Trading Apps?

If you’re curious about how technology can lend a hand in the trading world, you’ve likely come across auto trading apps. They sound futuristic, but the concept is pretty straightforward. Let’s break down what they are, what to look for, and some common misconceptions.

What They Do and Why They Might Be for You

At its core, automated trading (you might also hear it called algorithmic trading or algo-trading) uses computer programs to place and manage trades for you. These programs follow pre-set rules based on factors like price, volume, or timing. Think of it as giving a computer a detailed instruction manual for trading.

Why might this be for you? A key advantage is removing emotion from trading. Fear or excitement can lead to impulsive decisions, but an app simply follows its programming. Plus, these apps can monitor markets and execute trades much faster than humans, potentially catching opportunities you might miss. For busy individuals, it’s a way to engage with markets without constant screen time.

Key Features You’ll Want to See

When exploring auto trading apps, you’ll find various features. Some offer a no-code strategy builder, great if you have ideas but don’t code, letting you create rules visually. Backtesting is another vital feature, allowing you to test strategies with historical data to see potential past performance before going live.

Many apps also provide pre-built strategy templates, useful starting points for newcomers. At FN Capital, our FAST AI algorithm is a proprietary system focused on specific market conditions and robust risk management. Whether building from scratch or using a proven system, look for transparency and strong risk tools, like our DART (Dynamic Algorithmic Risk Tool), to help protect your capital.

Let’s Clear Up Some Common Myths

With the excitement around auto trading and AI, some misunderstandings can arise. A common myth is that trading bots guarantee profits. It’s crucial to understand that no app, however advanced, can promise returns. Markets are complex, and past performance doesn’t predict future results.

It’s important to separate realistic expectations from hype. AI-driven systems, like ours at FN Capital, are designed for data-driven decisions and removing human emotional bias, but they operate within market realities. They are tools for efficient strategy execution and risk management, not magic solutions. Approach auto trading with clear understanding and focus on the strategies.

A Look at Popular Auto Trading Apps

Alright, now that we’ve covered what auto trading apps are all about, let’s look at some of the popular players in the field. Each app has its own strengths and caters to different types of traders. Finding the right fit often comes down to your personal trading style, technical skills, and what you want to achieve. Here’s a rundown to give you a better idea of what’s available, helping you see how different platforms approach automated trading.

FN Capital’s FAST AI: Our Approach

At FN Capital, we’ve poured our expertise into creating IA RÁPIDA, a system designed to make sophisticated AI-powered algorithmic trading accessible. Our proprietary algorithm is the heart of our operation, executing thousands of trades each month. We focus on the EUR/USD pair because its high liquidity means smoother, more precise trades. We’re really proud of our 4-year verified track record, which transparently shows our consistent performance. A key component is DART (Dynamic Algorithmic Risk Tool), our AI that intelligently adjusts risk in real-time. Whether you’re just starting to explore passive income or you’re an institutional investor, FAST AI is built to help you work towards your financial goals without getting bogged down in the complexities of manual trading.

Capitalise.ai

If the idea of writing code for trading strategies sounds a bit daunting, then Capitalise.ai could be a fantastic option for you. This platform stands out because it lets you automate your trading ideas using everyday language – no programming degree needed! You can literally type out your trading plan, and Capitalise.ai translates it into an automated strategy. It’s incredibly empowering for traders who have solid strategies in mind but not the coding background. Plus, it offers robust tools for market research and backtesting, allowing you to thoroughly test your concepts against historical data before you put any real money on the line. This helps you refine your approach and trade with greater confidence.

uTrading

For those of you who like to manage things on the move, uTrading is a mobile app specifically for automated cryptocurrency trading. It’s available on Android and has quickly grown a large user base, which speaks to its appeal. The app really shines in its simplicity; they claim you can have your automated trading set up in under two minutes. uTrading provides a few different ways to automate your crypto trades, including using trading signals or even copy trading, where you can mirror the strategies of traders who have more experience. This makes it a really approachable entry point if you’re curious about automated crypto trading but want to avoid a complicated setup.

SpeedBot

Another interesting platform is SpeedBot, an algorithmic trading software application created for traders in India and the USA, whether you’re just starting out or have years of experience. What I find particularly helpful is its no-code strategy builder. This feature allows you to construct your own trading strategies without needing to dive into programming, making algorithmic trading much more accessible. SpeedBot also includes capabilities for both backtesting and forward testing. This means you can rigorously assess how your strategies might have performed based on past market data and also see how they hold up in current, live market conditions, which is crucial for fine-tuning your approach effectively.

MetaTrader 4/5

You’ll almost certainly come across MetaTrader (both its MT4 and MT5 versions) when you explore automated trading. It’s a powerhouse in the industry and one of the most established platforms, compatible with a huge range of brokers globally. These platforms are renowned for their comprehensive features, enabling users to build and run quite sophisticated trading algorithms, often called Expert Advisors or EAs. While there can be a bit more of a learning curve compared to some of the no-code options, the depth of customization and control MetaTrader offers makes it a top choice for serious traders who want to tailor their automated strategies precisely. Many successful automated traders have cut their teeth on this platform.

TradingView

TradingView is incredibly popular, and for good reason – its charting tools are top-notch, and it has a fantastic community where traders actively share insights and custom scripts. It’s an excellent platform for in-depth market analysis and for backtesting your trading ideas using its own Pine Script language. Keep in mind, Pine Script does require some coding familiarity. While TradingView excels at analysis and strategy development, its built-in capabilities for fully automating trade execution are somewhat limited. Often, to make your TradingView strategies trade automatically, you’ll need to connect it to a third-party execution tool or a compatible broker. So, it’s great for planning, but the hands-free trading part might need an extra step.

How to Pick the Right Auto Trading App for You

So, you’re thinking about using an auto trading app – that’s a smart move! But with so many choices out there, how do you find the one that’s genuinely a good match for you? It’s not just about picking the one with the slickest ads or what a friend might have mentioned. It’s about finding a tool that really clicks with your financial aims, how comfortable you are with tech, and what helps you sleep at night. Think of it like finding the perfect pair of running shoes; you wouldn’t just grab any pair off the shelf without checking the fit, the support, and if they’re right for the kind of running you do.

The trick is to do a little bit of looking around. You’ll want to figure out which features are essential for you, how much you’re prepared to invest (both in terms of your time and your money), and the kind of support you can expect. We’re talking about your money here, so taking a careful, informed approach is really important. Let’s go through some practical things to consider to help you find an app that feels like a great partner, helping you trade more effectively.

Check Out Its Features and How Easy It Is to Use

First up, let’s be real: the last thing you want is an app that feels like a puzzle you can’t solve. Some platforms are built for seasoned traders, loaded with complex tools, while others are designed to be welcoming for newcomers. Look for an interface that feels natural and instructions that are easy to follow. For instance, some apps like Capitalise.ai allow you to test and automate your trading ideas using everyday language instead of needing to know code, which is a huge help if programming isn’t your thing.

Think about what you really need the app to do. Are you after simple automation, or do you need sophisticated charting tools, the ability to backtest strategies, and a broad selection of indicators? Jot down your must-have features. At FN Capital, we’ve built our FAST AI system to be both powerful and user-friendly, so even if you’re new to trading, you can get started with an automated approach without a massive learning curve.

Make Sure It’s Secure and Reliable

This is a really important one. You’re placing your trust in an app with your financial details and, potentially, your investment funds. So, security should be a top priority. Find out what measures the app uses to keep your account and money safe. For example, uTrading makes it clear that user funds are kept on the exchange, not within the app itself, and it uses multiple security steps like email verification and two-factor authentication to protect user accounts.

Look for openness about how the app works and where your funds are held. Does it work with regulated brokers? How does it manage your data privacy? With FN Capital, we use a Third Party Fund Administrator (TPFA) structure. This not only simplifies access for our international clients but also adds an important layer of oversight. Knowing your investment is managed within a secure and compliant system is key for your peace of mind.

Match the App with Your Trading Goals

What are you aiming to get out of auto trading? Are you hoping to create some extra income, add variety to your investment portfolio, or actively manage and grow significant investments? The best app for you will largely depend on your specific financial targets. Some platforms, like SpeedBot, are made to be flexible, supporting different trading styles and levels of risk comfort, making them adaptable to what you want to achieve.

Also, consider how much risk you’re comfortable with. Some apps might lean towards high-frequency strategies that could carry higher risk, while others might focus more on protecting your capital. Our FAST AI, for instance, is designed for consistent monthly returns with a strong focus on managing risk through our DART (Dynamic Algorithmic Risk Tool) system. Whether you’re an individual investor or represent an institution, make sure the app’s methods align with your investment plans.

Compare Pricing and Any Trial Offers

Cost is always something to consider, but don’t just glance at the initial price. Think about the overall value you’re receiving. Some apps have monthly or annual subscription fees, while others might take a commission or a percentage of your profits. It’s wise to understand the full pricing structure to avoid any surprises. Many apps, such as Capitalise.ai, offer a free version or a trial period, which lets you explore the app before you decide to pay for a plan.

This is a great way to see if an app is a good fit without any immediate financial commitment. At FN Capital, we’re confident in our FAST AI’s performance, which is why we offer a 100-Day Money-Back Guarantee. This gives you the chance to try our AI-driven trading for yourself and see if it meets your needs, making your decision a bit easier.

See What Other Users Are Saying

Hearing from other users can give you some really valuable insights that you won’t find in the official descriptions. Check out what real people are sharing about their experiences with an app. Are they happy with how easy it is to use, the customer support, and its performance? Or are they pointing out issues like bugs, unexpected fees, or results that didn’t live up to the hype? For example, users have mentioned that Capitalise.ai is easy to use for basic auto-trading, though some wished for better backtesting features.

Look for reviews on independent websites, forums, and in app stores. While you’ll likely find a range of opinions for any app, a consistent theme in the feedback can be very informative. At FN Capital, we believe in being open, which is why our 4-year track record is publicly verified on FX Blue. This allows you to see detailed performance data and judge for yourself.

Making the Most of Your Auto Trading App

Alright, so you’ve picked out an auto trading app – that’s a great first step! Now, let’s talk about how to really make it work for you. Think of your app, especially a sophisticated one like FN Capital’s IA RÁPIDA, as a highly skilled trading partner. It’s designed to handle the complex, rapid-fire decisions, but your understanding and oversight are what steer the ship towards your financial goals. It’s not just about flicking a switch and walking away; it’s about knowing how to manage this powerful tool effectively. This means getting comfortable with how it operates, what its strengths are, and how your input, even if minimal on a day-to-day basis, plays a crucial role.

Many people hear “auto trading” and imagine a completely hands-off experience leading to instant riches. While the “hands-off” part can be true for execution, especially with advanced AI, the “instant riches” without any understanding is where myths creep in. The real power comes from using these apps smartly. It’s about leveraging their ability to ejecutar operaciones tirelessly and without emotion, based on strategies that would be impossible for a human to replicate manually due to speed and complexity. For instance, our FAST AI processes thousands of trades a month, something no individual could manage. Your role shifts from being the trader to being the manager of your trading technology. This involves understanding the setup, knowing how to interpret performance, and ensuring the strategy aligns with your risk comfort and long-term objectives. We’ll walk through setting things up, fine-tuning your approach (even with an AI that does most of the heavy lifting), keeping tabs on progress, and finding that sweet spot between automation and your personal financial strategy. The aim is to feel confident and in control, letting the technology do what it does best while you guide the overall journey.

Set Up Your First Automated Strategy: A Simple Guide

Getting started with automated trading doesn’t have to feel like rocket science. At its core, automated trading uses software to carry out trades for you based on a set of predefined rules. These rules might look at price movements, trading volume, or specific timing signals to make decisions.

With a system like FN Capital’s FAST AI, you’re essentially tapping into a highly optimized, pre-built strategy. Your setup journey involves getting your account ready, potentially connecting with a Third Party Fund Administrator (TPFA) – particularly helpful for our U.S. clients wanting to access international brokers – and then selecting the FAST AI trading script. The real advantage? The complex algorithmic rules are already built into FAST AI, which focuses on the EUR/USD pair for excellent liquidity and execution. Your main action is to register your account and follow our straightforward process to get the AI working for you.

Smart Tips to Improve How It Performs

Once your automated strategy is up and running, you’ll want to ensure it’s performing at its best. While some systems allow for deep customization of trading rules, others, particularly advanced AI-driven ones like FAST AI, handle the intricate decision-making. In this case, “improving performance” is less about tweaking code and more about understanding the system’s operational parameters and how they align with your financial objectives.

For instance, FAST AI incorporates our Dynamic Algorithmic Risk Tool (DART), which manages risk in real-time. While you don’t manually adjust trade-by-trade settings, being aware of how DART functions and ensuring your overall investment level is comfortable for you is crucial. You can explore our modelos financieros to get a better sense of the AI’s decision-making framework. Regularly reviewing performance reports, like our transparent FX Blue track record, also helps you stay informed and confident in the system’s operation.

Keep an Eye On and Adjust Your Trades

Even with the most sophisticated automation, it’s wise to monitor your trading activity. This doesn’t mean you need to be glued to your screen 24/7 – that’s what the app is for! However, regular check-ins are important. You’ll want to review your account statements, understand the trades being made, and see how they align with the strategy’s goals and your expectations.

With FN Capital, clients can monitor daily profit and loss in real-time through their TPFA dashboard. While FAST AI autonomously executes trades, your oversight involves ensuring the overall performance meets your satisfaction. If you’re new to this, starting with an investment level you’re comfortable with is a good approach, aligning with the general wisdom that beginners should proceed carefully. Our 100-Day Money-Back Guarantee is designed to give you peace of mind as you observe the AI’s performance firsthand, allowing you to assess its fit for your portfolio without initial financial risk.

Find the Right Balance: Automation and Your Input

Automated trading offers incredible speed, efficiency, and removes emotional decision-making, but it’s about finding a comfortable balance between the system’s autonomy and your oversight. Your “input” comes in at a higher level: setting your investment amount, understanding the risk parameters managed by tools like DART, and regularly reviewing performance.

Think of it this way: you’re the CEO of your investment strategy, and the auto trading app is your top-performing trading desk. You set the overall direction and risk tolerance, and the AI handles the moment-to-moment execution. For inversores minoristas, this means you can benefit from institutional-grade AI without needing to become a programming expert. The key is to stay informed, understand the reports, and ensure the app’s activity continues to align with your financial journey.

What’s Next for Auto Trading?

The world of automated trading is always moving forward, and it’s genuinely exciting to think about what’s on the horizon. As technology gets smarter and more accessible, we’re seeing some really interesting developments that could change how we approach the markets. It’s not just about speed anymore; it’s about smarter, more adaptive systems that can help traders of all levels. From advanced AI to more user-friendly platforms, the future looks set to offer even more sophisticated tools, making powerful strategies available to more people.

One of the biggest shifts is how AI and machine learning are becoming more deeply integrated. This means systems that don’t just follow pre-set rules but can actually learn from market behavior and adjust their strategies. We’re also likely to see a greater emphasis on transparency and education, helping users understand what their auto trading tools are doing and why. And as more people get interested in automated trading, the demand for intuitive, easy-to-use interfaces will only grow. It’s all about making these powerful tools more approachable and effective for everyone, from those just starting to explore ingresos pasivos to seasoned pros looking for an edge. The goal is to empower you with technology that works for your specific needs.

New Trends to Watch in Automated Trading

Keeping up with new trends in automated trading can feel like a whirlwind, but it’s so important for staying ahead! One key thing to remember is that amidst all the excitement, especially around AI, it’s crucial to separate myths from reality. Not every new feature or algorithm is a game-changer, and understanding the actual capabilities versus the marketing hype is vital for making smart choices. We’re seeing a push towards more personalized trading experiences, where automation can be tailored more closely to individual risk appetites and financial goals. Another area to watch is the development of even more sophisticated risk management tools, like FN Capital’s DART (Herramienta Algorítmica Dinámica de Riesgo), built directly into automated systems to help protect your capital.

How AI and Machine Learning Are Stepping Up

AI and machine learning are really starting to shine in the auto trading space, acting as the intelligent core of modern trading systems. Think of these technologies as the brains behind the brawn, constantly working to make trading smarter. Inteligencia artificial are designed to sift through massive amounts of market data, identify potential patterns, and make predictive models—all much faster than a human ever could. They then automate the execution of trades based on these insights. What’s really exciting is their ability to adapt. As market conditions change, these systems can learn and adjust their strategies, aiming for better performance over time. Our own Algoritmo FAST AI at FN Capital is a prime example, using AI to analyze markets and execute trades with a focus on precision and optimized returns.

What to Know About Rules and Regulations

As automated trading becomes more popular, it’s natural for rules and regulations to evolve alongside it. Staying informed about the regulatory landscape in your region is super important. This isn’t the most glamorous part of trading, but it’s essential for protecting yourself and ensuring you’re trading responsibly. Continuous learning is your best friend here. Understanding the common trading myths and misconceptions, including the regulatory aspects, can help you avoid pitfalls. Reputable platforms will always be transparent about their compliance and the regulatory frameworks they operate within. For instance, FN Capital utilizes a TPFA structure for international clients, ensuring compliance and seamless access to global brokers.

The Connection with Social Trading

Social trading, where traders can share strategies and even copy the trades of others, is an interesting area that’s starting to intersect more with automated systems. Imagine combining the insights from a community of traders with the efficiency of an automated execution platform. While this brings exciting possibilities, it also underscores the need to truly understand AI’s role and not just follow trends blindly. The key is to use social insights as one piece of the puzzle, complementing a well-thought-out automated strategy rather than replacing your own due diligence. As these areas merge, platforms that offer both community features and robust automation could become increasingly popular, but always approach with a discerning eye.

Why Easy-to-Use Designs Matter More Than Ever

As powerful as auto trading technology is, it’s not much good if it’s too complicated to use! That’s why easy-to-use designs are becoming absolutely critical. The goal is to make these advanced tools accessible to everyone, regardless of their tech skills or previous trading experience. A clean, intuitive interface means you can set up your strategies, monitor performance, and make adjustments without getting lost in a sea of confusing options. It’s also important to remember that no matter how sophisticated or user-friendly a bot is, it’s not a magic money-making machine. As some rightly point out, the idea that bots guarantee profits is a major misconception. Good design helps you manage the tool effectively, but sound strategy and risk management are still paramount.

Artículos relacionados

- Top 10 Automated Trading Apps for Hands-Free Investors – FN Capital

- Benefits of Automated Trading: A Practical Guide – FN Capital

- Algorithmic Trading: The Ultimate Guide – FN Capital

- AI Trading Bots: An Investor’s Guide to Automated Trading – FN Capital

- AI Trading Algorithms: Your Practical Guide – FN Capital

Preguntas frecuentes

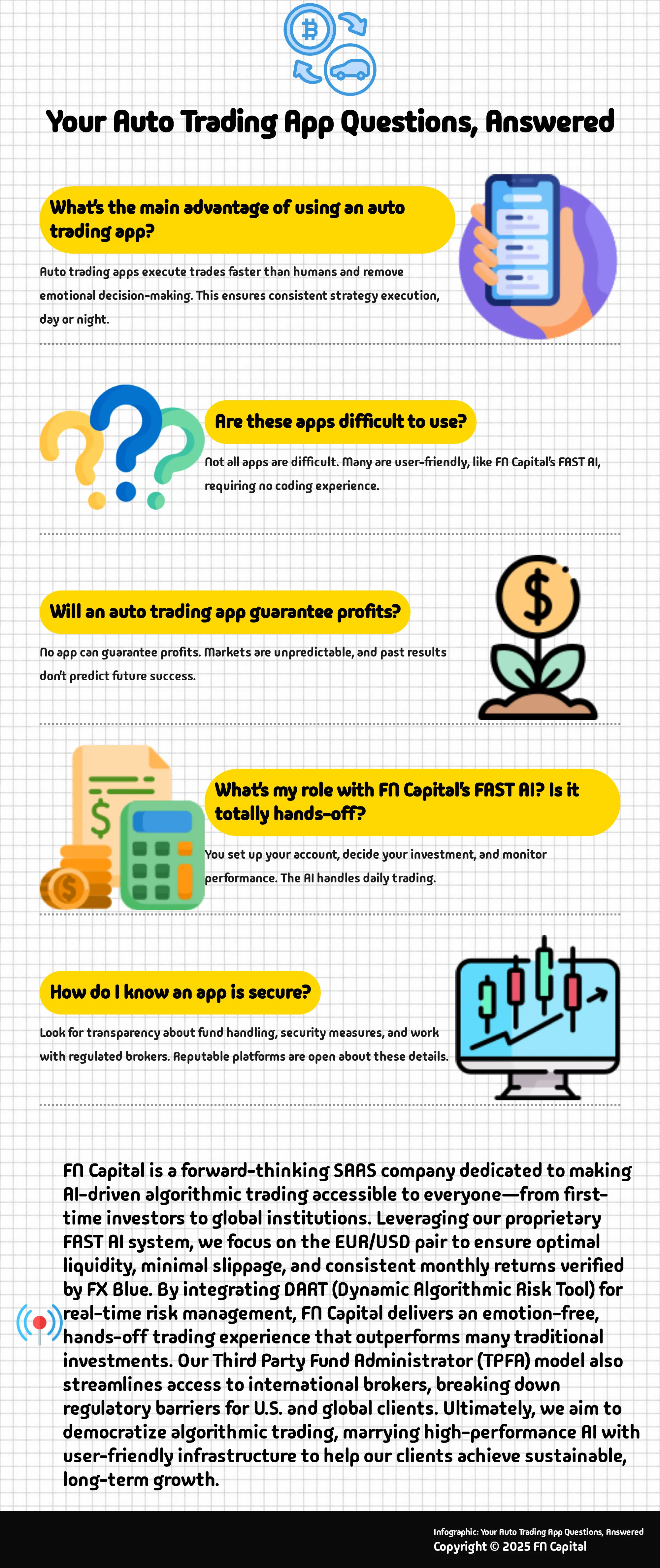

What’s the biggest perk of using an auto trading app instead of just trading on my own? Think of it this way: auto trading apps act like your super-efficient trading assistant. They can react to market changes much faster than any human can, and they stick to the plan without letting emotions like fear or excitement cloud their judgment. This means your trading strategy gets executed consistently, day or night, even when you’re busy with other things.

I’m not exactly a tech whiz. Are these apps complicated to get started with? That’s a really common concern, and the good news is, it varies! Some platforms are definitely geared towards experienced programmers. However, many modern apps, including our FAST AI system at FN Capital, are designed to be user-friendly. We focus on a straightforward setup so you can get the benefits of automated trading without needing a degree in computer science.

Is it true that auto trading apps will definitely make me money? It’s so important to be clear on this: no auto trading app, no matter how advanced, can guarantee profits. Markets are inherently unpredictable, and past results don’t promise future success. These apps are powerful tools for executing your trading strategies efficiently and managing risk, but they aren’t magic money-making machines.

If I use FN Capital’s FAST AI, what’s my role? Is it totally hands-off? While our FAST AI is designed to handle the complex trading decisions and executions for you, think of your role as more of an overseer. You’ll set up your account and decide on your investment level. After that, the AI takes care of the day-to-day trading. Your part involves monitoring performance through your dashboard and ensuring the strategy continues to align with your overall financial comfort and goals.

How can I tell if an auto trading app is secure and that my money will be safe? This is a crucial question! You’ll want to look for transparency from the provider. Understand how they handle your funds – for example, at FN Capital, we use a Third Party Fund Administrator structure for an added layer of oversight. Check for clear information on their security measures, like data encryption and two-factor authentication, and see if they work with regulated brokers. Reputable platforms will be open about these details.