Trading has always been about gaining an edge. That edge used to come from having the fastest connection to the exchange floor; today, it comes from having the smartest technology. The evolution from manual trading to algorithmic execution has now reached its next phase: artificial intelligence. An AI-powered automated trading app doesn’t just follow a simple set of rules; it learns from vast amounts of data to identify opportunities that are invisible to the human eye. It adapts to market volatility and executes with precision. This article explains this powerful shift and shows you how to find a system that uses true intelligence to trade smarter.

Key Takeaways

- Choose Your Path: Builder or Investor?: Decide upfront if you want a toolkit to create your own strategies or a fully managed AI system that works for you. Knowing whether your goal is active trading or passive growth is the fastest way to find the right platform.

- Look for Proof, Not Promises: A flashy website means nothing without verifiable results. Prioritize platforms that offer a publicly accessible track record and transparent risk management tools, as these are the best indicators of a system’s real-world reliability.

- Stay in the Driver’s Seat: Automation is about delegating execution, not abdicating responsibility. The best approach is to let the technology handle the split-second trades while you monitor overall performance and ensure the strategy continues to align with your financial goals.

What Are Automated Trading Apps?

Think of an automated trading app as a personal robot for your investment strategy. Instead of watching the market tick by and manually placing every buy or sell order, you use a computer program to do the work for you. At its core, automated trading is about setting rules and letting software execute them with precision, speed, and consistency. This removes the emotional guesswork that can often lead to impulsive decisions.

But not all automated systems are the same. The real game-changer is the integration of artificial intelligence. While basic bots simply follow the rules you give them, AI-powered trading apps can do much more. These advanced systems analyze enormous amounts of market data—from price movements and economic reports to news and social media sentiment—to identify opportunities that a human trader might miss. They don’t just follow instructions; they learn and adapt.

This is where the power of a solution like our БЫСТРЫЙ ИСКУССТВЕННЫЙ ИНТЕЛЛЕКТ algorithm comes in. It’s designed to process information and execute trades in milliseconds, capitalizing on fleeting market opportunities without hesitation. By using AI, these apps can move beyond simple rule-following to perform sophisticated investment analysis in real time. This allows for a more dynamic and intelligent approach to trading, one that’s built on data-driven decisions rather than human emotion.

The 8 Best Automated Trading Apps to Try

Finding the right automated trading app feels a lot like finding the right business partner. You need one you can trust, one that understands your goals, and one that works the way you do. There’s no single “best” platform for everyone, because the ideal choice depends entirely on your trading style, technical skills, and what you want to achieve. Are you a hands-on trader who loves building strategies from scratch? Or are you looking for a set-it-and-forget-it solution that works for you while you focus on other things?

To help you decide, I’ve explored eight of the top automated trading apps available. This list includes everything from powerful, code-heavy platforms for seasoned pros to user-friendly, no-code builders perfect for beginners. We’ll look at tools that let you design intricate strategies based on AI-driven patterns and others that let you simply write out your trading ideas in plain English. And for those who want to bypass the building process altogether, we’ll cover a fully autonomous AI that offers a proven, hands-off approach to the markets. Let’s walk through your options.

ProRealTime

Think of ProRealTime as a powerful and reliable all-rounder. It’s highly regarded for a few key reasons, but the biggest one is its server-side execution. This means your automated strategies run on their servers, not your computer, so you don’t have to worry about your internet connection dropping or your machine shutting down mid-trade. It also features reliable backtesting tools to help you validate your ideas with historical data. Best of all, ProRealTime offers a no-code option, making it accessible even if you’ve never written a line of code. It’s a fantastic choice for traders who want professional-grade tools without a steep technical learning curve.

TradingView

If you’ve ever looked up a stock chart online, you’ve likely come across TradingView. It’s incredibly popular for its beautiful, intuitive charts and a massive community of traders sharing ideas. While it’s a top-tier platform for analysis, its automation requires a bit more work. To build automated strategies, you’ll need to learn its proprietary language, Pine Script. It also isn’t designed for full, hands-off automation in the same way other platforms are. TradingView is best for traders who are deeply involved in technical analysis and want a powerful tool to help them develop and test custom indicators and strategies before placing trades.

TrendSpider

TrendSpider is built for traders who want to let AI do the heavy lifting. Its standout feature is its sophisticated AI-powered pattern recognition, which automatically scans charts to find technical patterns you might have missed. It also simplifies strategy creation by integrating large language models (LLMs), allowing you to describe your trading rules in plain English. The platform then translates your words into a functional automated strategy. With robust backtesting features to test your AI-generated ideas, TrendSpider is an excellent tool for traders who want to combine their market insights with the power of artificial intelligence.

MetaTrader 4 and 5

MetaTrader, often called MT4 or MT5, is an institution in the forex trading world. It’s free, compatible with an enormous number of brokers, and has been a go-to for retail traders for years. Its main strength is its widespread adoption and the massive ecosystem of third-party tools and “Expert Advisors” (EAs), which are pre-built trading bots. The trade-off is that creating your own strategy from scratch requires learning the MQL programming language. It also relies on client-side execution, meaning the platform must be running on your computer for your bots to function, which is a key difference from server-side platforms.

NinjaTrader

NinjaTrader is a favorite among serious, data-driven traders, particularly in the futures market. It’s known for its high-performance, advanced charting capabilities and a comprehensive suite of market analysis tools. This is the platform for you if you want to perform deep, institutional-level analysis and build complex strategies from the ground up. While it offers powerful automation, NinjaTrader is geared more toward experienced traders who are comfortable with advanced technical concepts and want a high degree of control over their strategy development and execution. It’s less of a beginner’s tool and more of a professional’s workshop.

Capitalise.ai

What if you could automate your trading strategy just by writing it out like an email? That’s the magic of Capitalise.ai. This platform completely removes the coding barrier, allowing you to type out your trading rules in natural language. For example, you could write, “If the price of gold is below $2,300 and the RSI is below 30, buy $1,000 worth.” The system takes care of the rest, monitoring the market and executing the trade for you. It’s an incredibly empowering tool for traders who have clear ideas but lack the programming skills to implement them, making automated trading accessible to anyone.

uTrading

If you’re focused on the cryptocurrency market, uTrading is an app designed specifically for you. It’s a copy trading bot, which means its core feature is allowing you to automatically replicate the trades of other, more experienced users on the platform. This is a fantastic way for newcomers to get started, as it lets you learn from successful traders while participating in the market. uTrading simplifies the often-complex world of crypto trading, making it a great entry point for anyone looking to automate their digital asset strategy without needing to build everything from scratch.

FN Capital’s FAST AI

FN Capital offers a different approach entirely. Instead of giving you a platform to build your own strategies, it provides a fully managed, AI-powered trading system. The БЫСТРЫЙ ИСКУССТВЕННЫЙ ИНТЕЛЛЕКТ is a hands-free solution designed for investors who want institutional-grade performance without the learning curve. It focuses exclusively on the highly liquid EUR/USD pair and uses a dynamic risk management tool to protect your capital. With a 4-year verified track record and a seamless onboarding process, it’s built for those who want to put their capital to work with a proven system. This is the ideal choice if your goal is passive growth driven by sophisticated AI.

Key Features Every Great Trading App Needs

With so many automated trading apps on the market, it can be tough to tell which ones are genuinely effective and which are just hype. The best platforms aren’t just about flashy charts; they’re built with a core set of features designed to give you a real edge. Think of this as your checklist. Whether you’re a beginner looking for a hands-off solution or a seasoned trader wanting to automate a complex strategy, these are the non-negotiable features that separate the great apps from the rest.

A powerful app should feel intuitive, provide deep insights, and most importantly, protect your capital. It’s the combination of a user-friendly design, robust analytics, and smart safety nets that creates a truly reliable trading tool. As you explore your options, measure them against these standards. The right app will empower you to execute your strategy with confidence and precision, letting the technology do the heavy lifting while you stay in control.

An Easy-to-Use Interface

The last thing you want is a trading app that feels like you need a pilot’s license to operate. A clean, intuitive user interface is essential. You should be able to find what you need, understand the data presented, and execute actions without getting lost in a maze of menus and complicated jargon. The goal of automation is to simplify trading, and that starts with the user experience. A great app empowers you to focus on your strategy, not on figuring out how the software works. When an app is designed with clarity in mind, it makes it easier for everyone, from beginners to pros, to manage their investments effectively.

Real-Time Analytics

The financial markets move fast, and yesterday’s data is ancient history. A top-tier trading app must provide real-time analytics, allowing you to see what’s happening as it happens. This includes live price feeds, volume data, and performance metrics that update instantly. Some advanced platforms use AI to continuously analyze market conditions and identify high-probability opportunities in the moment. This access to live information is critical for making timely decisions and allows an automated system to react to market shifts far faster than a human ever could. Without it, you’re essentially trading with one hand tied behind your back.

Backtesting and Customization

Would you trust a strategy you’ve never tested? Backtesting lets you run your trading idea against historical market data to see how it would have performed in the past. It’s a crucial step for validating your approach before you risk any real money. The best apps offer robust backtesting tools that are both powerful and easy to use. While backtesting is a great start, nothing beats a publicly verified track record that shows how a system performs in live market conditions. Customization is also key, as it allows you to tweak variables and adapt your strategy to your specific goals and risk tolerance.

Built-in Risk Management Tools

Protecting your capital is the most important job of any trading system. That’s why built-in risk management tools are an absolute must-have. These features automatically implement rules to minimize potential losses, such as setting stop-losses, take-profit levels, and position sizes. Advanced systems use dynamic tools that adjust your exposure based on real-time market volatility. For example, FN Capital’s DART (Dynamic Algorithmic Risk Tool) continuously optimizes trades to protect your account. Effective risk mitigation is what allows you to trade sustainably over the long term, ensuring that one bad trade doesn’t wipe out your progress.

No-Code Strategy Builders

In the past, algorithmic trading was reserved for those who could write complex code. Today, that’s no longer the case. Many modern trading apps feature no-code strategy builders, which allow you to create sophisticated automated rules using a simple, visual interface. You can drag and drop indicators, set conditions, and define actions without writing a single line of code. This feature has made automated trading accessible to a much wider audience, empowering retail investors to build and deploy their own strategies. It’s a game-changer that puts the power of automation in everyone’s hands.

24/7 Trading Capability

The markets don’t stick to a 9-to-5 schedule, especially forex, which runs 24 hours a day, five days a week. An automated trading app can work for you around the clock, scanning for opportunities and executing trades even while you’re asleep. This 24/7 capability ensures you never miss a potential move, whether it happens during the London, New York, or Tokyo session. It allows your strategy to operate at its full potential without being limited by your time zone or your schedule. This constant vigilance is one of the biggest advantages automation has over manual trading.

Support for Multiple Assets

While some traders specialize, many prefer to diversify their portfolios across different asset classes. A versatile trading app should support a wide range of markets, including stocks, forex, cryptocurrencies, and commodities. This flexibility allows you to deploy different strategies across various markets from a single platform. However, there’s also a strong case for specialization. Some of the most effective algorithms, like БЫСТРЫЙ ИСКУССТВЕННЫЙ ИНТЕЛЛЕКТ, achieve superior results by focusing exclusively on a single, highly liquid asset like the EUR/USD pair. This approach minimizes slippage and ensures there’s always enough volume for precise trade execution.

Why Use an Automated Trading App?

If you’ve ever felt the stress of watching market charts or second-guessed a trade, you already know how mentally taxing manual trading can be. Automated trading apps offer a different path. By handing the execution over to a system, you can approach the markets with more discipline, speed, and objectivity. These tools aren’t just about convenience; they’re about fundamentally changing how you interact with your investment strategy, letting you focus on the big picture while the software handles the moment-to-moment decisions. Let’s break down the key advantages.

Trade Without Emotion

We’ve all been there. The fear of missing out (FOMO) pushes you into a risky trade, or panic causes you to sell at the worst possible moment. These emotional reactions are one of the biggest hurdles for any trader. Automated trading systems help you sidestep this problem entirely. Because the software operates purely on pre-set rules and data, it removes emotions from the decision-making process. There’s no greed, no fear—just logic. At FN Capital, our FAST AI was designed to execute trades based on data-driven intelligence, ensuring that human bias never interferes with market execution and your potential returns.

Improve Your Speed and Efficiency

In today’s markets, opportunities can appear and disappear in the blink of an eye. Even the most focused human trader can’t compete with the speed of an algorithm. Automated systems can analyze market conditions and execute trades in milliseconds, a speed that’s impossible to match manually. This efficiency is crucial for strategies that rely on capturing small price movements or reacting instantly to market news. Our FAST AI algorithm, for example, is a high-frequency execution system built specifically to identify and act on low-risk, high-probability opportunities with institutional-grade speed and precision.

Execute Your Strategy Consistently

Discipline is the cornerstone of successful trading, but it’s also one of the hardest things to maintain. It’s easy to drift from your strategy after a few losses or a big win. Automated trading enforces consistency by sticking to your plan without fail. The system executes trades based on the exact rules you define, minimizing the risk of human error or impulsive decisions. This allows for a more systematic and reliable application of your investment analysis. Whether you’re a beginner or a seasoned pro, automation ensures your strategy is followed with precision, day in and day out.

Find New Ways to Diversify

Manually tracking a handful of assets is challenging enough, let alone exploring dozens of new markets or complex strategies. AI-powered trading apps can process enormous amounts of data across various markets simultaneously, uncovering opportunities you might never find on your own. These systems can automate technical analysis and identify patterns that aren’t obvious to the human eye. This capability opens the door to more effective portfolio diversification and lets you explore alternative investments without needing to become an expert in every single one. It’s a powerful way to spread risk and find new sources of growth.

Breaking Down the Costs: What to Expect

Figuring out the cost of an automated trading app can feel a bit like solving a puzzle. Prices aren’t one-size-fits-all; they vary widely based on the platform’s features, complexity, and the level of support you get. Some apps are free to download, while others require a significant investment. Understanding the common pricing models is the first step to finding a tool that fits your budget and your trading goals. Let’s walk through what you can expect to see.

Subscription Plans

The most common pricing structure you’ll encounter is the monthly or annual subscription. This model gives you ongoing access to the platform, including updates and customer support. Prices can range from under a hundred dollars a month for basic plans to several hundred for premium tiers that offer more advanced analytics, faster data, and the ability to run multiple strategies at once. Some companies, like FN Capital, offer a license fee that grants you access to their proprietary AI for a set period, which functions similarly to a subscription but is focused on a single, powerful algorithm.

One-Time Fees

While less common for comprehensive trading platforms, you might run into one-time fees. This could be a single payment for lifetime access to a specific piece of software or an add-on for a particular feature. More often, you’ll see a “freemium” model. For example, an app might be free to download and use for backtesting or strategy building, but you’ll need to pay a fee to connect it to your brokerage account for live trading. Always read the fine print to understand what’s included for free and where the paywall begins.

Free Trials and Demo Accounts

I can’t stress this enough: always look for a free trial or demo account before you commit. These are your best friends when you’re evaluating a new platform. A demo account lets you trade with virtual money, so you can test the app’s features and your strategies without any real-world risk. Some platforms take this a step further. For instance, FN Capital offers a 100-day money-back guarantee, giving you a risk-free window to see how its AI performs with your own capital, backed by a publicly verified track record you can check beforehand.

How to Find the Best Value

The “best value” isn’t always the cheapest option. It’s the platform that gives you the right tools to meet your goals without overpaying for features you’ll never use. Before you choose, ask yourself a few key questions: What are my trading goals? Am I looking for passive income or an active trading tool? Does the app support the assets I want to trade? The right choice for a beginner might be a simple, user-friendly platform, while an experienced trader might need advanced customization. Finding a solution tailored to your needs, like a hands-free AI for retail investors, is how you find true value.

Real Performance: What Do Users Say?

Marketing materials and feature lists can tell you a lot about a trading app, but they don’t give you the full picture. To understand how an app truly performs, it’s best to listen to the people who use it every day. User feedback cuts through the noise and reveals what it’s actually like to rely on a platform for your trading strategy. From the initial setup to watching your strategy unfold in a live market, real-world experiences are the ultimate test of an app’s quality. Here’s what users consistently highlight when talking about the best automated trading apps.

Ease of Use

A powerful trading app is useless if you can’t figure out how to work it. That’s why a clean, intuitive interface is one of the most praised features among traders. The best platforms are designed to get you up and running quickly, with a straightforward onboarding process that doesn’t leave you searching for instructions. Users often report that a simple design allows them to focus on their strategy and analysis rather than getting stuck on technical details. When an app feels effortless to use from day one, you can spend less time learning the software and more time putting it to work. This focus on a smooth user experience is a hallmark of a well-designed trading tool.

Real-World Effectiveness

Ultimately, a trading app is judged by its results. Does it execute trades efficiently? Does it perform as expected under real market conditions? The most effective apps deliver on their promises with consistent, verifiable performance. Users look for a combination of advanced, reliable algorithms and features that make sense for their personal trading style. An app that can demonstrate a publicly verified track record gives you a transparent look at its historical performance, which is far more valuable than any marketing claim. This proof of real-world effectiveness shows that the system can handle the pressures of the live market and helps build the confidence you need to trust its automation.

Support and Learning Resources

Even the most experienced trader has questions, especially when using a new platform. That’s why strong customer support and accessible learning materials are so important. When you’re starting out, you’re not just learning a new piece of software; you’re learning how its specific bots and tools operate. Users appreciate platforms that offer clear guidance and responsive help when they need it. The best companies also actively listen to customer feedback to make their systems more efficient and add features that traders actually want. This commitment to support shows that the company is invested in your success and is continually working to improve the platform for its community of investors.

How to Choose the Right App for You

With so many options available, finding the right automated trading app can feel overwhelming. The key is to focus on what fits your specific needs, not just what’s popular. The best app for a seasoned day trader won’t be the same as the one for someone just starting with passive income strategies. Your decision should come down to four key things: your personal trading goals, the features you actually need, the overall value for the price, and what real users have to say. By breaking down your choice into these simple steps, you can confidently select a tool that aligns with your financial journey and helps you execute your strategy effectively.

Define Your Trading Style and Goals

Before you even look at an app, you need a clear picture of what you want to accomplish. Automated trading is all about using a program to execute trades based on your own predetermined rules. If you don’t know what your rules are, you can’t pick the right tool. Ask yourself a few questions: Are you looking for a fully autonomous, hands-off system, or do you want an app that assists your manual trading? Are you focused on a specific asset like forex, or do you need a platform that handles stocks and crypto? Your answers will help you narrow the field immediately and filter out the apps that don’t match your investment analysis approach.

Compare Features and Compatibility

Once you know your goals, you can start comparing what different apps offer. The features list can be long, but focus on what matters to you. Some platforms excel at AI-powered pattern recognition, while others offer sophisticated backtesting and no-code strategy builders. Don’t get distracted by flashy tools you’ll never use. Instead, check for compatibility with your existing setup. Does the app integrate with your preferred broker? Does it support the currency pairs or stocks you want to trade? For example, our FAST AI is built for quantitative trading with a laser focus on the EUR/USD pair to ensure maximum liquidity and execution speed. Make sure the app’s core strengths align with your strategy.

Analyze the Pricing and Value

It’s easy to fixate on the price tag, but the cheapest option is rarely the best value. A better approach is to weigh the cost against the features, reliability, and potential returns. Look at the platform’s entire pricing structure—are there monthly subscriptions, one-time fees, or commissions on profitable trades? Many top-tier apps offer free trials or demo accounts, which are great for testing the software before you commit. A slightly more expensive platform with a transparent, verified track record and excellent customer support often provides far more value and peace of mind than a free tool with hidden costs and unreliable performance.

Read User Reviews and Expert Opinions

Finally, see what other traders are saying. User feedback is one of the most valuable resources for understanding how an app performs in the real world. Check sites like Trustpilot or Reddit for honest reviews on everything from ease of use to customer service responsiveness. Look for patterns in the feedback. Are users consistently praising the platform’s stability and accurate execution? Or are there frequent complaints about technical glitches and poor support? A smooth onboarding process and reliable performance are common themes in positive reviews. This firsthand insight can help you avoid platforms with a great marketing pitch but a disappointing user experience.

How to Implement Your First Strategy

Getting your first automated trading strategy up and running is easier than you might think. The key is to find a platform that aligns with your goals and technical comfort level. While some traders enjoy building algorithms from the ground up, many others prefer a proven, hands-off system. The good news is that you don’t need to be a programmer to get started. The focus is on choosing the right tool, funding your account, and letting the technology do the heavy lifting.

Set Up Your First Automated Strategy

First, you’ll need to choose your trading platform. Some tools allow you to build and test your own strategies, which is great if you have a specific idea you want to try. However, for a more direct path, you can use a service that provides a pre-built, high-performance algorithm. With a solution like FN Capital’s FAST AI, the complex development work is already done. The setup process is straightforward: you create your account, connect your capital through a secure administrator, and activate the trading script. This approach lets you tap into an institutional-grade strategy without writing a single line of code.

Follow These Best Practices

Once you’re set up, it’s important to follow a few best practices to stay on track. Start by understanding exactly what your chosen strategy does. A transparent system will always be superior to a “black box.” For instance, FAST AI’s focus on the EUR/USD pair and its built-in risk management are clearly defined. You should always lean on a system with a publicly verified track record, as this data provides a realistic baseline for performance. Finally, make sure your platform has a clean, intuitive user interface. You should be able to monitor your account and understand your results without feeling overwhelmed.

Monitor and Adjust Your Strategy

While automation is designed to be hands-off, it’s not something you should completely “set and forget.” Plan to regularly review your dashboard to track performance and stay informed. However, this doesn’t mean you should micromanage the system. The primary benefit of AI trading is removing emotional decision-making from the equation. Trust the system’s built-in risk mitigation tools to manage market volatility. If you decide you want to make a change, think in terms of your overall capital allocation rather than trying to tweak the algorithm’s rules. Your job is to be the investor, not the programmer.

Understanding the Risks of Automated Trading

Automated trading apps are powerful tools, but they aren’t magic money-printing machines. Like any investment strategy, they come with their own set of risks. Being aware of these potential downsides is the first step toward making smart, informed decisions and protecting your capital. It’s not about being scared of the technology; it’s about respecting the market and understanding how your tools interact with it.

The goal is to find a system that not only performs well but also has built-in safeguards to handle the unexpected. A reliable platform should be transparent about how it manages risk, from unpredictable market events to simple technical issues. Thinking through these potential problems helps you evaluate different apps more effectively. Instead of just looking at potential returns, you can start asking the right questions about how an app protects you when things don’t go as planned. This balanced view is what separates a casual user from a strategic investor.

Algorithmic Errors and Potential Losses

Let’s be real: no technology is perfect. An automated trading strategy is run by an algorithm, which is essentially a set of rules written in code. If there’s a flaw in that code or the logic behind it, the system could make trades you never intended, leading to unexpected losses. This is why the quality and history of the algorithm matter so much. A system that has been rigorously tested and has a long, verified track record is less likely to contain these kinds of costly errors. Before committing your funds, you want to see proof that the algorithm has performed consistently over time, not just in a simulated backtest.

How Market Volatility Affects Your System

Markets can be unpredictable. Sudden news events or shifts in sentiment can cause extreme volatility that pushes prices far outside their normal ranges. An algorithm designed for calm, predictable conditions might struggle to perform well during these chaotic periods. It could either stop trading altogether, missing opportunities, or make poor decisions based on historical data that no longer applies. This is why dynamic risk mitigation is so important. The best systems have tools that can adapt in real time, adjusting position sizes or pausing trades automatically when volatility spikes, protecting your account from drastic swings.

Technical Glitches and System Downtime

Your trading algorithm doesn’t exist in a vacuum. It relies on a stable internet connection, a server to run on, and a connection to your broker. A failure at any of these points can cause problems. Imagine your Wi-Fi cuts out right as your bot needs to close a trade—that’s a technical risk. Reputable automated trading platforms invest heavily in robust infrastructure to minimize downtime. When choosing an app, consider the technology it’s built on. You’re looking for a service that offers institutional-grade reliability, ensuring your strategy is always online and ready to execute when it needs to.

Why Human Oversight Still Matters

Even with the most advanced AI, “automated” should never mean “set it and forget it.” The most successful users of automated trading systems see themselves as supervisors, not passive bystanders. Your role shifts from placing trades to monitoring the system’s performance and ensuring it aligns with your financial goals. Regular check-ins allow you to spot any unusual behavior and make sure the strategy is still appropriate for current market conditions. This combination of powerful quantitative trading technology and smart human oversight is the key to long-term success.

What’s Next for Automated Trading?

Automated trading is evolving far beyond simple “if-then” commands. The future is about creating smarter, more intuitive, and deeply integrated systems that work for a wider range of people. We’re seeing a shift from pure automation to intelligent execution, where platforms don’t just follow rules but learn, adapt, and connect to the market in more powerful ways. This evolution is breaking down old barriers, making sophisticated strategies accessible to everyone from new investors to seasoned institutions. The most exciting developments are happening in three key areas: the integration of true artificial intelligence, a strong focus on user-friendliness, and deeper connections with the global financial ecosystem.

The Rise of AI and Machine Learning

The biggest leap forward in automated trading is the move from basic algorithms to true artificial intelligence and machine learning. Instead of just executing pre-set commands, modern platforms are using AI to analyze vast amounts of market data, identify subtle patterns, and make predictive decisions. Think of it as the difference between a simple calculator and a supercomputer. AI-powered stock trading tools are becoming the new standard, capable of processing news, social media sentiment, and complex chart patterns in real time. This is where platforms built on proprietary AI, like FN Capital’s FAST AI, really shine. They aren’t just automating a strategy; they’re using intelligence to find low-risk, high-probability opportunities that a human or a simple bot would likely miss.

Making Apps Easier to Use

As trading tools become more powerful, there’s a parallel movement to make them radically simpler to use. The best developers understand that a complicated interface is a barrier to entry. The goal is to create a clean, intuitive experience that lets you focus on your strategy, not on figuring out the software. A great user interface empowers you to implement your ideas without needing a degree in computer science. This user-centric approach means more no-code strategy builders, clear dashboards, and helpful educational resources. By listening to user feedback, companies are designing platforms that feel less intimidating and more supportive, opening the door for more people to build wealth through automated trading.

Connecting with the Broader Financial World

Modern trading apps no longer operate in a vacuum. The future is one of seamless integration, where your trading platform connects to everything from your broker to real-time news feeds and alternative data sources. This connectivity creates a much richer and more responsive trading environment. The best AI trading software can pull in information from thousands of sources, analyze it, and execute trades automatically, eliminating the delays of manual entry. This also allows for more sophisticated risk management and access to global markets. For example, systems that integrate with third-party administrators can give you access to international brokers and better trading conditions, which was once only available to large institutions.

Related Articles

- Top 10 Automated Trading Apps for Hands-Free Investors – FN Capital

- How AI Trading Works: Strategies & Benefits – FN Capital

- AI-Driven Investing: Enhance Your Portfolio

- Automated Trading Returns: Strategies for Success

- Algorithmic Trading Platforms: Features & Risks

Frequently Asked Questions

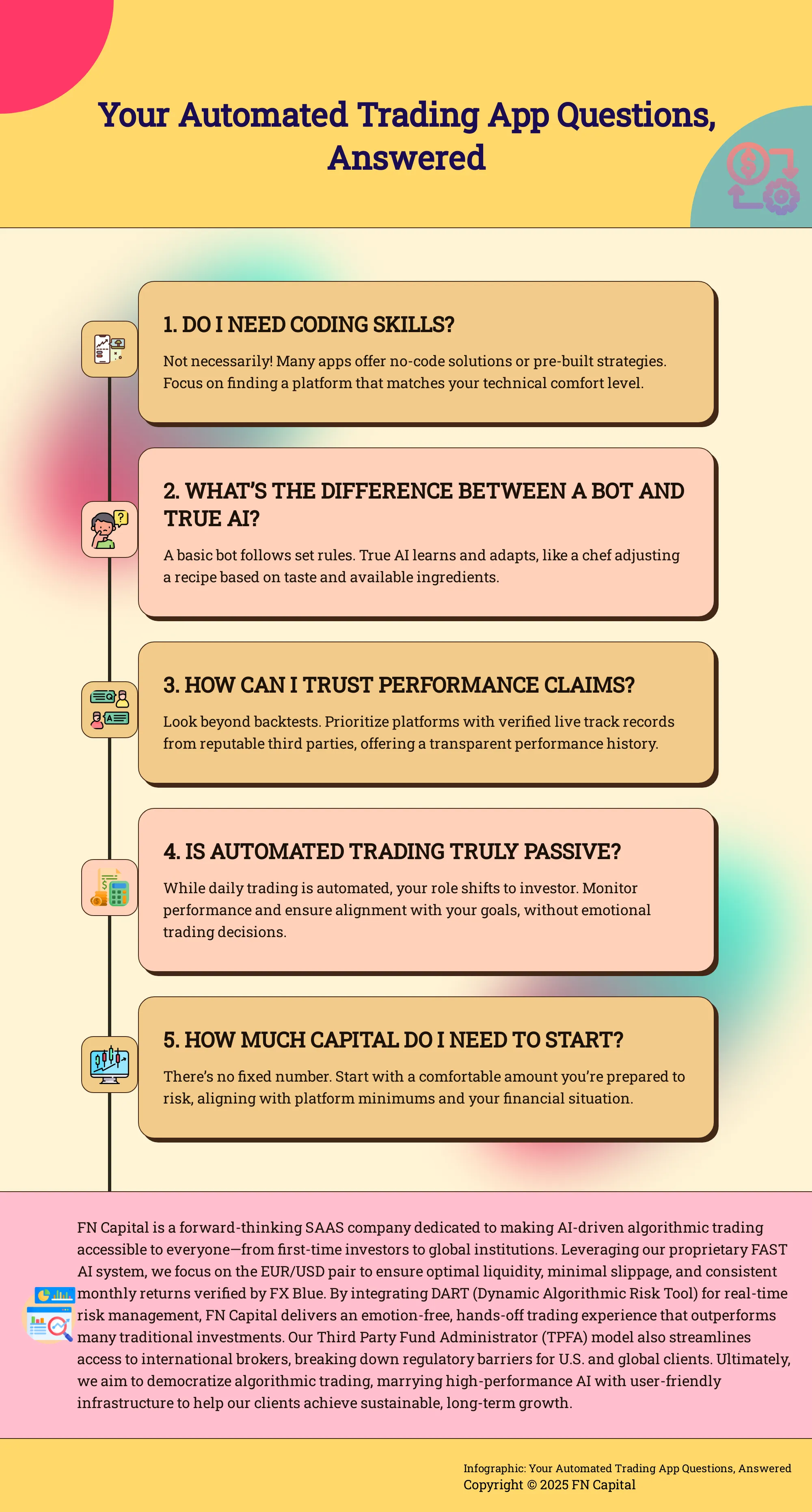

Do I need to be a programmer to use an automated trading app? Not at all. While some platforms are built for developers, many of the best tools today are designed for everyone, regardless of technical skill. Some apps let you build strategies by simply typing out your instructions in plain English, while fully managed systems like FN Capital’s FAST AI handle all the complex work for you. The goal of modern automation is to make these powerful tools accessible, not exclusive.

What’s the real difference between a simple trading bot and a true AI system? Think of it this way: a simple bot is like a cook following a recipe. It will execute the exact same steps in the same order every time, no matter what. A true AI system is like a professional chef. It understands the fundamentals but can also adapt to changing conditions, taste the ingredients, and make intelligent adjustments on the fly to create the best possible outcome. It learns from experience instead of just repeating instructions.

How can I tell if an app’s performance claims are legitimate? This is a great question. Many platforms will show you “backtests,” which are simulations of how a strategy would have performed in the past. While helpful, they aren’t proof. The gold standard is a publicly verified, live track record from a trusted third-party service like FX Blue. This shows you exactly how the system has performed with real money in live market conditions, offering a transparent and honest look at its history.

Is automated trading completely passive, or do I still need to be involved? While the day-to-day trading is hands-off, your role shifts from being a trader to being an investor. You won’t be clicking the buy and sell buttons, but you should still monitor your account to ensure the strategy’s performance aligns with your financial goals. The best approach is to let the system do its job without emotional interference, but stay informed about your investment’s progress over time.

How much capital do I actually need to begin with automated trading? There isn’t a single magic number, as it depends on the platform and your personal financial situation. Some apps or brokers have set minimums, but the most important rule is to only invest what you are comfortable and prepared to lose. It’s wiser to start with a smaller amount you can confidently risk while you get familiar with the system’s performance than to jump in with a large sum.