Tired of chasing market trends and second-guessing your investment decisions? Automated trading offers a data-driven, emotion-free approach to navigating the complexities of the forex market. This fn capital automated trading tutorial focuses on FN Capital, a platform that puts the power of AI in your hands. We’ll demystify the process, explain how their proprietary FAST AI algorithm works, and guide you through setting up your first automated trade. Join us as we explore the potential of automated trading with FN Capital and discover how it can simplify your investment strategy.

Key Takeaways

- Automated forex trading is now accessible to everyone: FN Capital’s FAST AI platform, combined with its dynamic risk management tool (DART), handles the complexities of algorithmic trading, making it user-friendly for both beginners and experienced traders.

- Transparency and independent verification build trust: Verify FAST AI’s performance through FX Blue and monitor your investments in real-time via your TPFA dashboard.

- Active engagement enhances automated trading: While FAST AI automates trades, staying informed, utilizing available resources, and actively managing your account remain crucial for maximizing your returns.

What is FN Capital and How Does its Automated Trading Work?

FN Capital is a financial technology company specializing in AI-powered forex trading automation. Its proprietary automated trading platform, FAST AI, uses sophisticated algorithms to execute trades on your behalf, aiming to generate consistent monthly returns. One of the key advantages of FN Capital is its accessibility. The platform is designed to be user-friendly, requiring no minimum investment to get started, making algorithmic trading accessible to both seasoned traders and beginners. FN Capital offers a compelling solution for those exploring alternative investments.

What is FAST AI?

FAST AI is FN Capital’s core technology: a sophisticated algorithmic trading system that acts as your personal automated trading assistant. It executes trades 24/5, removing the emotional element often associated with trading. This automated approach aims to create more consistent and rational trading strategies. By simplifying algorithmic trading, FAST AI empowers individuals to access advanced trading techniques without needing in-depth market knowledge. This makes it a powerful tool for those seeking passive income.

Why Focus on EUR/USD?

FAST AI concentrates specifically on the EUR/USD currency pair. This strategic decision is based on the pair’s high liquidity and volatility. As one of the most liquid currency pairs in the forex market, EUR/USD offers several advantages for automated trading. Its high trading volume ensures efficient order execution and minimizes slippage. The EUR/USD pair’s volatility, while managed by FAST AI’s risk management system, creates opportunities for profit. This focused approach allows FAST AI to specialize and optimize its algorithms for this specific market, potentially leading to enhanced performance.

Key Features of FN Capital’s FAST AI Platform

FN Capital’s FAST AI platform stands out with its unique blend of proprietary technology, strategic focus on the EUR/USD pair, and robust risk management tools. Let’s explore the core features that power its performance.

What is DART?

DART (Dynamic Algorithmic Risk Tool) sits at the heart of FN Capital’s risk management strategy. It’s not a static set of rules; DART constantly adapts to shifting market conditions. This dynamic approach allows the system to adjust leverage, trade exposure, and stop-loss orders in real time. By actively managing these parameters, DART helps protect your capital and optimize returns, even when markets are volatile. This focus on real-time risk mitigation sets FN Capital apart, offering a level of security often missing in other automated trading systems.

How FN Capital Manages Execution and Liquidity

FN Capital uses MetaTrader 5 (MT5), a platform known for its support of Expert Advisors (EAs) and automated trading tools. This integration allows the FAST AI algorithm to seamlessly execute trades based on its sophisticated analysis. The platform’s robust infrastructure ensures efficient order filling, minimizing slippage and maximizing potential profits. Focusing exclusively on the EUR/USD currency pair gives FN Capital access to exceptional liquidity, a critical factor for smooth and efficient trade execution. This strategic choice minimizes transaction costs and allows the algorithm to operate with optimal precision.

How to Verify Trades and Track Performance

Transparency is key in automated trading. FN Capital understands this and provides several ways to verify trades and track performance. All trading activity is independently verified through FX Blue, a reputable third-party platform, giving you an objective view of FAST AI’s performance. This independent verification adds a layer of credibility and lets you confidently assess the algorithm’s track record. Clients also have access to real-time performance monitoring through their chosen Third Party Fund Administrator (TPFA) dashboard. This provides up-to-the-minute insights into your investment, ensuring you’re always informed about your trading activity.

FN Capital’s Pricing Plans: Choosing the Right Option

FN Capital offers three distinct pricing plans designed for different investment levels and experience. Whether you’re just starting with automated trading or you’re a seasoned investor, there’s a plan that aligns with your goals. Let’s break down each option:

Basic Plan

The Basic Plan is perfect for those new to automated trading or who prefer to start small. With no minimum investment required, it’s incredibly accessible. This plan provides an expected monthly yield of approximately 1–2%, allowing you to explore the platform and experience automated trading firsthand. It’s a great way to get your feet wet and familiarize yourself with FN Capital’s FAST AI system.

Essential Plan

The Essential Plan is designed for investors ready to enhance their automated trading. Priced at $250 per month with a $1,000 activation fee, this plan grants access to 70% of FAST AI’s capabilities. Expect a monthly yield of around 4–5% with this plan. The Essential Plan balances cost and performance, making it ideal for those looking to improve their trading without a substantial upfront investment. Learn more about the specifics of this plan on the FN Capital website.

Unleashed Plan

For investors seeking maximum performance and access to all of FN Capital’s advanced features, the Unleashed Plan is the premier option. At $500 per month with a $2,000 activation fee, this plan unlocks 100% of FAST AI’s capabilities, offering an expected monthly yield of 7.5% or more. The Unleashed Plan is designed for serious investors committed to maximizing returns through sophisticated, AI-driven trading strategies. Explore the full potential of the Unleashed Plan and its features on FN Capital’s pricing page.

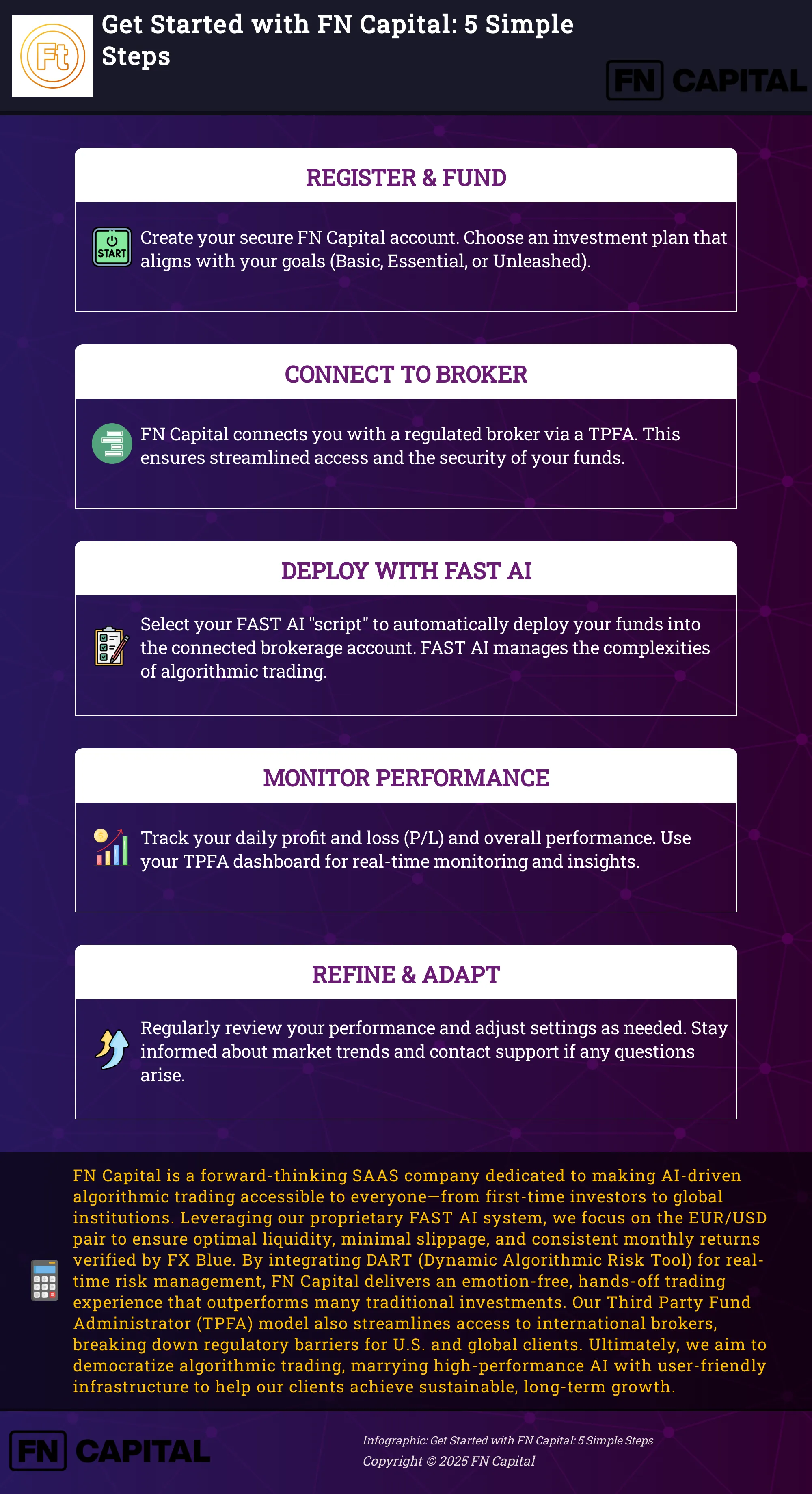

Getting Started with FN Capital: A Step-by-Step Guide

Ready to experience the power of AI-driven forex trading? Getting started with FN Capital is straightforward. Here’s a step-by-step guide to get you up and running:

Register and Verify Your Account

First, create an account on the FN Capital website. The process is simple and secure. You’ll provide some basic information and then verify your email address. As FN Capital’s Fast AI is fully automated, no prior trading experience is required. The system manages your investments, so you can sit back and relax.

Fund Your Account

Once your account is verified, the next step is funding. FN Capital offers flexible pricing plans: Basic (free), Essential ($250/month + $1000 activation fee), and Unleashed ($500/month + $2000 activation fee). Choose the plan that best suits your investment goals and budget. The higher-priced plans offer higher potential returns and more dedicated support. You can fund your account via wire transfer or cryptocurrency.

Set Up Your First Automated Trade

After funding your account, you’re ready to begin trading. FN Capital uses a third-party fund administrator (TPFA) to streamline access to international brokers. This process simplifies regulatory compliance and ensures optimal trade execution. Your funds will be allocated to a segregated or pooled account at a regulated broker, providing institutional-grade security and liquidity. You’ll then select an FN Capital FAST AI trading “script,” which automatically deploys your funds into a connected brokerage account. The MT5 trading platforms support Expert Advisors (EAs) and trading robots, enabling automated trading. These tools execute trades based on predefined strategies and sophisticated algorithms, allowing continuous market participation without constant monitoring. From there, FAST AI takes over, executing trades 24/5 based on its sophisticated algorithms and real-time market analysis. You can monitor your daily profit and loss (P/L) through the TPFA dashboard.

Understanding Returns and Risk Management

Smart investing involves understanding both potential returns and the inherent risks. Let’s break down how FN Capital approaches both, giving you a clearer picture of what to expect.

What Returns Can You Expect with FN Capital?

FN Capital offers a tiered system, allowing you to select a plan that aligns with your financial goals. Returns vary by plan, with the Basic plan designed for more conservative growth and the Unleashed plan targeting more aggressive returns. FN Capital aims for monthly returns ranging from 1-2% (Basic) to 7.5%+ (Unleashed). Remember that these are targets, not guarantees. Market conditions play a role, and past performance doesn’t predict future results. For a detailed breakdown of each plan’s projected returns, visit the pricing page.

How FAST AI Mitigates Risk

While aiming for strong returns, FN Capital prioritizes protecting your investment. Their proprietary FAST AI algorithm incorporates several risk mitigation strategies. One key element is DART (Dynamic Algorithmic Risk Tool), which constantly monitors market volatility and adjusts trading parameters. Think of it as a vigilant guardian, automatically fine-tuning your exposure to keep your capital safer. Beyond the algorithms, FN Capital emphasizes human oversight. As Isaac Adams, a leader at FN Capital, explained in a recent interview, every trade undergoes rigorous checks to ensure it meets strict safety and compliance standards. This blend of automated intelligence and human oversight provides a balanced approach to risk management.

Why Risk Awareness Matters

No investment is entirely without risk, and algorithmic trading is no exception. A common pitfall is overfitting to historical data—essentially, designing a strategy that worked perfectly in the past but might not hold up in the future. FN Capital addresses this by constantly refining its algorithms and adapting to evolving market dynamics. It’s important to remember that algorithmic trading, while powerful, isn’t a magic bullet. Success depends on a well-designed strategy, rigorous testing, and a realistic understanding of market fluctuations. For a deeper dive into the realities of algorithmic trading profitability, check out this helpful article. By understanding the inherent risks and how FN Capital works to mitigate them, you can approach your investment decisions with greater confidence.

Optimizing Your FN Capital Experience

Once you’re up and running with FN Capital, these tips will help you make the most of the platform and refine your approach over time.

Customize Your Trading Parameters

Automated trading systems have revolutionized how trading is conducted, offering speed, precision, and the ability to execute predefined strategies. By customizing your trading parameters, you can align the system with your specific investment goals and risk tolerance. While FAST AI handles the complex execution, you retain control over key settings. This allows you to adjust the system’s behavior to better suit your individual preferences and market outlook. Think of it as fine-tuning the engine of your automated trading strategy. For a deeper dive into the world of automated trading systems, check out this helpful article on Understanding Automated Trading Systems.

Contact Support

Even with a sophisticated automated system, questions might pop up. FN Capital recognizes the importance of clear communication and accountability. Reach out to support for any issues you encounter—they can provide guidance and assistance tailored to your needs. Whether it’s a technical question or a need for clarification on a specific feature, the support team is there to help you. Don’t hesitate to connect with them, as customer reviews often highlight the responsiveness and helpfulness of the FN Capital support team.

Interpret Reports and Analytics

Understanding the data generated by FAST AI is key to making informed decisions. The algorithms used by FN Capital are truly innovative, and learning to interpret the reports generated by these systems is essential for maximizing your results. FN Capital provides comprehensive analytics that offer insights into your trading performance. Take the time to familiarize yourself with these reports, as they can help you track progress, identify trends, and refine your trading parameters over time. You can find more information about how FN Capital guides users through the trading process and helps them interpret analytics effectively in these customer reviews.

FN Capital vs. Traditional Trading: Key Differences

This section explores the core differences between FN Capital’s automated approach and traditional trading methods. We’ll cover the advantages of automation and how FN Capital addresses common trading challenges.

Automated vs. Manual Trading

Traditional trading often involves extensive research, ongoing market monitoring, and manual order execution. This can be time-consuming and emotionally taxing. FN Capital’s FAST AI provides fully automated trading, leveraging the speed and efficiency of algorithms, as discussed in our guide to the best algorithmic trading platforms. This automated approach, highlighted in our introduction to Ben, a hypothetical client, eliminates emotional decision-making. Removing this human element can lead to greater profitability, as explained in Quantified Strategies’ analysis of algorithmic trading.

How FN Capital Solves Common Trading Challenges

Choosing the right platform is a critical first step for any trader. FN Capital simplifies this with a comprehensive solution featuring a user-friendly design, real-time data, and robust risk management tools, as detailed in our guide to choosing an algorithmic trading platform. Active risk management is essential, and FN Capital’s DART system tackles this head-on. This focus on risk mitigation, combined with the platform’s accessibility, makes automated trading achievable for a wider range of investors. Tech Times highlights FN Capital’s commitment to safety and compliance, ensuring every trade follows strict rules and regulations.

Common Misconceptions About Automated Trading

Automated trading systems have revolutionized how we approach the markets, bringing speed and precision once exclusive to institutional players. However, some misconceptions can cloud the real potential of AI in trading. Let’s clear those up.

Debunking Myths

One persistent myth is that automated systems are “set-it-and-forget-it” money machines. While a platform like FN Capital’s FAST AI executes trades autonomously, it’s not about ignoring your investments. Think of it more like delegating the repetitive tasks. At FN Capital, human oversight is key. Our team of experts continuously monitors the system, adjusting strategies and stepping in when necessary. AI enhances our decision-making, not replaces it. For more on this balanced approach, see Isaac Adams’s insights on algorithmic trading.

Another misconception is that automated trading eliminates risk entirely. No investment is entirely risk-free. However, what automated systems can do is mitigate risk through precise execution and data-driven decisions. FN Capital’s DART system, for example, dynamically adjusts risk parameters in real-time, responding to market fluctuations far faster than any human could. For a deeper understanding of automated trading systems, check out this article on debunking common misconceptions.

Overcoming the Learning Curve

Some believe automated trading requires advanced technical expertise. The truth is, platforms like FN Capital are designed for accessibility. You don’t need to be a coding whiz to benefit from AI-powered trading. Our platform provides a user-friendly interface that lets you monitor performance and manage your account with ease.

While you don’t need to be a programmer, understanding the basics of automated trading is still important. Learning about different types of trading risks (technical, market, over-optimization, etc.) empowers you to make informed decisions and feel confident in your investment strategy. Articles like this one on the risks of automated trading can be a great starting point. FN Capital also offers resources and support to help you along the way. We believe knowledge is key to successful trading, no matter your experience level.

Maximizing Success with FN Capital’s Automated Trading

Getting started with automated trading can feel like a big step, but with the right approach, you can confidently use FN Capital’s platform to pursue your financial goals. This section covers some best practices and tips for continuous learning to help you maximize your automated trading experience.

Best Practices

Choosing the right platform is the first step toward successful automated trading. Look for key features like a user-friendly design, real-time data feeds, robust backtesting capabilities, and effective risk management tools—all available on the FN Capital platform. Active risk management is crucial. While FN Capital’s DART system handles much of this automatically, understanding how it works and how to use features like stop-loss orders is important. Diversifying your investments is another sound practice, even within automated systems. Finally, remember that maintaining human oversight of any automated system is key. Think of it as setting the overall strategy and letting the AI handle the execution, not a complete “set it and forget it” approach. Backtesting your strategies with historical data is also vital for understanding how your approach might perform under different market conditions. FN Capital offers tools to help you do this effectively. However, avoid over-optimizing based on past performance, as markets are constantly evolving. Continuously adapt your strategies based on real-world market conditions.

Continuous Learning and Adaptation

The world of algorithmic trading is constantly evolving. The success of your automated trading depends heavily on the quality of the underlying trading strategy and its rigorous testing. It’s not a get-rich-quick scheme, as sources like Quantified Strategies point out. Getting started requires learning about algorithmic trading and consistent effort. FN Capital provides resources to help you understand the core concepts and strategies behind our FAST AI system. Take advantage of these resources to build a strong foundation for your trading journey. While automated trading reduces emotional influences, it doesn’t eliminate them entirely. Monitoring and management are still crucial. Regularly review your portfolio’s performance and make adjustments as needed. Stay informed about market trends and news that could impact your investments. By combining a solid understanding of market dynamics with the power of FN Capital’s AI, you’ll be well-positioned to achieve your trading goals.

Alternative Automated Trading Platforms

While FN Capital offers a robust and specialized approach to automated trading, exploring other platforms can broaden your understanding of the automated trading landscape. This section provides a brief overview of some alternative

eToro

eToro is a social trading and multi-asset investment platform providing access to thousands of instruments, including stocks, cryptocurrencies, and commodities. Its key differentiator is the CopyTrader feature, which allows you to automatically replicate the trades of other, potentially more experienced, investors on the platform. This can be a good starting point for those new to automated trading, offering a hands-off approach. However, keep in mind that past performance is not indicative of future results, and copying another trader’s strategy doesn’t guarantee profits. It’s essential to carefully research and select traders to copy based on their track record, risk tolerance, and overall investment philosophy.

Quantopian

Quantopian was a unique platform that empowered users to design, backtest, and deploy their own algorithmic trading strategies using Python. It fostered a collaborative environment where traders could share insights and learn from each other. Unfortunately, Quantopian is no longer operational. However, its legacy highlights the growing interest in customizable algorithmic trading and the importance of community-driven learning in this space.

MetaTrader

MetaTrader, specifically MetaTrader 4 (MT4) and MetaTrader 5 (MT5), are among the most popular platforms for forex and CFD trading. These platforms support automated trading through Expert Advisors (EAs), which are essentially custom scripts that automate trading decisions based on pre-defined rules. The flexibility of EAs allows for a wide range of strategies, from simple to highly complex. However, developing and optimizing EAs often requires programming knowledge or the assistance of a skilled programmer. You can learn more about automated trading systems, including those available on eToro, through resources like BrokerChooser.

TradingView

Known for its comprehensive charting tools and social networking features, TradingView also offers automated trading capabilities. Its Pine Script programming language allows users to create custom indicators and trading strategies, backtest them against historical data, and even automate live trades. The platform’s active community provides a wealth of shared scripts and ideas, making it a valuable resource for learning and collaboration. However, like MetaTrader, leveraging the full potential of TradingView for automated trading may require some coding experience.

AlgoTrader

AlgoTrader caters to institutional and professional traders with its advanced algorithmic trading software. It supports a wide range of asset classes and offers sophisticated backtesting and execution capabilities. AlgoTrader is designed for high-frequency trading and integrates with various data feeds and execution venues. While its robust features make it a powerful tool for experienced traders, it may be overly complex for beginners or those with limited technical expertise. Its focus on institutional-grade trading also typically comes with a higher price tag than retail-focused platforms.

Related Articles

- Forex AI Trading: A Practical Guide – FN Capital

- Algorithmic Trading Platforms: Features, Benefits, and Risks – FN Capital

- Automated Trading Systems: A Practical Guide – FN Capital

- Forex God Myth: Debunked – FN Capital

- Algo Trading Risks Explained: Your Essential Guide – FN Capital

Frequently Asked Questions

Do I need prior trading experience to use FN Capital? No, prior trading experience isn’t required. FN Capital’s FAST AI platform is fully automated, meaning the system manages your investments, executing trades 24/5 based on its algorithms and real-time market analysis. This hands-off approach makes it accessible to both beginners and experienced traders.

What is the minimum investment required to start using FAST AI? FN Capital offers a tiered pricing structure with varying minimums depending on the chosen plan. The Basic plan requires no minimum investment, making it an accessible entry point for those new to automated trading. The Essential and Unleashed plans have higher minimums, reflecting their increased access to FAST AI’s capabilities and higher target returns. You can find the specifics for each plan on the FN Capital pricing page.

How does FN Capital ensure the security of my funds? FN Capital prioritizes the security of client funds. They partner with regulated brokers and utilize segregated or pooled accounts to ensure your investments are held securely. Additionally, FN Capital operates within a structured legal framework and uses Third Party Fund Administrators (TPFAs) to provide further transparency and oversight.

What kind of returns can I realistically expect from FAST AI? While FN Capital aims for specific monthly return targets for each plan (ranging from 1-2% for the Basic plan to 7.5%+ for the Unleashed plan), it’s important to remember that these are targets, not guarantees. Actual returns can vary based on market conditions. Past performance is not indicative of future results. It’s crucial to have realistic expectations and understand that all investments carry inherent risks.

How can I monitor the performance of my investments with FN Capital? FN Capital provides several ways to monitor your investment performance. You can track your daily profit and loss (P/L) in real-time through your chosen TPFA’s dashboard. Additionally, all trading activity is independently verified through FX Blue, offering an objective view of FAST AI’s performance. This transparency allows you to stay informed about your investments and assess the algorithm’s track record.