Algorithmic trading can be a powerful tool, but choosing the right platform is critical. Nurp offers an automated solution designed to simplify forex trading, but how does it measure up against the competition? This review provides an in-depth look at Nurp, exploring its features, user experience, and potential risks. We’ll analyze Nurp reviews, complaints, and BBB ratings to understand user perspectives and address any concerns. We’ll also discuss essential risk management strategies and due diligence practices to help you protect your investments when using any trading service. Whether you’re a seasoned trader or just starting, this review will equip you with the knowledge you need to evaluate Nurp effectively.

Key Takeaways

- Verify claims and check multiple reviews: Don’t just take marketing materials at face value. See what real users are saying on various platforms before committing to a trading service.

- Algorithmic trading isn’t foolproof: Even advanced algorithms can be affected by market volatility. Testing and risk management are essential.

- Weigh Nurp’s ease of use against potential risks: Consider both the pros and cons, including user reviews and the possibility of financial loss, before using Nurp.

What is Nurp?

Nurp offers algorithmic trading software and educational resources geared toward forex traders. They aim to equip both beginners and seasoned traders with the tools and knowledge they need to navigate the forex market. Let’s explore what Nurp offers.

Nurp’s Algorithmic Trading Platform

Nurp’s core product is its Algorithmic Trading Accelerator. This platform provides traders with a suite of trading algorithms, allowing them to use sophisticated trading technology across different financial markets. The goal is to give traders access to tools previously available only to institutional investors. A key part of Nurp’s appeal lies in its user-friendly design. The platform emphasizes a smooth user experience by integrating real-time data and offering actionable insights to inform trader decisions.

Nurp highlights its product called The Intelligent Trader. This tool uses advanced algorithms, automation, and risk management features to potentially improve trading performance in currency and cryptocurrency markets. The Intelligent Trader adapts to the specific characteristics of different asset classes, including forex, gold, and cryptocurrencies, using machine learning algorithms.

Forex Trading Courses and Educational Resources

Beyond its trading platform, Nurp emphasizes education. They offer various educational resources, including courses and training materials, to help users better understand forex trading and algorithmic strategies. It’s important to understand that Nurp is not a brokerage or broker-dealer; they focus on developing financial education and algorithmic trading software. By combining software with educational resources, Nurp aims to give traders a well-rounded approach, offering effective trading plans suited to different experience levels.

What Are Nurp’s Customer Ratings and Reviews?

BBB Ratings and Complaints

The Better Business Bureau (BBB) is a non-profit organization focused on advancing marketplace trust. It’s often a good starting point when researching a company. The BBB’s main goal is to improve transparency between businesses and consumers by acting as a mediator in disputes. Check the BBB website for Nurp’s rating and any complaints filed against them. This information can offer valuable insights into how the company handles customer issues and its overall reputation.

Trustpilot and Other Platform Reviews

Nurp receives mixed reviews on Trustpilot, a popular platform for customer feedback. While it has a 3.6-star average rating, a significant number of users give it 1-star, indicating substantial dissatisfaction. Many negative reviews allege the software leads to financial losses, citing issues like underperforming algorithms and exaggerated return claims. Beyond Trustpilot, consider exploring other review sites and online communities. A Reddit thread discussing Nurp Algo, for instance, shows a range of opinions, from users reporting consistent profits to others describing significant losses and poor support. Looking at various sources provides a more comprehensive understanding of user experiences.

What Are Common Complaints About Nurp?

Several online forums and review sites feature discussions about Nurp, highlighting both positive and negative user experiences. Let’s take a closer look at some common complaints.

Software Performance Issues

A recurring theme in negative Nurp reviews revolves around the software’s performance. Users on platforms like Trustpilot report that the algorithms don’t perform as advertised, leading to financial losses. Some even allege that the software is a scam and that the advertised returns are exaggerated. These claims raise questions about the efficacy and reliability of Nurp’s core offering.

Customer Service Concerns

Another area of concern centers around Nurp’s customer service. Users on Reddit and Trustpilot describe poor or unresponsive customer service, particularly after experiencing losses. Allegations include delayed responses and even the deletion of negative posts within the Nurp community. This perceived lack of support during critical times understandably fuels user frustration.

Transparency and Marketing Claims

Nurp also faces criticism regarding its marketing practices and transparency. Some users on Reddit accuse Nurp of misleading marketing tactics, including potentially fake reviews and using the same spokesperson as a competitor. These claims, coupled with Nurp’s tendency to publicly dismiss negative Trustpilot), create skepticism about the company’s authenticity.

Financial Loss Reports

Perhaps the most concerning complaints involve user reports of substantial financial losses while using the Nurp platform. On Reddit, users share stories of losses ranging from tens of thousands to over $1 million, allegedly due to the bot’s performance, especially during market volatility. These reports, while anecdotal, paint a concerning picture of the potential financial risks associated with using Nurp.

How Does Nurp Address Customer Feedback?

This section explores how Nurp handles customer feedback, both negative and positive, to get a sense of their commitment to customer satisfaction and ongoing improvements.

Responses to Negative Reviews

Nurp actively monitors and responds to negative reviews, especially on platforms like Trustpilot. They often suggest that some negative reviews are from competitors or contain misleading information. While Nurp emphasizes transparency and offers support to users with genuine concerns, this approach might not fully resolve all user issues and could be perceived as dismissive by some. It’s worth keeping this in mind as you consider the overall user experience.

Improvements Based on User Input

Despite some negative reviews, Nurp appears committed to improving its platform based on user feedback. Its user-friendly design is a frequently mentioned strength, making algorithmic trading more accessible. Benzinga points to Nurp’s positive user experience as a primary reason for its popularity with forex traders, highlighting the real-time data and helpful trading algorithms. InvestingRobots.com emphasizes Nurp’s customization options, which allow traders to personalize the platform. An active user community where traders share tips and discuss strategies further suggests that Nurp is building a supportive environment and using user input to improve the platform.

What Are the Benefits and Risks of Using Nurp?

Deciding if a trading platform is right for you requires careful consideration of its potential advantages and disadvantages. Let’s explore the benefits and risks associated with Nurp.

User-Friendly Algorithmic Trading Interface

Nurp is praised for its user-friendly interface. Benzinga’s Nurp review highlights how the platform’s intuitive design and real-time data integration empower traders to make informed decisions. This ease of use can be particularly beneficial for those new to algorithmic trading, allowing them to quickly grasp the platform’s functionalities. A smooth interface contributes to a more efficient and enjoyable trading experience.

Educational Resources and Community Support

Beyond the platform itself, Nurp offers educational resources and fosters a supportive community. Traders can connect with each other, share strategies, and discuss market trends, as InvestingRobots.com points out in their Nurp review. This sense of community can be invaluable, especially for newcomers seeking guidance. Learning from experienced traders and sharing insights can accelerate the learning curve and contribute to a more well-rounded trading approach.

Financial Loss Potential

While Nurp offers potential benefits, it’s crucial to acknowledge the inherent risks. Several reviews on Trustpilot allege that the software has led to significant financial losses. These complaints often center around algorithms not performing as advertised and potentially exaggerated return claims. It’s essential to approach any trading platform, including Nurp, with realistic expectations and a clear understanding of the potential for financial loss. Remember that past performance is not indicative of future results.

Technical Issues and Platform Limitations

Another area of concern revolves around technical issues and platform limitations. While some reviews praise Nurp’s smooth interface, it’s important to be aware of potential technical glitches or limitations that could impact your trading. Thorough research and due diligence are essential before committing to any platform. Consider testing Nurp with a demo account or starting with a small investment to assess its performance and stability firsthand.

Nurp vs. Competitors

Choosing the right trading platform depends on your individual needs and preferences. How does Nurp stack up against other popular options? Let’s take a look.

eToro

eToro is known for its social trading features, letting you follow and copy other investors’ trades. This can be a great way to learn, but your success depends on someone else’s performance. If you want more control over your strategies, Nurp’s algorithmic trading platform might be a better fit. eToro offers a broad range of assets, including cryptocurrencies, which is appealing for diversification. However, some users report higher spreads than other platforms, potentially impacting profits.

Oanda

Oanda is recognized for its robust trading tools and extensive market research. They offer a flexible trading environment with competitive spreads and no minimum deposit. While Oanda provides a more traditional trading experience focused on forex, Nurp focuses on algorithmic trading. Oanda is a solid choice for both beginners and experienced traders, especially those interested in forex, thanks to their excellent customer service and educational resources.

Pepperstone

Pepperstone is a favorite among forex traders for its low-cost trading and fast execution. If speed and cost are your primary concerns, Pepperstone might be worth considering. However, Nurp offers algorithmic trading solutions and proprietary tools that Pepperstone lacks. Pepperstone is transparent in its pricing and offers various trading platforms, including MetaTrader 4 and 5.

IC Markets

Similar to Pepperstone, IC Markets excels in providing low spreads and high leverage, attracting high-frequency traders. IC Markets focuses on a direct market access (DMA) trading environment, while Nurp integrates algorithmic trading technologies. While users appreciate IC Markets’ speed and reliability, its interface can be complex for beginners. If you’re new to trading or prefer a user-friendly experience, Nurp might be a better option.

XM

XM caters to all experience levels with extensive educational resources and customer support. While Nurp emphasizes algorithmic trading, XM offers a more traditional trading experience with various instruments and account types. XM is known for its promotional offers and bonuses, but some users have reported withdrawal issues. If reliable transactions are a priority, research this aspect of XM and compare it with Nurp’s withdrawal processes.

Should You Use Nurp?

Weighing Pros and Cons

Deciding if Nurp is right for you means balancing the good and the bad. Like any platform, it has strengths and weaknesses, so let’s break those down based on what users and experts are saying.

On the plus side, Nurp gets positive feedback for its user-friendly design. Many forex traders appreciate how easy it is to get started with Nurp, especially compared to more complex software. The platform’s real-time data and trading algorithms can give you helpful insights to make smarter trades. Another perk is Nurp’s customization options. You can set things up just how you like, creating a trading experience that fits your style. Plus, Nurp has an active user community where traders share tips and strategies—always a bonus for learning and connecting with others. Nurp also offers an Algorithmic Trading Accelerator, a tool designed to help both new and seasoned traders use sophisticated algorithms across different markets.

However, Nurp may not be the perfect fit for everyone. It seems to be geared towards high-net-worth investors, so if you’re just starting out or have a smaller account, it might not be the best match. It’s essential to consider your own trading goals and experience level before jumping in.

Considering Your Trading Goals and Experience

Before you sign up with Nurp, take a moment to think about what you want to achieve with your trading. Nurp is designed for people interested in algorithmic trading, especially in forex, gold, and cryptocurrency. The platform uses machine learning to adjust to each market, aiming to maximize returns and manage risk effectively. If you’re brand new to trading or have different investment priorities, Nurp might not align with your needs. Do your research and make sure the platform’s features and target audience match your own trading journey.

How Can You Protect Yourself When Using Trading Services?

Protecting your capital is paramount when using any trading service. Whether you’re exploring automated trading platforms or considering educational resources, a cautious approach is key. This section outlines practical steps to help safeguard your investments.

Due Diligence Strategies

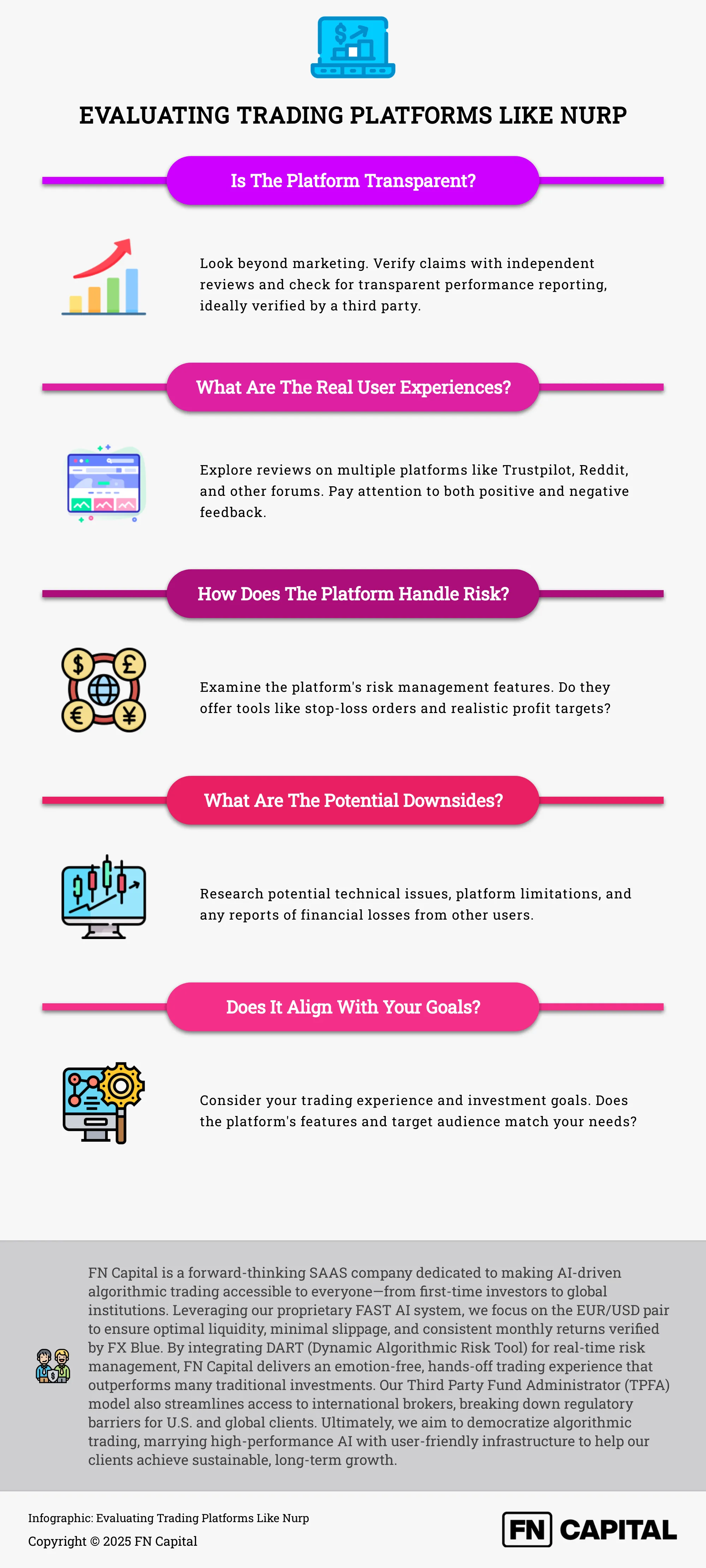

Before committing to any trading service, especially those involving algorithmic trading like Nurp, thorough research is essential. Don’t rely solely on marketing materials. Independent verification of performance claims is crucial. Look for transparent reporting of trading results, ideally verified by a third party. For example, if a platform publishes real-time trading results on Myfxbook, take the time to examine the data. Scrutinize the historical performance, paying attention to drawdowns and consistency. Remember, past results don’t guarantee future success, but they offer valuable insights into a service’s track record.

Risk Management Techniques

Even with the most promising trading services, managing risk is non-negotiable. Advanced algorithms and risk management strategies can help optimize results, but they aren’t foolproof. Understanding and implementing your own risk management plan is essential. This includes setting appropriate stop-loss orders to limit potential losses and establishing profit-taking targets to secure gains. Be wary of high-risk strategies like grid and Martingale systems, especially when applied across multiple currency pairs with large lot sizes. As a recent review highlighted, these approaches can amplify losses significantly. A well-defined risk management plan acts as a safety net, protecting your capital from unexpected market fluctuations.

What Are the Risks of Algorithmic Trading?

Algorithmic trading, while potentially advantageous, has inherent risks traders should understand. Let’s explore some key areas where caution is warranted.

Market Volatility and Unpredictability

Forex markets are notoriously volatile. Even sophisticated algorithms can struggle with sudden market swings. A Nurp review highlights the “ever-evolving” nature of forex, requiring constant adaptation. While platforms like Nurp create algorithms for various assets like gold and cryptocurrencies, market unpredictability remains a risk. Unexpected news, economic shifts, or technical glitches can trigger rapid price fluctuations, potentially leading to losses if algorithms don’t react effectively.

Importance of Testing and Backtesting

Thorough testing and backtesting are crucial before deploying any algorithmic trading strategy. Testing evaluates your algorithm’s performance under simulated market conditions. Backtesting assesses its potential effectiveness against historical data. Nurp publishes real-time trading results on Myfxbook, demonstrating transparency and allowing potential investors to verify performance. However, remember that past performance doesn’t guarantee future results. Robust risk management features, as discussed in this piece on algo trading software, are essential for minimizing potential losses. These features should be informed by your testing and backtesting, helping define appropriate parameters and safeguards for your automated strategies.

Related Articles

- Futures Trading Algorithms: The Ultimate Guide – FN Capital

- A Practical Guide to Buying Algorithmic Trading Software – FN Capital

- Algorithmic Trading Platforms: Features, Benefits, and Risks – FN Capital

- Forex God Myth: Debunked – FN Capital

- EasyFXTrading: Your Guide to AI Forex Trading – FN Capital

Frequently Asked Questions

What is algorithmic trading, and how does Nurp use it?

Algorithmic trading automates trades based on pre-defined rules and market conditions. Nurp’s platform offers a range of these algorithms, often called “bots,” designed to execute trades in forex, cryptocurrency, and gold markets. These bots use machine learning to adapt to different market conditions.

What are the main concerns about Nurp raised by users?

User reviews express several concerns, including the software’s performance not matching marketing claims, leading to financial losses for some. There are also complaints about customer service responsiveness, particularly regarding issues with the platform or unexpected losses. Some users question Nurp’s marketing tactics and transparency.

Does Nurp offer educational resources alongside its trading platform?

Yes, Nurp provides educational materials like courses and training to help users understand forex trading and algorithmic strategies. They aim to empower traders with both the tools and the knowledge to navigate the markets. However, remember that educational resources don’t guarantee trading success.

How does Nurp compare to other trading platforms like eToro or Oanda?

While eToro focuses on social trading and copying other traders, Nurp centers on algorithmic trading. Oanda offers a broader range of traditional trading tools and research, while Nurp specializes in automated strategies. Each platform caters to different trading styles and preferences.

What steps can I take to protect myself when using a trading service like Nurp?

Thorough research is crucial. Don’t solely rely on marketing materials; seek independent reviews and verify performance claims. Implement a robust risk management strategy, including stop-loss orders and profit targets, to limit potential losses. Start with a small investment to test the platform before committing significant capital.